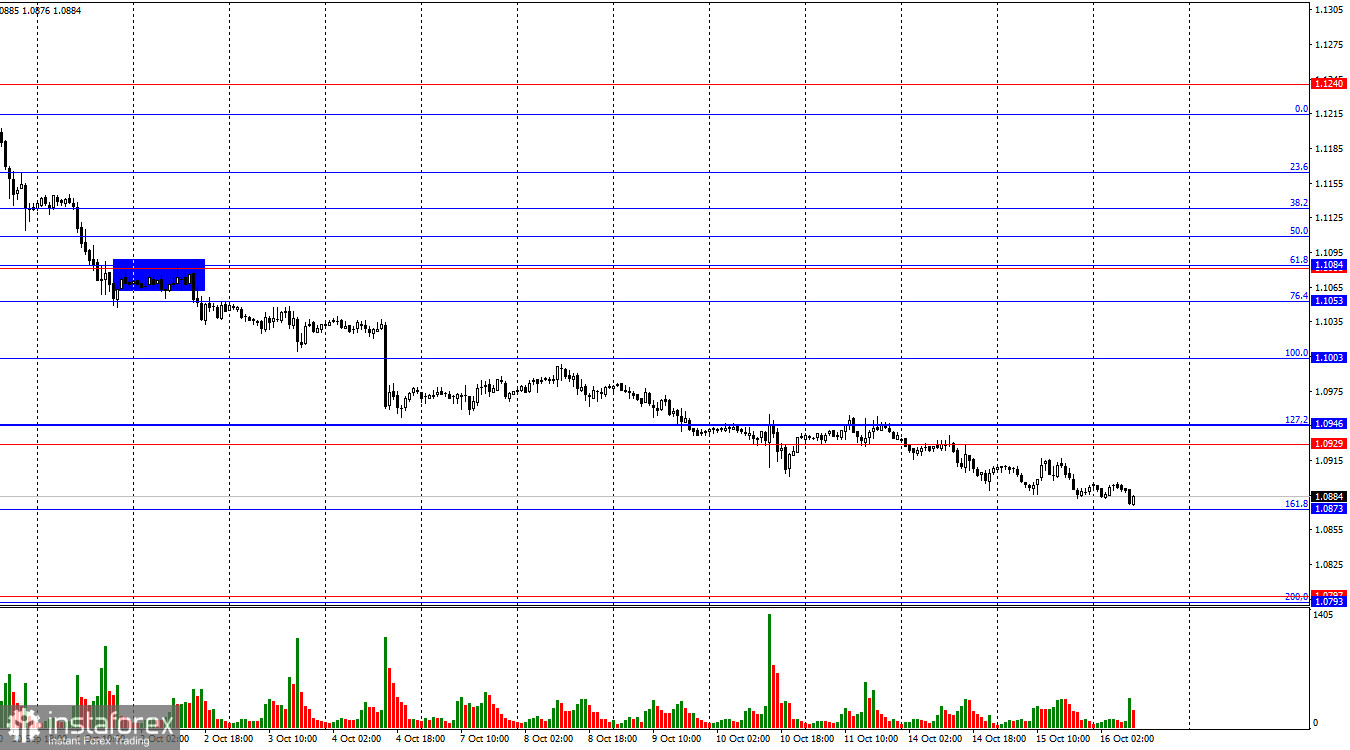

On Tuesday, the EUR/USD pair continued its decline toward the 161.8% Fibonacci retracement level at 1.0873. A rebound from this level could signal a potential reversal in favor of the euro and some growth toward the resistance zone of 1.0929–1.0946. However, consolidation below 1.0873 would support further declines toward the next support zone at 1.0793–1.0797. Bears maintain sustained pressure.

The wave structure has become slightly more complex in recent weeks, but there are no significant concerns. The last completed upward wave (September 25–30) did not break the peak of the previous wave, while the new downward wave (still forming) has broken the lows of the previous three waves. The pair is currently forming a new bearish trend. We may see a corrective wave in the near future, but bulls have already lost market momentum. Regaining it will require significant effort.

Tuesday's news flow could have given the euro a brief respite, but traders didn't find the industrial production report significant enough to halt selling of the euro. It is worth noting that the ECB meeting is scheduled for tomorrow. The European regulator is preparing to cut rates for the third time, sooner than originally anticipated. The next rate cut was expected in December, but the weakness in the European economy requires faster monetary easing. Traders are now factoring in this third ECB rate cut and are awaiting Christine Lagarde's speech. If the ECB president signals that rates could be lowered a fourth time in December, the euro may continue its decline and quickly approach the 1.0793–1.0797 zone.

On the 4-hour chart, the pair continues its decline toward the 50.0% Fibonacci level at 1.0872. Both indicators are currently showing forming "bullish" divergences, which suggest the possibility of a correction. However, the ongoing bearish trend suggests traders are disregarding these divergences, further confirming the bearish trend. A rebound from the 1.0872 level could lead to a slight rise, while consolidation below this level would support further declines toward the next retracement level of 38.2% – 1.0807.

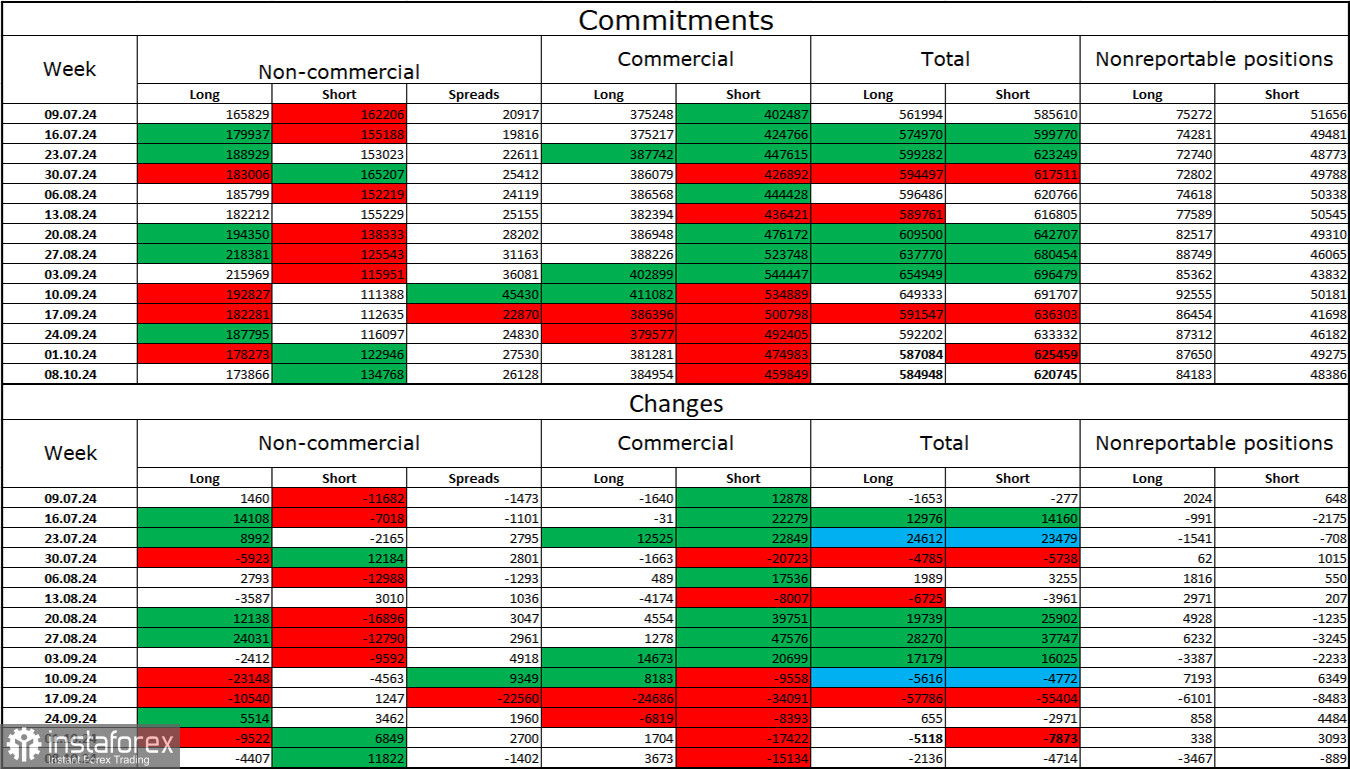

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 4,407 long positions and opened 11,822 short positions. The sentiment of the "Non-commercial" group shifted to a bearish stance several months ago, but bulls are regaining control. The total number of long positions held by speculators now stands at 174,000, while short positions total 135,000.

However, for five consecutive weeks, major players have been offloading the euro. In my opinion, this could be a precursor to a new bearish trend or at least a strong correction. The key factor behind the dollar's decline – the expectation of FOMC easing – has already been priced in, and there are now fewer reasons for the dollar to fall. While new factors may emerge over time, for now, the dollar's appreciation seems more likely. Technical analysis also indicates the start of a bearish trend, so I am preparing for an extended decline in the EUR/USD pair.

News Calendar for the US and the Eurozone:

- Eurozone – ECB President Christine Lagarde's speech (18:40 UTC).

On October 16, the economic calendar contains one moderately significant event. The impact of this news on trader sentiment today will likely be moderate, mainly in the evening.

EUR/USD Forecast and Trader Tips:

Selling opportunities emerged after the pair closed below the 1.1139 level on the 4-hour chart, with targets at 1.1081, 1.1070, 1.1013, and 1.0984. All targets have been reached. I don't currently see new sell signals, but they may appear (for example, a close below 1.0873) if Christine Lagarde delivers dovish rhetoric today and tomorrow. I would consider buying the pair after a rebound from the 1.0873 level, but it's important to remember that the trend has shifted to bearish.

The Fibonacci levels are drawn from 1.1003 to 1.1214 on the hourly chart and from 1.1139 to 1.0603 on the 4-hour chart.