Analysis of Trades and Tips for Trading the British Pound

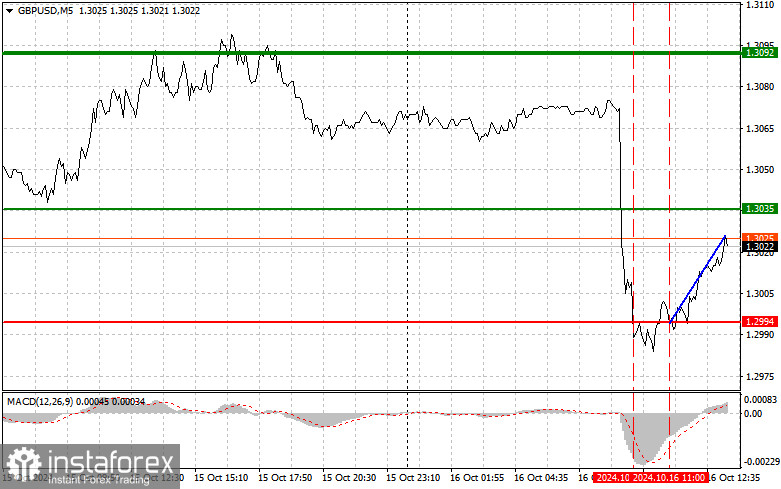

The test of the 1.2994 price level occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's further downward potential. For this reason, I did not sell the pound, especially considering that we had already dropped significantly following the data showing a decline in the UK Consumer Price Index. The second test of 1.2994, which occurred shortly after, coincided with the MACD being in the oversold area and beginning to recover. This set up Scenario #2 for a buy, leading to the pair rising by more than 30 points. Given that the only upcoming data is the U.S. Import Price Index, we might expect some further recovery of the pound. However, pressure on the pair will likely return sooner or later, so be cautious with buying at current levels. As for my intraday strategy, I plan to implement Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy the pound at the entry point around 1.3035 (green line on the chart), aiming for a rise to the 1.3080 level (thicker green line on the chart). At 1.3080, I will close my buy position and open a sell position, targeting a 30-35 point move in the opposite direction. Any rally in the pound today is likely to be part of a correction. Note: Before buying, ensure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.3010 price level, at a time when the MACD indicator is in the oversold area. This will curb the pair's downward potential and likely lead to an upward reversal. We can expect growth towards the resistance levels of 1.3035 and 1.3080.

Sell Signal Scenario #1: I plan to sell the pound when it breaks below 1.3010 (red line on the chart), which would lead to a quick decline in the pair. The key target for sellers will be 1.2961, where I will exit sales and immediately buy in the opposite direction, expecting a 20-25 point move from this level. Sellers will become active if they fail to hold the price at the 1.3035 level. Note: Before selling, ensure the MACD indicator is below the zero line and just starting to fall from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.3035 price level, at a time when the MACD indicator is in the overbought area. This will curb the pair's upward potential and likely trigger a downward reversal. We can expect a decline towards the support levels of 1.3010 and 1.2961.

What's on the Chart:

- Thin green line – the entry price where you can buy the trading instrument.

- Thick green line – the expected price where you can place Take Profit or lock in profits manually, as further growth beyond this level is unlikely.

- Thin red line – the entry price where you can sell the trading instrument.

- Thick red line – the expected price where you can place Take Profit or lock in profits manually, as further declines beyond this level are unlikely.

- MACD Indicator: When entering the market, it is crucial to consider overbought and oversold zones.

Important: Beginner traders in the Forex market must exercise caution when deciding to enter the market. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, one can quickly lose their entire deposit, especially when trading large volumes without proper money management.

Remember, successful trading requires a clear trading plan, like the one outlined above. Spontaneous trading decisions based on the current market situation are generally a losing strategy for an intraday trader from the outset.