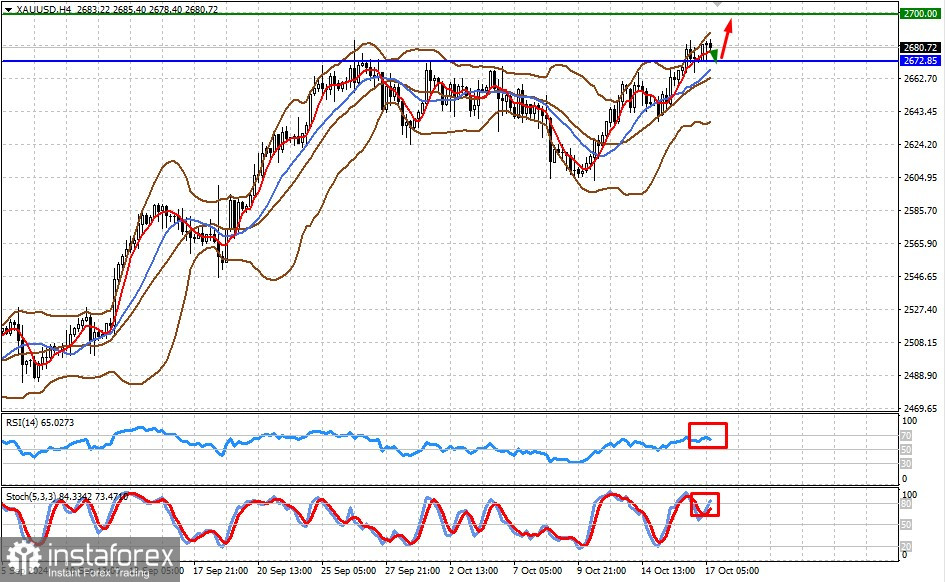

Gold prices have managed to break through the strong resistance level of 2672.85, where they had been consolidating since the end of September. Neither historically high prices nor strengthening the U.S. dollar could hold them back. The main reason for sustained demand for the yellow metal continues to be high geopolitical risks in the Middle East and Europe and the evident weakening of U.S. hegemony and, consequently, the dollar globally. Against this backdrop, central banks continue buying physical gold, driving prices upward.

It is pretty likely that after breaking through the 2672.85 level, the price will correct towards it, consolidate, and resume growth soon.

Technical Outlook and Trade Idea:

The price is above the middle line of the Bollinger Bands, above the SMA 5 and SMA 14. The RSI is turning downward from the overbought zone, while Stochastics are still rising.

A possible corrective pullback to the 2672.85 level could be seen by the markets as a signal for new buying opportunities. In this scenario, prices could rise toward 2700.00.