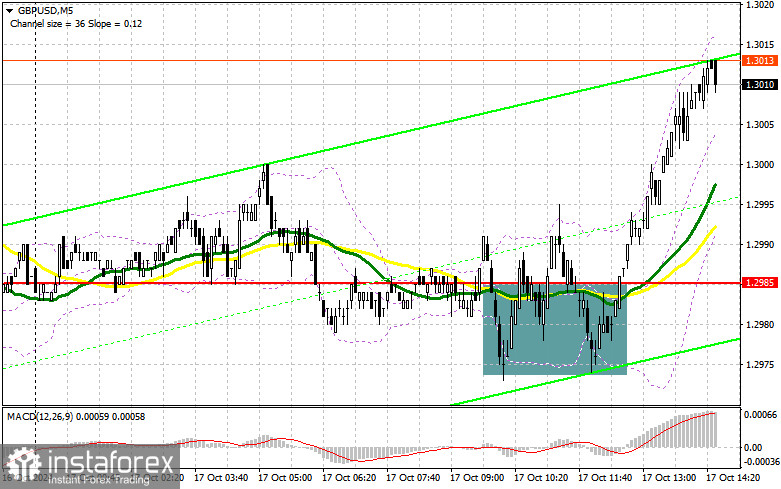

In my morning forecast, I focused on the 1.2985 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened. A decline followed by a false breakout around the 1.2985 level provided an entry point for buying the pound, resulting in a small correction of around 30 points. The technical picture was slightly revised for the second half of the day.

To Open Long Positions on GBP/USD:

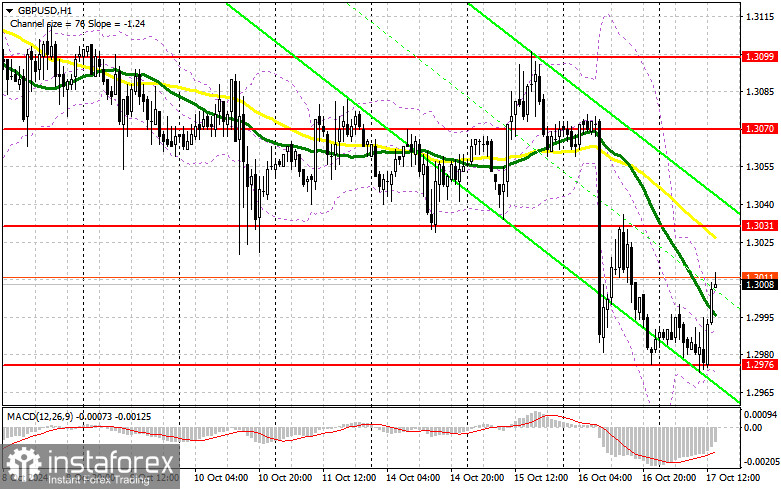

The lack of U.K. statistics helped pound buyers hold around the monthly low, and that is the situation for now. The small correction in the pair doesn't suggest that many are eager to buy even at current levels. For this reason, the focus will shift to U.S. statistics. Special attention will be on U.S. retail sales data for September, as well as initial jobless claims, the Philadelphia Fed manufacturing index, and industrial production. Strong figures could return pressure to the pair, and I plan to take advantage of this. In the event of a decline in GBP/USD, only after a false breakout around 1.2976 will there be an opportunity to enter long positions, aiming for a recovery towards the 1.3031 resistance, formed from the results of yesterday's session. A breakout and retest from top to bottom of this range will increase the likelihood of an upward correction developing, leading to a stop-loss squeeze for sellers and a suitable entry point for buying with a target of 1.3070. Testing this level will negate sellers' plans for further pound declines. The final target will be the 1.3099 level, where I will take profits. If GBP/USD declines and there's no activity from the bulls around 1.2976 in the second half of the day, the bearish market will return. This will also lead to a drop and a retest of the next support at 1.2941. Only a false breakout there will provide a good condition for opening long positions. I will consider buying GBP/USD on a rebound only from the 1.2911 low, aiming for a correction of 30-35 points within the day.

To Open Short Positions on GBP/USD:

Sellers were unable to hold the monthly low and decided to retreat. While a correction is underway, I plan to act strictly after testing and forming a false breakout around the nearest resistance at 1.3031, where the moving averages which favor the sellers are located. This will provide a solid opportunity for selling, with a target of a decline towards the 1.2976 support, formed as a result of the first half of the day. A breakout and retest from below of this range on the back of strong U.S. statistics will hit the buyers' positions, triggering stop-losses, and paving the way to 1.2941. The final target will be the 1.2911 level, where I will take profits. Testing this level will further strengthen the bearish market. In the event of GBP/USD rising and no bearish activity at 1.3031 in the second half of the day, buyers may attempt to regain control. The bears will have no choice but to retreat towards the 1.3070 resistance. I will only sell there after a false breakout. If there is no downward movement, I will look for short positions on a rebound from 1.3099, but only for a downward correction of 30-35 points within the day.

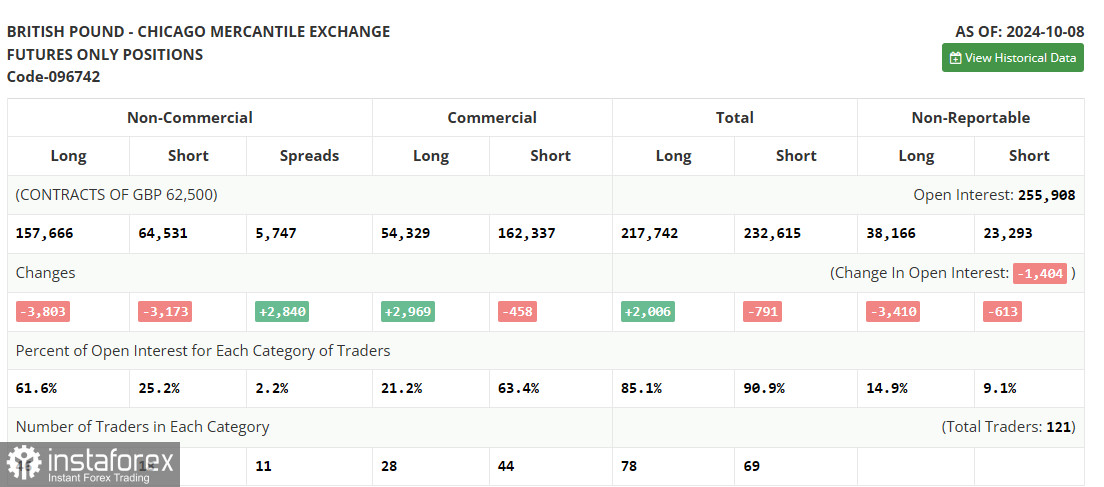

In the COT report (Commitment of Traders) for October 8, both long and short positions decreased by nearly the same amount. Recent U.K. data hasn't helped the pound rise, but at least it has kept the pair within a significant sideways channel, which could signal the end of the bearish market and the formation of a new bullish one. However, for this to happen, U.S. policymakers must again start talking about actively lowering interest rates, which seems an unlikely scenario at the moment. The latest COT report indicated a decrease in long non-commercial positions by 3,803 to 157,666, while short positions fell by 3,173 to 64,531. As a result, the gap between long and short positions increased by 2,840.

Indicator Signals:

Moving Averages:

Trading is occurring below the 30-day and 50-day moving averages, indicating the potential for further declines.

Note: The period and prices of the moving averages are based on the author's H1 chart and differ from the classic daily moving averages on the D1 chart.

Bollinger Bands:

In the event of a decline, the lower boundary of the indicator around 1.2976 will serve as support.

Indicator Descriptions:

- Moving Average (MA): Determines the current trend by smoothing volatility and noise. The 50-period MA is marked in yellow on the chart.

- Moving Average (MA): Determines the current trend by smoothing volatility and noise. The 30-period MA is marked in green on the chart.

- MACD (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: 20-period Bollinger Bands.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet specific criteria.

- Long non-commercial positions: The total long open position of non-commercial traders.

- Short non-commercial positions: The total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.