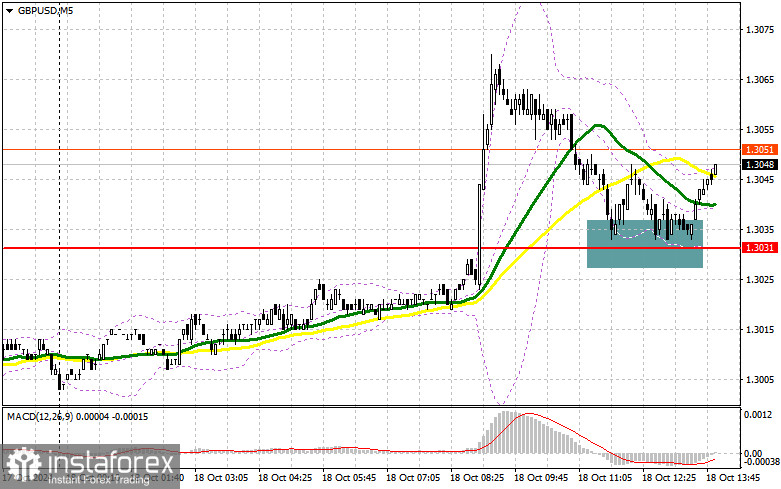

In my morning forecast, I focused on the 1.3031 level and planned trading decisions accordingly. Let's look at the 5-minute chart to see what happened. The breakout and retest of 1.3031 provided a suitable entry point for buying the pound, but as you can see on the chart, a new wave of growth did not materialize. The technical picture for the second half of the day has been slightly revised.

For opening long positions on GBP/USD:

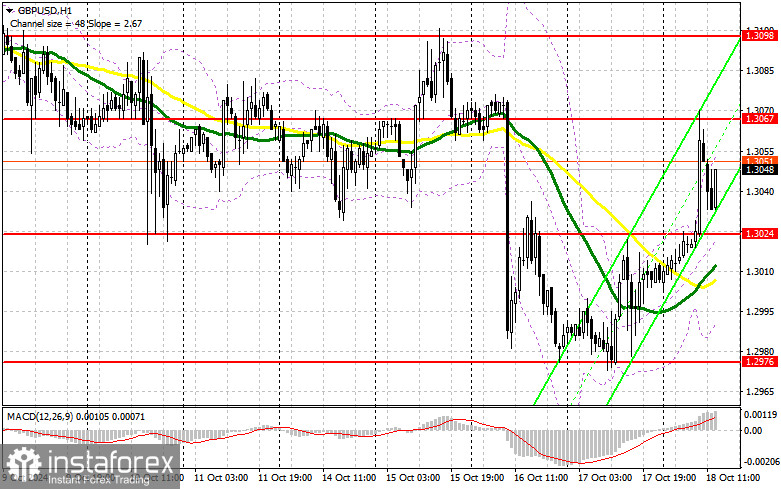

Strong retail sales data from the UK helped pound buyers to hold above 1.3031, but that was it. Confidence in further growth has waned, so it's better to focus on U.S. statistics now. Data on building permits issued in the US, along with speeches from FOMC members Raphael Bostic and Neel Kashkari, are expected. A hawkish stance from these policymakers could pose new challenges for pound buyers. Hints at a pause in the rate-cut cycle would add to the pressure. Therefore, I will act on a decline after a false breakout formation near the new support at 1.3024, formed based on today's results. The target will be the 1.3067 resistance. A breakout and retest of this range will increase the chances of a continued upward correction, leading to stop-loss orders being triggered and providing a good entry point for buying with a potential move to 1.3098. Testing this level will invalidate the sellers' plans for a further decline in the pound. The ultimate target will be the 1.3131 level, where I will take profit. In case of a GBP/USD decline and the absence of buying interest around 1.3024 in the second half of the day, the bearish market will return. This would also lead to a decline and retesting of the next weekly low and support at 1.2976. A false breakout there would be the only suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from the 1.2941 low, aiming for a correction of 30-35 points intraday.

For opening short positions on GBP/USD:

Sellers retreated after the data, but buying interest also waned significantly after a small upward movement. The main objective for bears now is to defend the new resistance at 1.3067, where a false breakout formation would provide a suitable opportunity to sell with a target of reaching the 1.3024 support formed based on the first half of the day's results. This level also coincides with the moving averages, which currently favor buyers. Thus, a breakout and retest from below amid strong U.S. statistics will strike a blow to buyers' positions, leading to the triggering of stop-loss orders and opening the way towards 1.2976. The ultimate target will be the 1.2941 level, where I plan to take profit. Testing this level will bring back the bearish market. In the case of a GBP/USD rise and lack of activity at 1.3067 in the second half of the day, buyers will try to regain control. The bears will have no choice but to retreat to the 1.3098 resistance area. I will only sell there on a false breakout. If there is no downward movement, I will look for short positions on a rebound around 1.3131, aiming for a downward correction of 30-35 points intraday.

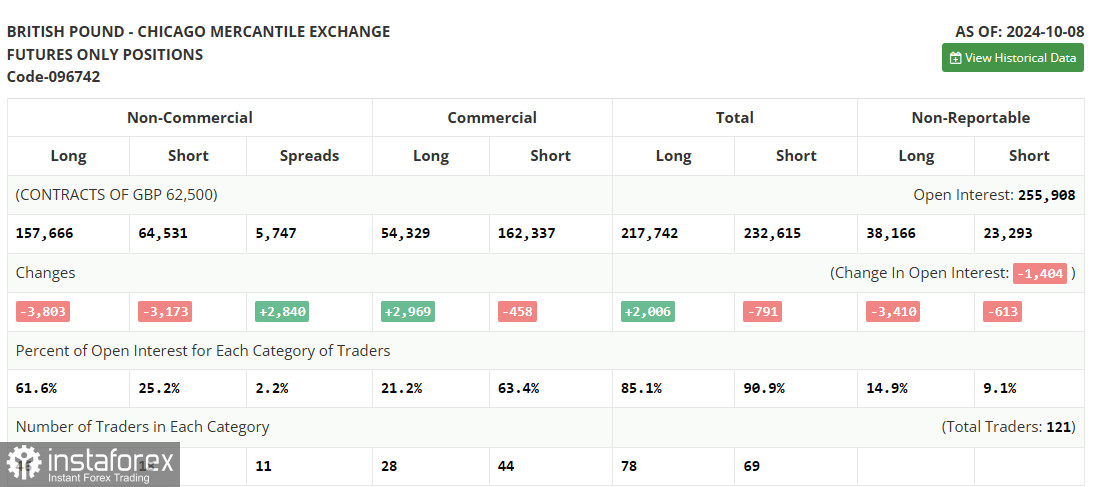

In the COT report (Commitment of Traders) for October 8, a decrease in both long and short positions was observed, almost by similar amounts. Recent data from the UK hasn't helped the pound to rise, but it has kept the pair within a significant sideways channel, which could signal the end of the bearish market and the emergence of a new bullish trend. However, for this to happen, U.S. policymakers would need to start discussing active rate cuts again, which seems unlikely in the current situation. The latest COT report indicates that long non-commercial positions decreased by 3,803 to a level of 157,666, while short non-commercial positions fell by 3,173 to a level of 64,531. As a result, the gap between long and short positions increased by 2,840.

Indicator Signals:

Moving Averages:

Trading is conducted above the 30 and 50-day moving averages, indicating a potential rise in the pound.

Note: The period and prices of the moving averages are considered by the author on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.2980 will serve as support.

Description of Indicators:

- Moving average: Determines the current trend by smoothing out volatility and noise. Period – 50. Marked in yellow on the chart.

- Moving average: Determines the current trend by smoothing out volatility and noise. Period – 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Net non-commercial position: The difference between the short and long positions of non-commercial traders.