Analysis of Trades and Tips for Trading the British Pound

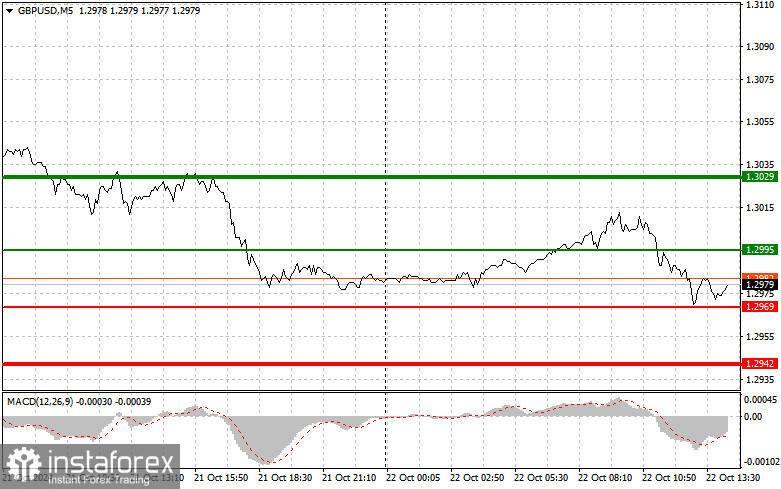

The first test of the 1.3007 level occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upward potential—especially within the downward trend observed in the previous day's trading for the British pound. The second test of this level, after a short time, coincided with the MACD being in the overbought zone, allowing for the implementation of Scenario #2 for selling the pair. As a result, we saw a fairly good decline toward the target level of 1.2976. The Richmond Fed Manufacturing Index and the speech by FOMC member Patrick T. Harker will be the key events in the second half of the day, so the pound has very little chance for an upward correction. For the intraday strategy, I plan to focus more on implementing Scenario #2.

Buy Signal

Scenario #1: Today, I plan to buy the pound if it reaches the entry point around 1.2995 (green line on the chart) with a target of rising to the 1.3070 level (thicker green line on the chart). Around 1.3029, I plan to exit the buy trades and open sell positions in the opposite direction (expecting a 30-35 point move in the opposite direction from the level). A rise in the pound today can only be expected following weak economic data from the US. Important: Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.2969 level when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to an upward market reversal. A rise toward the target levels of 1.2995 and 1.3029 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after a breakout of the 1.2969 level (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be the 1.2942 level, where I plan to exit sell trades and consider opening buy positions in the opposite direction (expecting a 20-25 point move in the opposite direction from the level). Sellers will make their presence felt if the Fed members adopt a more hawkish stance on monetary policy. Important: Before selling, ensure that the MACD indicator is below the zero mark and just starting its decline from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.2995 level when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a downward market reversal. A decline to the target levels of 1.2969 and 1.2942 can be expected.

Chart Overview:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Approximate price where take profit orders can be set or profits can be secured, as further growth above this level is unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Approximate price where take profit orders can be set or profits can be secured, as further decline below this level is unlikely.

- MACD Indicator: It is important to consider overbought and oversold zones when entering the market.

Important: Beginner traders in the forex market should be very careful when making entry decisions. It is best to stay out of the market before the release of important fundamental reports to avoid being caught in sharp price movements. If you decide to trade during news releases, always use stop-loss orders to minimize losses. Without using stop-loss orders, you can quickly lose your entire capital, especially if you do not practice money management and trade in large volumes.

And remember, successful trading requires a clear trading plan, such as the example outlined above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for intraday traders.