Traders have to deal with mixed trends for market instruments on Friday. The US dollar and precious metal have reached key support levels today.

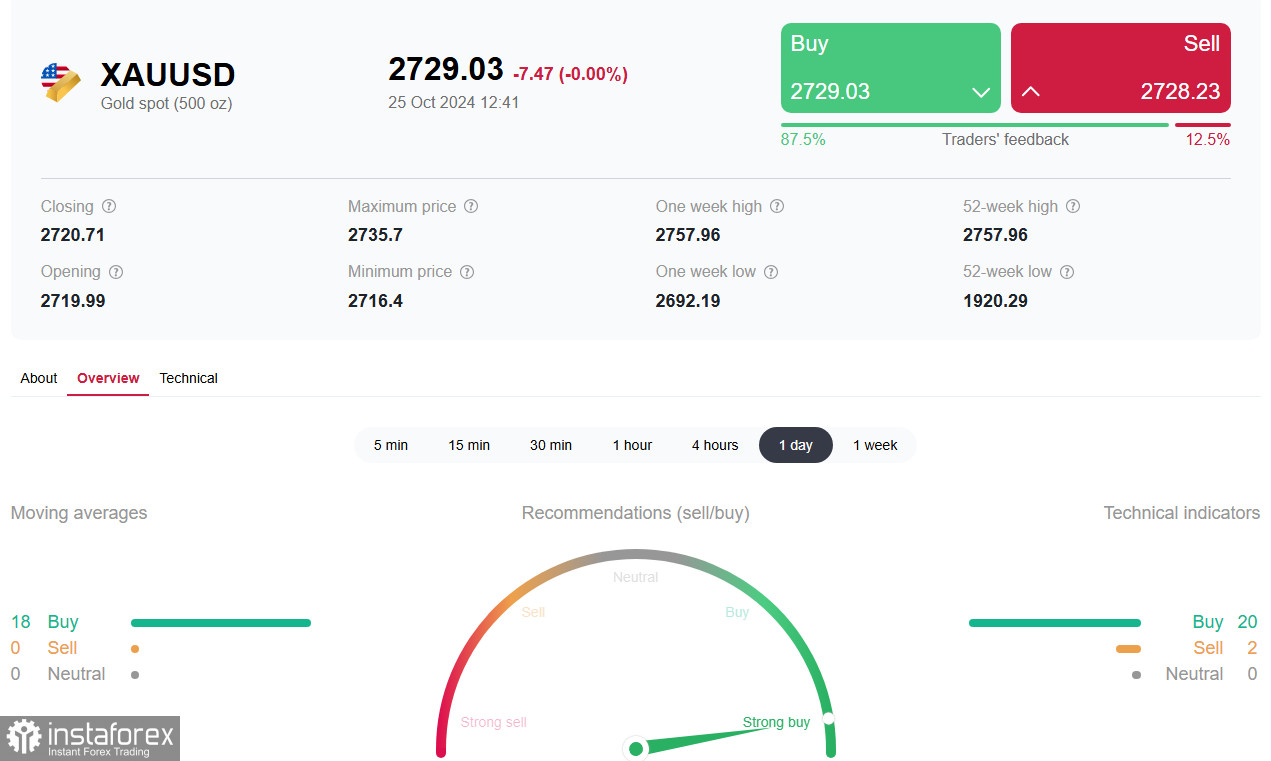

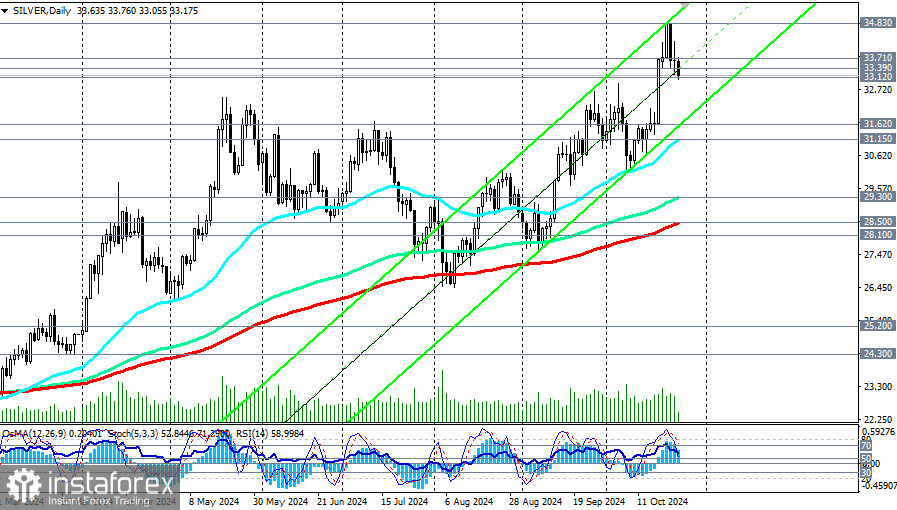

Silver's price, in the first half of today's trading session, reached 33.05, testing the strong short-term support level of 33.12 (the 200-period moving average on the 1-hour chart). The XAU/USD pair, reflecting gold's price movement, hit 2,722.00 by the time of this article, after testing a strong short-term support level (the 144-period moving average on the 1-hour chart).

Economists believe that gold and silver prices have dipped due to upbeat recent US macroeconomic data. Preliminary data from yesterday showed an increase in October's S&P Global Manufacturing PMI in the US from 47.3 to 47.8 (against a forecast of 47.5) and the Services PMI from 55.2 to 55.3 (forecasted at 55.0).

The US Labor Department reported that initial jobless claims for the week ending October 18 fell to 227,000 from 242,000 previously, while continuing unemployment claims (for the week ending October 11) dropped to 1.867 million from 1.869 million the prior week.

Additionally, Thursday's Census Bureau data on home sales, an important indicator of the US real estate market, showed a 4.1% increase in new home sales in September following a -2.3% decline a month ago.

Economists predict consumer spending growth of +2.4% in 2024 compared to +2.2% last year. The US economy grew by +3.0% in the second quarter of 2024, with overall GDP growth expected to be +2.7% for the year. Retail sales in September inched up by +0.1%, while industrial production increased by +0.8%. Overall, this positive data is bullish to the US dollar.

However, it may be premature to bet on a further and deeper decline in precious metal prices, given the continued high demand amid global geopolitical tensions.

In our view, the current price declines for silver and gold are part of a correction following their impressive bullish rally. So, it makes sense to plan long positions at about support levels of 2,719.00, 2,710.00, 2,700.00 (for gold) and 33.12, 33.00 (for silver).

Today, market participants will assess US macroeconomic data scheduled for release at 12:30 (GMT) and 14:00. According to the consensus, durable goods orders sank to -1.1% in September from 0% previously, and excluding transportation, to -0.1% from 0.5% in the previous month. Additionally, the University of Michigan consumer confidence index for October is expected to have decreased to 69.0 from 70.1 in September, with 5-year consumer inflation expectations dropping from 3.1% to 3.0%.

If this data proves even weaker than expected, the US dollar will weaken in response, along with end-of-week profit-taking, potentially leading to a new bullish sequence in precious metal prices.