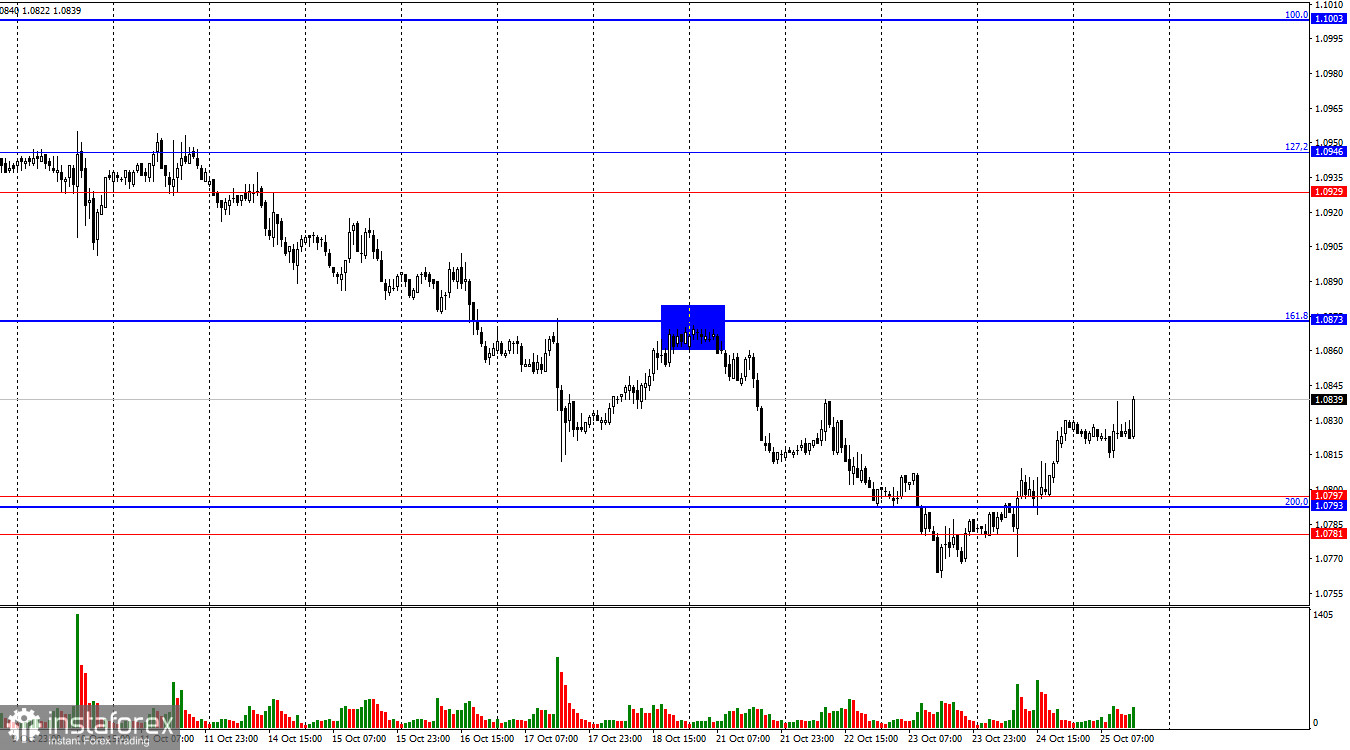

On Thursday, the EUR/USD pair managed to consolidate above the resistance zone of 1.0781 – 1.0797. This resulted in a reversal in favor of the euro and initiated a rise towards the 161.8% corrective level at 1.0873, which continues today, Friday. A rebound at the 1.0873 level would favor the U.S. dollar, leading to a renewed decline towards the 1.0781 – 1.0797 zone. A close above the 1.0873 level would increase the likelihood of further growth towards 1.0929. The trend remains clearly "bearish."

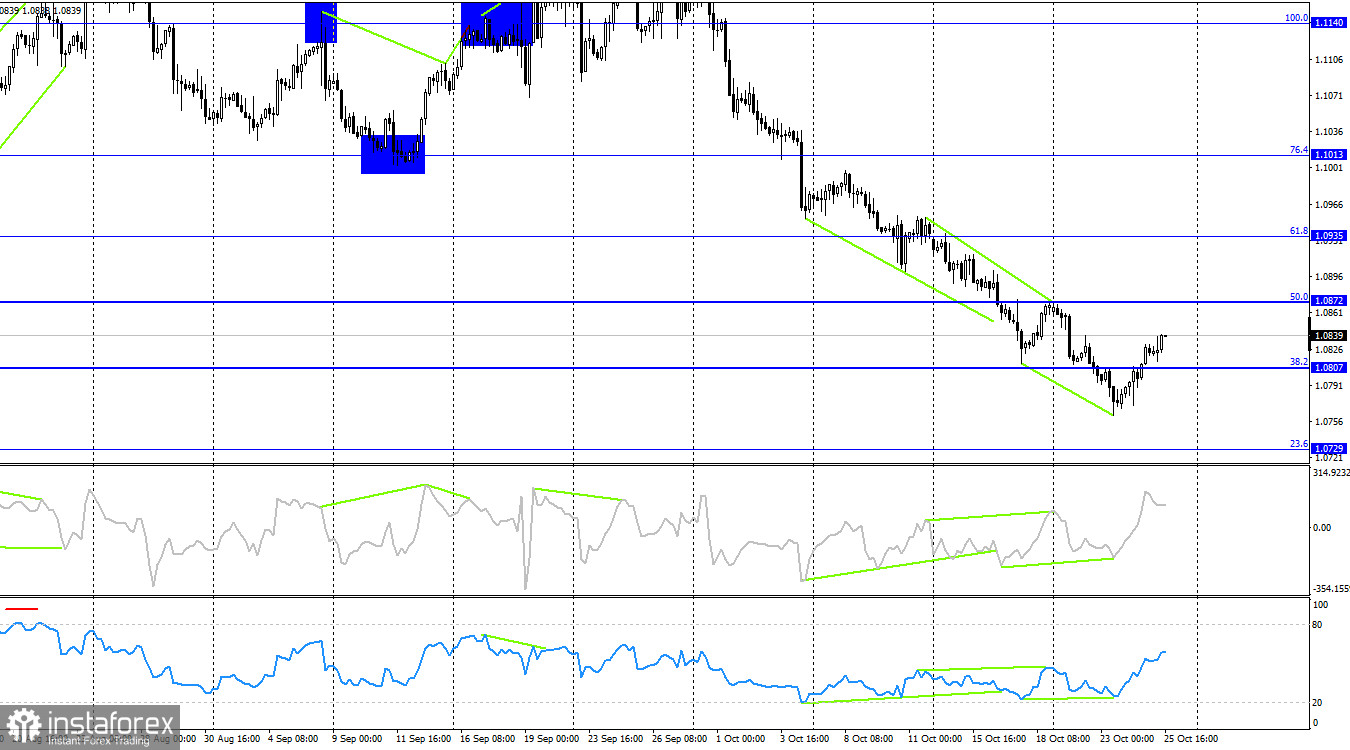

The wave structure is clear. The last completed upward wave (September 25-30) did not break the high of the previous wave, while the new downward wave (which is still forming) has broken the lows of the previous three waves. Thus, the pair is currently forming a new "bearish" trend. A corrective wave may form soon, but the bulls have already lost their market initiative. Regaining it would require significant effort, making it unlikely to happen soon.

The information background on Thursday provided some help to the bulls, but only a little. The business activity indices in Germany and the Eurozone's services and manufacturing sectors were generally better than traders' expectations, though the manufacturing sectors remained below the 50.0 mark. Therefore, while the reports were better than forecasts, they were not particularly strong. In my view, the euro's rise yesterday and today is attributed to a pause by the bears before initiating new attacks. Thus, this is a correction that could end at any time. If the news background in the coming weeks favors the euro, the correction could last two to three weeks. The pair had been in a state of decline for nearly a month. The correction could take even more time. However, it might also end quickly, considering the recent pressure from the bears.

On the 4-hour chart, the pair reversed in favor of the euro after forming another "bullish" divergence. The pair's consolidation above the 1.0807 level suggests a continuation of the upward movement towards the 50.0% Fibonacci level at 1.0872. However, "bearish" divergences are already emerging in the RSI and CCI indicators, so, as I mentioned earlier, the correction may not last long. A rebound from the 1.0872 level could provide an opportunity for the bears to reassert control.

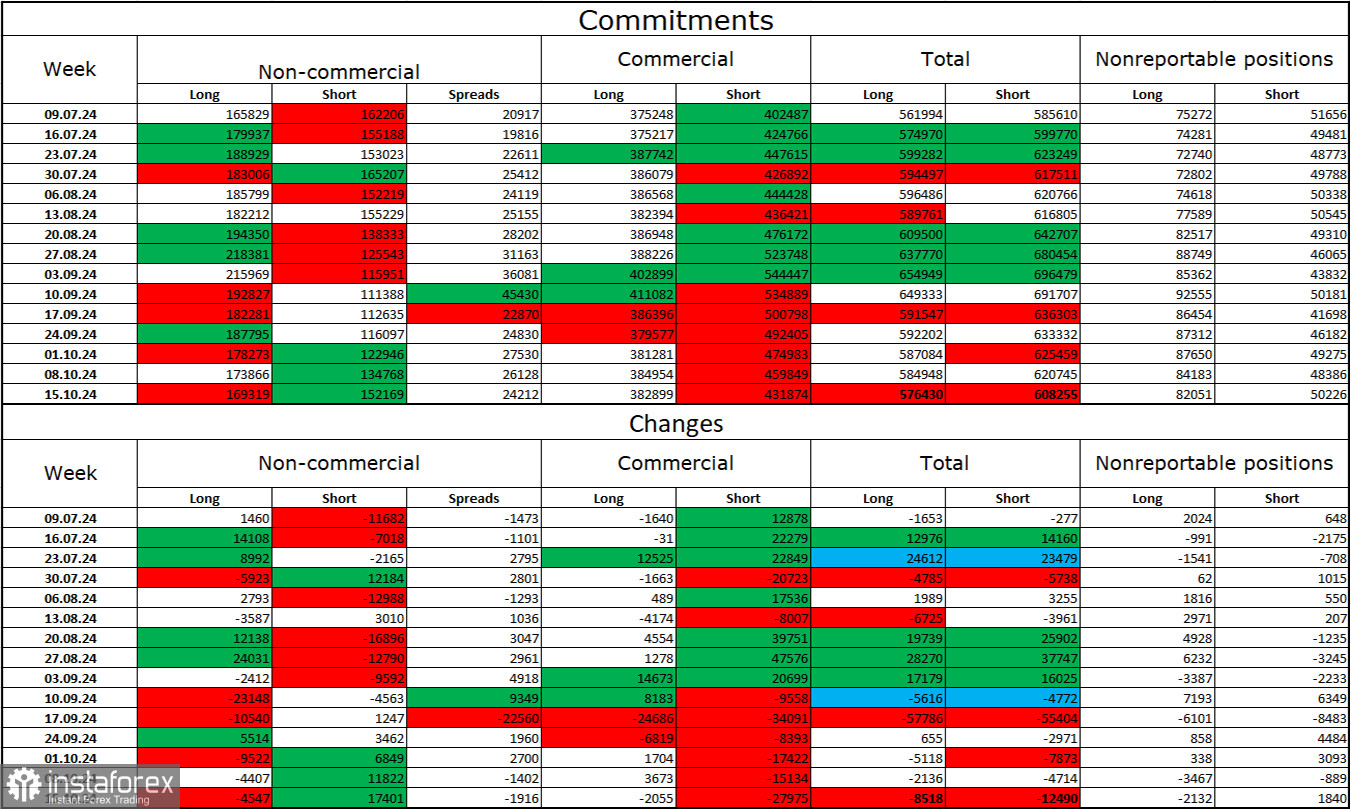

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 4,547 long positions and opened 17,401 short positions. The sentiment of the "non-commercial" group turned "bearish" a few months ago, but currently, the bulls are dominating again. However, their momentum is weakening each week. The total number of long positions held by speculators is now 169,000, while short positions number 152,000.

For the sixth consecutive week, large players have been reducing their euro holdings. In my view, this could signal a new "bearish" trend or at least a strong correction. The main factor behind the dollar's decline—expectations of FOMC easing—has already been priced in, and the market no longer has reasons for widespread dollar selling. Such reasons could emerge over time, but for now, a rise in the U.S. currency seems more likely. Technical analysis also indicates the start of a "bearish" trend. Therefore, I am preparing for a prolonged decline in the EUR/USD pair.

News Calendar for the US and Eurozone:

- US – Change in Durable Goods Orders (12:30 UTC)

- US – University of Michigan Consumer Sentiment Index (14:00 UTC)

On October 25, the economic calendar includes just two events, but they are quite important. The influence of the information background on market sentiment may be moderate today, but only during the second half of the day.

Forecast for EUR/USD and Trading Tips:

Selling the pair is possible if it closes below the 1.0781 – 1.0797 zone on the hourly chart, targeting 1.0729. Buying the pair could be considered after consolidating above the 1.0781 – 1.0797 zone, targeting 1.0873.

Fibonacci levels are plotted from 1.1003 to 1.1214 on the hourly chart and from 1.1139 to 1.0603 on the 4-hour chart.