Trade Analysis and Tips for Trading the Euro

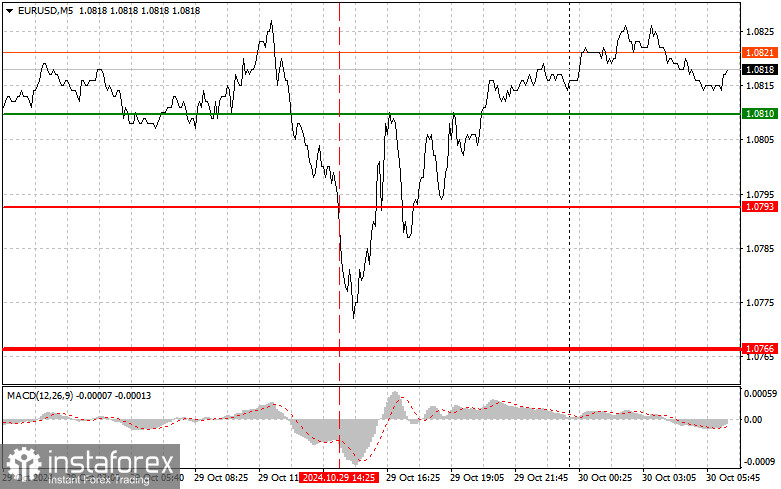

The test at the 1.0793 level occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downward potential. For this reason, I didn't sell the euro. Strong U.S. data triggered the pair's sharp decline, but it ended there. Falling short of reaching the monthly low, sellers quickly retreated, leading to a rebound in euro demand. A lot of economic data is scheduled for the first half of the day. Key releases will include the Eurozone GDP and Consumer Price Index data. The Eurozone consumer confidence index and speeches by European Central Bank Executive Board members Isabel Schnabel and Joachim Nagel will be secondary. In case of weak GDP data, the euro has a good chance of a significant new drop. Otherwise, a rise is expected, as Eurozone inflation data will likely be favorable. I'll focus on scenarios #1 and #2 for intraday strategy.

Buy Signal

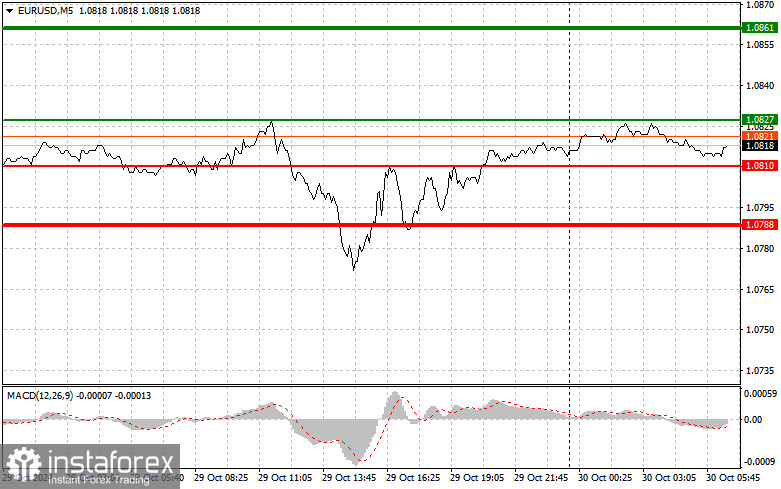

Scenario #1: Today, buy the euro if the price reaches around 1.0827 (green line on the chart), aiming for a rise to 1.0861. At 1.0861, I plan to exit the market and sell the euro in the opposite direction, targeting a move of 30-35 pips from the entry point. A rise in the euro during the first half of the day may occur following strong data, contributing to a new upward trend. Important! Before buying, ensure the MACD indicator is above zero and starting to rise.

Scenario #2: I'll also consider buying the euro if there are two consecutive tests of the 1.0810 level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and could lead to an upward market reversal. A rise to the opposite levels of 1.0827 and 1.0861 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.0810 level (red line on the chart). The target will be the 1.0788 level, where I plan to exit the market and buy immediately in the opposite direction (targeting a move of 20-25 pips from this level). Pressure on the pair will return if there's a failed attempt to break past the daily high and weak Eurozone GDP data. Important! Before selling, ensure the MACD indicator is below zero and just beginning to fall from it.

Scenario #2: I'll also consider selling the euro if there are two consecutive tests of the 1.0827 level, with the MACD indicator in the overbought area. This will limit the pair's upward potential and could lead to a market reversal downward. A decline toward the opposite levels of 1.0810 and 1.0788 can be expected.

Chart Indicators:

Thin Green Line – Entry price to buy the instrument.

Thick Green Line – Suggested price level for setting Take Profit or manually taking profits, as further growth beyond this level is unlikely.

Thin Red Line – Entry price to sell the instrument.

Thick Red Line – Suggested price level for setting Take Profit or manually taking profits, as further decline beyond this level is unlikely.

MACD Indicator – When entering the market, consider overbought and oversold zones.

Important: Novice traders should exercise caution when entering the market. Before the release of significant fundamental reports, it is best to stay out of the market to avoid sudden price swings. If you choose to trade during news releases, always set stop orders to minimize losses. You may quickly lose your entire deposit without stop orders, especially if trading large volumes without proper money management.

Remember, successful trading requires a clear plan, like the above example. Spontaneous trading decisions based on current market conditions are inherently a losing strategy for an intraday trader.