Analysis of Macroeconomic Reports:

There aren't many macroeconomic events scheduled for Thursday, but there will be some genuinely significant releases. The most important report will be on inflation in the Eurozone. Yesterday, it was reported that Germany's inflation accelerated to 2%, so today, we can reasonably expect the Eurozone's overall inflation to surpass forecasts. A rise in Eurozone inflation would mean that the European Central Bank could consider a pause in December. If inflation increases in November, the ECB might pause for several meetings. This scenario would support the euro. We don't expect this alone to reignite the two-year uptrend for the euro, but at the very least, it could prompt a correction.

Today's data in the U.S. includes the Personal Consumption Expenditures (PCE) index, jobless claims, and personal income and spending figures for Americans. We believe these aren't the most critical data points, but the PCE index may still trigger a market reaction.

Analysis of Fundamental Events:

There's nothing particularly notable among Thursday's fundamental events. Yesterday's inflation report from Germany raised doubts about the ECB cutting rates in December, and today's Eurozone inflation data will provide a clearer picture. No statements are scheduled from either the ECB or the Federal Reserve.

General Conclusions:

Throughout the penultimate trading day of the week, movements in both currency pairs will depend on the macroeconomic background, making them hard to predict in advance. Eurozone inflation may support the euro, while the pound could again struggle. Only a weaker-than-expected U.S. PCE index could provide some relief to the pound.

Basic Trading System Rules:

- The strength of a signal is determined by the time it takes to form (whether a bounce or breakthrough of a level). The quicker the formation, the stronger the signal.

- If two or more trades have been made near a level due to false signals, any further signals from that level should be ignored.

- In a flat market, a pair can generate many false signals or none at all. In any case, it's best to stop trading at the first signs of a flat market.

- Trading occurs between the start of the European and middle of the US sessions, after which all trades should be manually closed.

- On the hourly time frame, it's recommended to trade MACD indicator signals only when there is good volatility and a trendline or trend channel confirms a trend.

- If two levels are too close together (5 to 20 pips apart), they should be treated as support or resistance areas.

- After the price moves 15-20 pips in the intended direction, set the Stop Loss to breakeven.

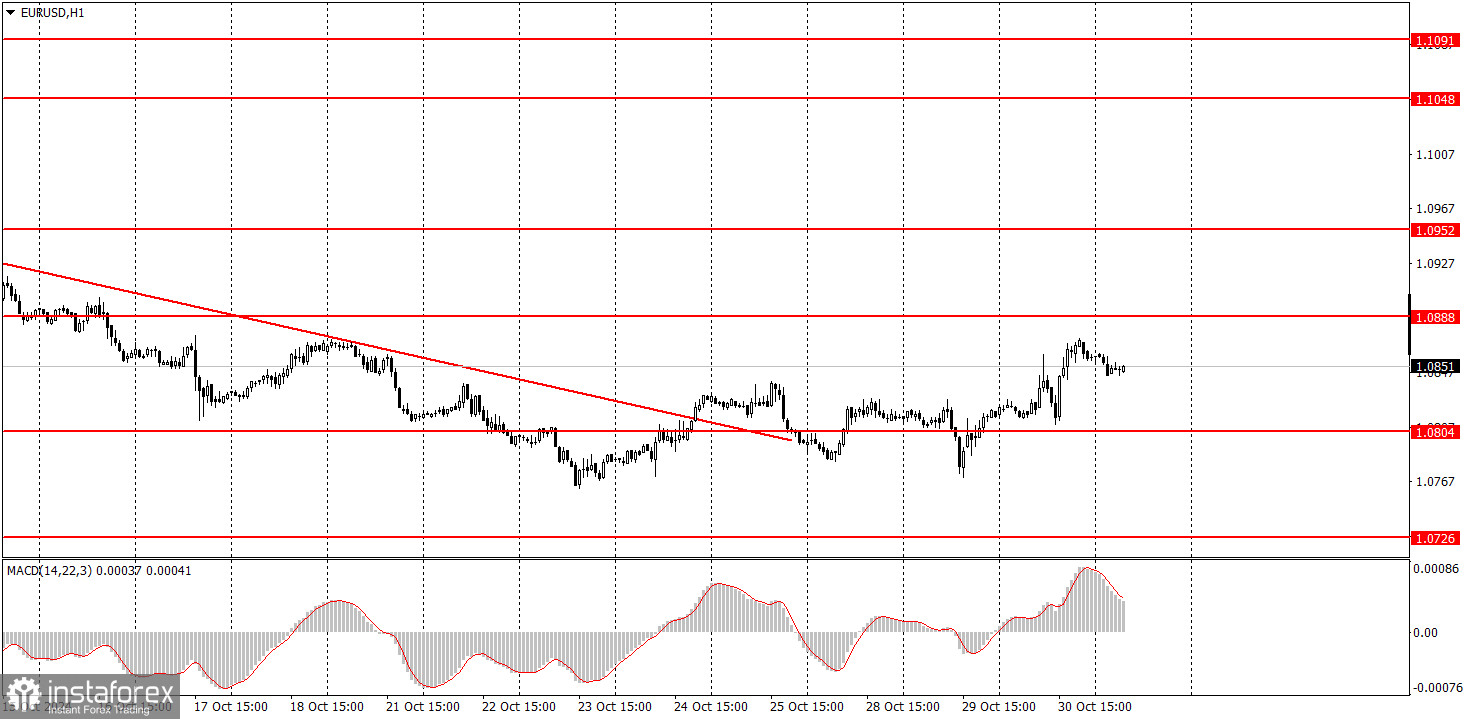

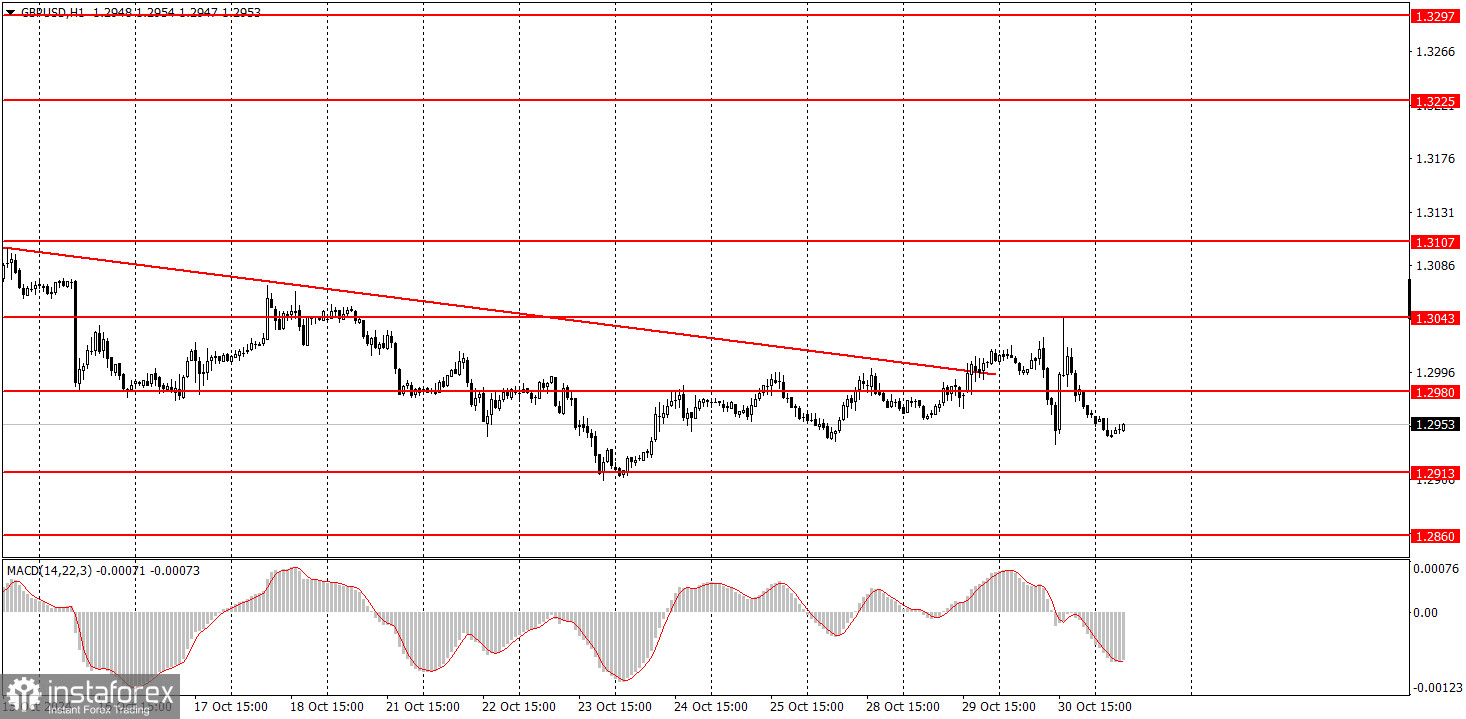

What's on the Charts:

Support and Resistance Levels: Levels that serve as targets for opening buys or sells. Take Profit levels can be placed around these areas.

Red Lines: Channels or trend lines that indicate the current trend and the preferred trading direction.

MACD Indicator (14,22,3): Histogram and signal line—an auxiliary indicator that can also be used as a source of signals.

Major speeches and reports (always found in the news calendar) can significantly impact currency pair movements. Therefore, it's advised to trade cautiously or exit the market during their release to avoid sharp price reversals against prior movements.

Beginners trading on the forex market should remember that not every trade will be profitable. A clear strategy and money management are the keys to success in long-term trading.