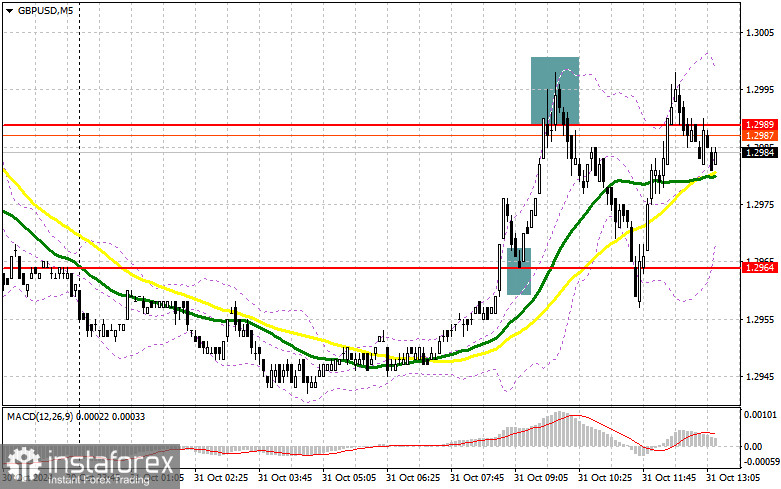

In my morning forecast, I highlighted the 1.2964 level as a key entry point. Let's look at the 5-minute chart to analyze what happened. The breakout and retest of 1.2964 provided an excellent buy entry, resulting in a rise of more than 30 points for the pair. Selling around 1.2989 after a failed consolidation yielded another 30 points. I decided against another buy from 1.2964. The technical picture has been slightly adjusted for the second half of the day.

To Open Long Positions on GBP/USD:

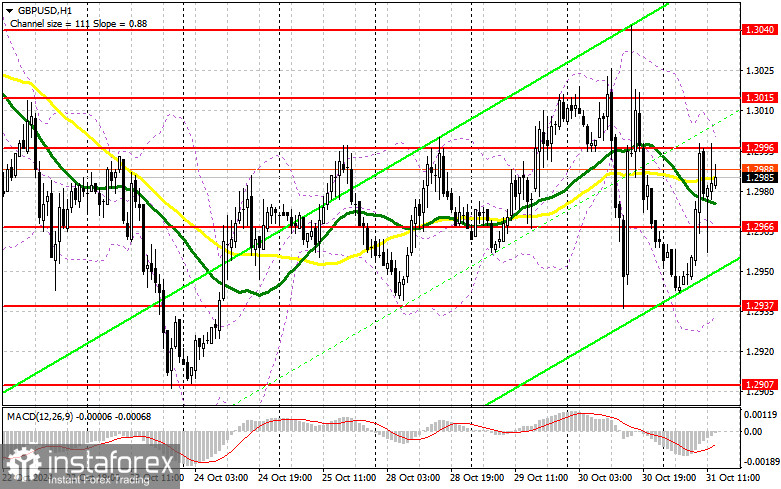

The pound continues to experience high volatility due to a lack of significant data, which we are using to our advantage. In the second half of the day, weekly initial jobless claims, the core personal consumption expenditure index, and changes in personal spending and income data are expected, likely keeping volatility high. Strong statistics could remind pound sellers of the necessary actions in current conditions, while weak data would bring buyers back into the market. If selling pressure returns to the pair, only a false breakout at the new support level of 1.2966 would confirm a buy entry, aiming for recovery toward 1.2996. A breakout and retest of 1.2996 would create a new buy entry point with the potential to reach 1.3015 as the next resistance. The farthest target is 1.3040, where I plan to take profits. If GBP/USD declines and there is no buying activity at 1.2966 in the second half, the bearish market will return. This could lead to a move toward the next support at 1.2937. Only a false breakout there would provide an appropriate condition for long positions. I plan to buy GBP/USD on an immediate rebound from the 1.2907 low with an intraday correction target of 30-35 points.

To Open Short Positions on GBP/USD:

Sellers are active and unwilling to yield. If the pair moves upward on the data release, bears are expected to act again around the closest resistance at 1.2996. A false breakout there, similar to the scenario I discussed earlier, would be a suitable selling opportunity, aiming for a decline to the 1.2966 support, keeping the pair within a range-bound movement. A breakout and retest of this range from below would pressure buyers, triggering stop-losses and opening a path to 1.2937. The final target will be the 1.2907 area, where I plan to take profits. Testing this level would strengthen the bearish market. If GBP/USD rises in the second half of the day and no bearish activity is seen at 1.2996, amid weak U.S. data, buyers will likely continue driving the price higher. In that case, bears will have to retreat toward the 1.3015 resistance. I'll only sell there after a failed consolidation. If there is no downward movement there, I'll seek short positions on a rebound near 1.3040, targeting a 30-35 point downward correction.

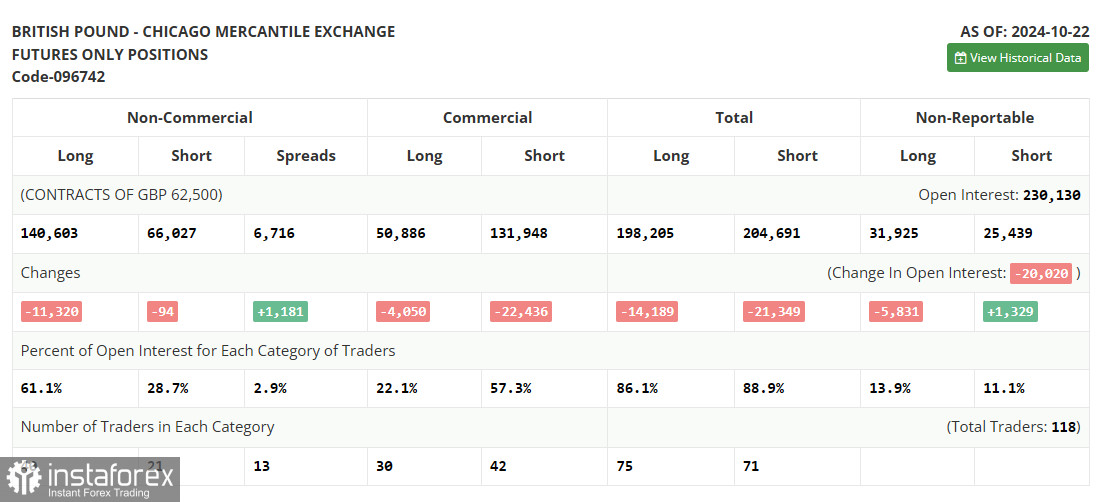

The Commitment of Traders (COT) report for October 22 showed a decrease in both long and short positions. However, the decline in long positions did not significantly alter the market balance, as buyers still outnumber sellers by almost two and a half times. There is no major data from the U.K. this week, and since British policymakers have said all that can be said, I expect further recovery for the pound against the dollar. However, much depends on U.S. GDP and labor market data, which shouldn't be overlooked. The latest COT report showed a drop of 11,320 in non-commercial long positions, down to 140,603, while non-commercial short positions fell by only 94, to 66,072, resulting in an increase in the gap between long and short positions by 1,181.

Indicator Signals:

Moving AveragesTrading around the 30- and 50-day moving averages indicates market uncertainty.

Note: The author's analysis considers moving averages on the H1 hourly chart, which differs from the standard interpretation on the daily D1 chart.

Bollinger BandsIf the pair declines, the lower Bollinger Band boundary near 1.2937 will serve as support.

Indicator Descriptions:

- Moving Average (MA): Smooths volatility and noise to indicate the current trend. Period – 50, marked in yellow on the chart.

- Moving Average (MA): Smooths volatility and noise to indicate the current trend. Period – 30, marked in green on the chart.

- MACD (Moving Average Convergence/Divergence): Fast EMA – 12 periods, Slow EMA – 26 periods, SMA – 9 periods.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes.

- Long non-commercial positions: The total long open position held by non-commercial traders.

- Short non-commercial positions: The total short open position held by non-commercial traders.

- Total non-commercial position: The difference between short and long positions of non-commercial traders.