Analysis of Trades and Trading Tips for the Japanese Yen

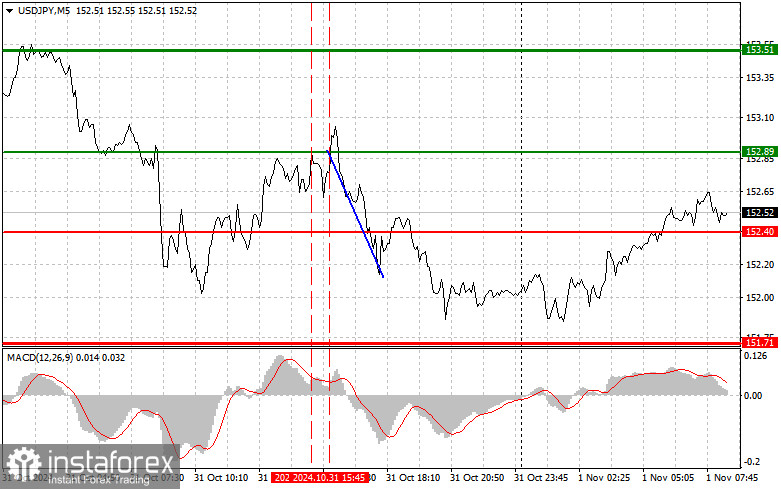

The test of the 152.89 price level occurred when the MACD indicator had moved significantly above the zero mark, limiting the pair's upward potential, especially within the downward trend observed following the Bank of Japan's decision. For this reason, I didn't buy. Shortly afterward, another test of this range coincided with the MACD being in the overbought zone, which allowed Scenario #2 for selling to play out. As a result, the pair dropped by more than 60 pips. The Bank of Japan's decision to leave interest rates unchanged put pressure on the dollar as the central bank indicated plans for further rate hikes soon. Today, there's no need to rush with sales as key U.S. data are upcoming, which could reverse the current downward trend. We'll discuss this in more detail in the afternoon forecast, but it's better to trade within the channel now. I'll rely more on implementing Scenarios #1 and #2 for intraday strategy.

Buy Signal

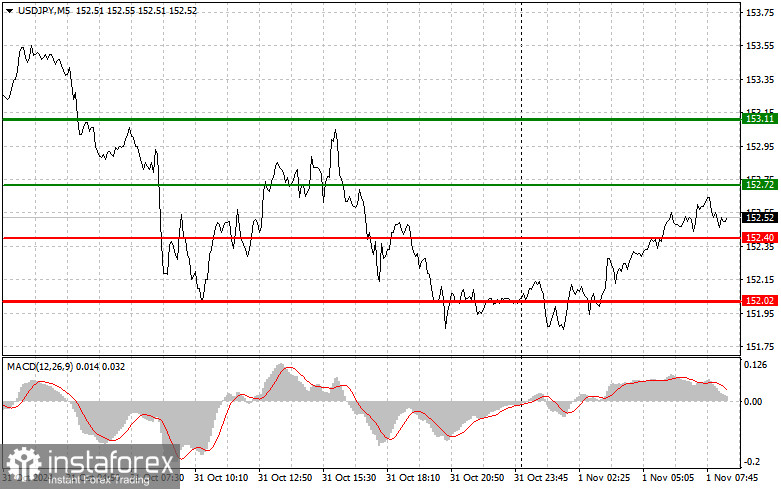

Scenario #1: I plan to buy USD/JPY today if it reaches the entry point around 152.72 (green line on the chart) with a target of 153.11 (thicker green line). Around 153.11, I plan to exit long positions and open short positions in the opposite direction (targeting a 30-35 pip move back from this level). Growth in the pair can be expected, but buying is best done on corrections. Important! Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of the 152.40 level while the MACD indicator is in the oversold area. This will limit the pair's downward potential and prompt an upward market reversal. Growth to the opposite levels of 152.72 and 153.11 can be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY today only after the 152.40 level is broken (red line on the chart), which will lead to a rapid decline in the pair. The main target for sellers will be the 152.02 level, where I plan to exit shorts and open longs immediately in the opposite direction (targeting a 20-25 pip move back from this level). Pressure on the pair will return if U.S. data turn out weak. Important! Before selling, ensure the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of the 152.72 level while the MACD indicator is in the overbought area. This will limit the pair's upward potential and prompt a market reversal downward. A decline to the opposite levels of 152.40 and 152.02 can be expected.

Chart Indicators:

Thin Green Line – Entry price to buy the instrument.

Thick Green Line – Suggested price level for setting Take Profit or manually taking profits, as further growth beyond this level is unlikely.

Thin Red Line – Entry price to sell the instrument.

Thick Red Line – Suggested price level for setting Take Profit or manually taking profits, as further decline beyond this level is unlikely.

MACD Indicator – When entering the market, consider overbought and oversold zones.

Important: Novice traders should exercise caution when entering the market. Before the release of significant fundamental reports, it is best to stay out of the market to avoid sudden price swings. If you choose to trade during news releases, always set stop orders to minimize losses. You may quickly lose your entire deposit without stop orders, especially if trading large volumes without proper money management.

Remember, successful trading requires a clear plan, like the above example. Spontaneous trading decisions based on current market conditions are inherently a losing strategy for an intraday trader.