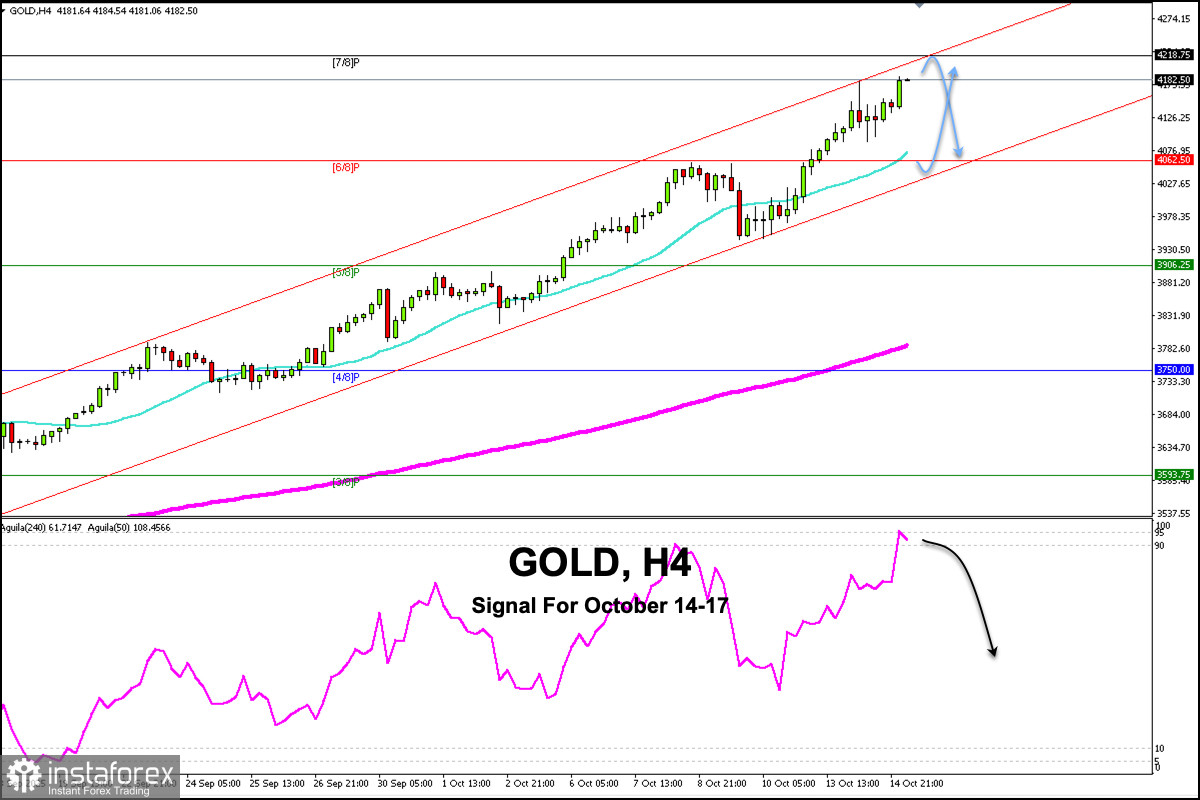

Early in the European session, gold is trading around 4,182, below the uptrend channel formed on September 15 and with a positive bias after a strong rebound above 4,100.

In the coming hours, gold could continue its rise and reach the top of the uptrend channel around 4,205 and could even reach the 7/8 Murray around 4,218.

If gold falls below the 7/8 Murray and fails to consolidate above this area, we can expect a pullback to reach the 21SMA around 4,080. The instrument could even get the 6/8 Murray at 4,062.

Technically, the Eagle indicator has reached the overbought zone, so a strong technical correction is likely in the coming days, and gold could reach the psychological level of $4,000.

A sharp break below the Murray four-point six-eighth level and a sharp break of the uptrend channel could lead to a technical correction. Hence, gold could reach the 200 level around 3,800 in the short term and even the Murray four-point four at 3,750.

Our outlook is cautious, as we could expect overbought levels around 4,218 to sell in the coming days, with a target at 4,062.