The GBP/USD currency pair also experienced a massive decline on Wednesday. In the EUR/USD review, we detailed numerous reasons why the euro fell and the dollar strengthened, all of which applied just as much to the pound. While we noted that predicting a 200-pip rise in the dollar was nearly impossible, we expected the dollar's growth to resume eventually.

If the euro had multiple reasons for its fall, the pound sterling had even more. First, throughout 2024, the pound showed remarkable resistance against the dollar. The pound did not decline even when the macroeconomic and fundamental background supported the dollar. As a result, the pound appreciated much more than the euro, which was fundamentally unjustified and illogical. In the medium term, a decline was the only reasonable expectation.

Second, the pound's inability to start a correction contributed to its fall. While the EUR/USD pair managed to form a clear correction that allowed traders to time their re-entries for selling, GBP/USD didn't establish a correction—only a minor pullback. Consequently, the pound plummeted.

It's hard to predict what will happen today. The Bank of England (BoE) and Federal Reserve (Fed) meetings are significant events, and the market needs to fully digest the U.S. election results. Moreover, the market could continue reacting to these developments today. This creates a scenario where critical events overlap, leading to unpredictability.

It wouldn't be surprising if the dollar starts declining today and resumes its upward trend later. Similarly, we wouldn't be surprised if the dollar continues its growth uninterrupted, ignoring the outcomes of both central bank meetings.

We know that the BoE is at the very beginning of its monetary policy easing cycle, and the market has likely priced in less than 50% of it. There is substantial room for the pound to fall. While we don't expect the pound to drop to 1.25 or lower this week, we continue to forecast further declines.

In the daily time frame, the pair has firmly settled below the Ichimoku cloud, increasing the likelihood of further depreciation for the pound. Regarding the weekly time frame, the current week might close below the critical line. We see no factors that could support the pound in the coming months. The UK economy continues to struggle, and the arrival of the Labour government has only brought higher taxes without meaningful change. Meanwhile, the U.S. economy continues to grow at a rate of 3% per quarter, and the weak labor market doesn't seem to impact growth significantly. With the Fed easing monetary policy, the labor market is expected to recover to normal levels, which is only a matter of time. Additionally, the economy is likely to accelerate further as interest rates decrease.

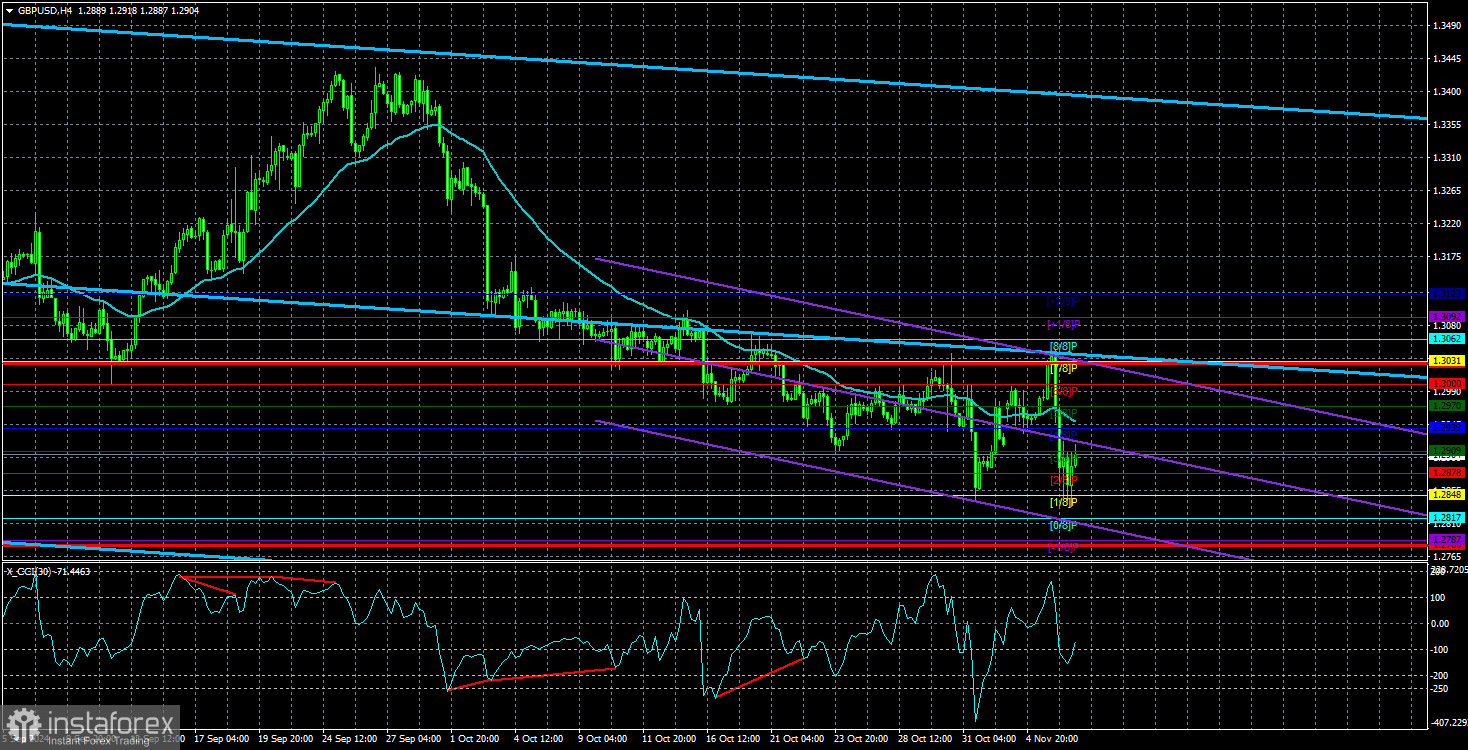

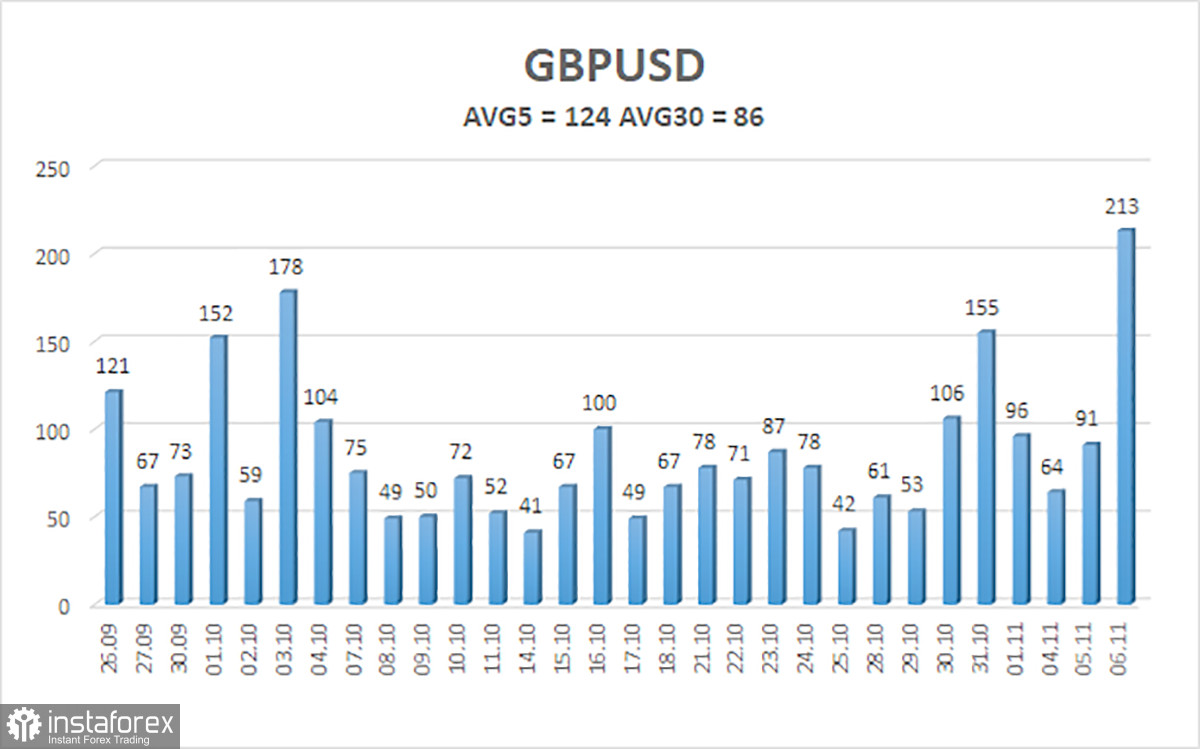

The average volatility of the GBP/USD pair over the past five trading days is 124 pips, indicating "high" volatility. On Thursday, November 7, we expect the pair to trade within the range of 1.2780 to 1.3028. The higher linear regression channel has turned downward, signaling a bearish trend. The CCI indicator has formed a bullish divergence, hinting at a potential upward correction.

Nearest Support Levels:

- S1: 1.2878

- S2: 1.2848

- S3: 1.2817

Nearest Resistance Levels:

- R1: 1.2909

- R2: 1.2939

- R3: 1.2970

Trading Recommendations:

The GBP/USD pair maintains its downward trend. Long positions remain unappealing as we believe the pound's growth factors have already been priced multiple times. For those trading "pure technicals," long positions are possible with targets at 1.3062 and 1.3092, provided the price moves above the moving average line. Short positions remain more relevant, targeting 1.2817 and 1.2787. Due to the strong fundamental backdrop, mixed movements may occur this week.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.