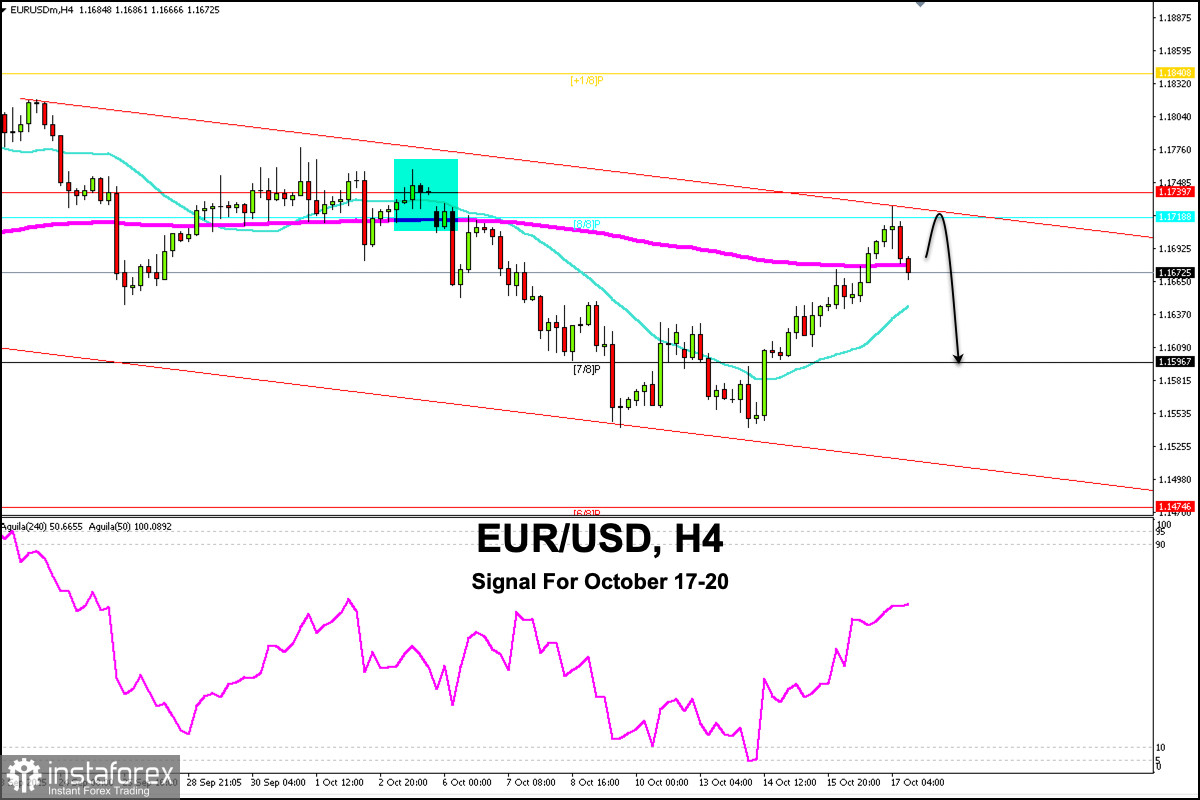

Early in the American session, the euro is trading around 1.1672 and below the 200 EMA, undergoing a technical correction after reaching a high of 1.1726.

The euro encountered strong resistance around the top of the bearish channel and around the 8/8 Murray. If the euro falls below 1.1720, it will be seen as a signal to sell, as we can expect a further reach of 1.1796.

On the chart, we see that the euro has left a gap around 1.1739. Therefore, it is likely that the euro will try to rise further in the coming days to fill this gap.

In the short term, the euro is expected to continue its bearish cycle and could reach 1.15 and even return to 1.12.

If the EUR/USD pair consolidates above 1.1770, the outlook could be positive, expecting the price to reach +1/8 Murray, 1.1840, or even the psychological level of 1.20.

Our trading plan for the coming hours is to sell below 8/8 Murray. Besides, if there is a technical rebound, EUR/USD could fill the gap it left in early October, which is also seen as a signal to sell.