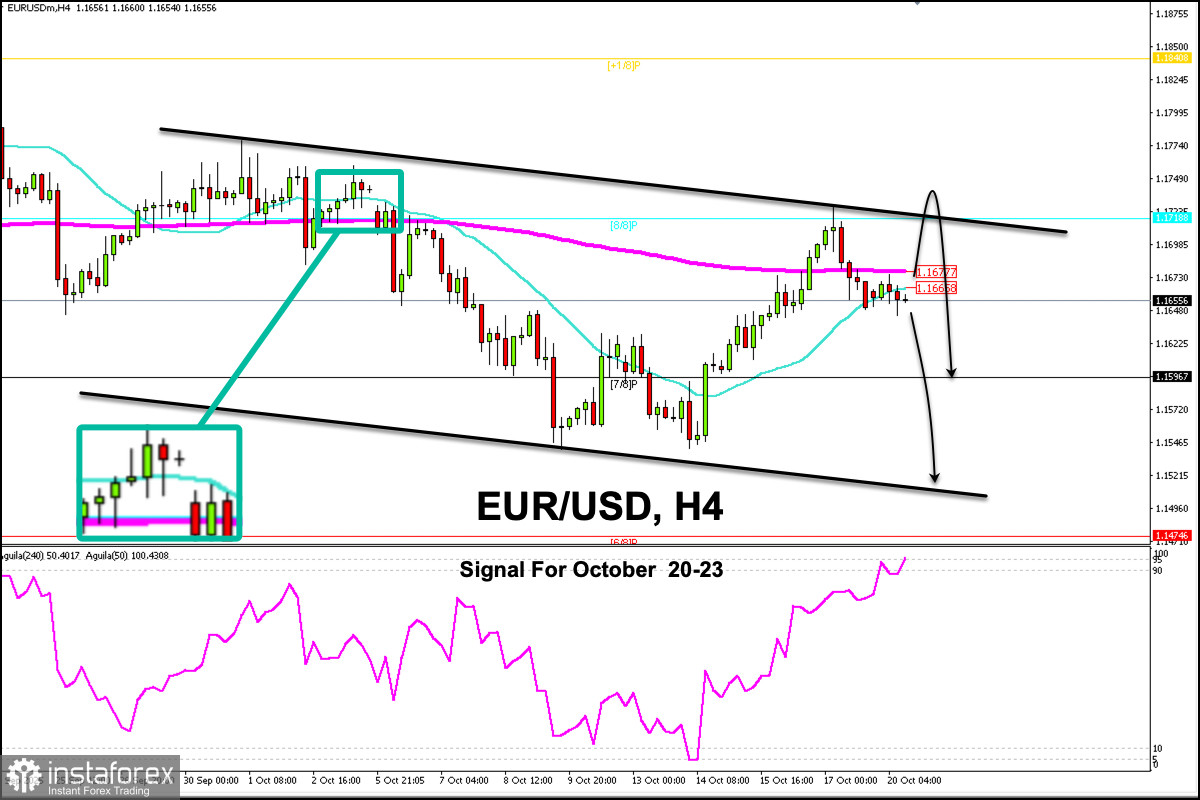

Early in the American session, the euro is trading around 1.1655, below the 200 EMA, and below the 21 SMA under bearish pressure as the euro failed to consolidate above the 8/8 Murray level. It is likely that EUR/USD will continue to fall in the coming days to reach the 6/8 Murray level around 1.1474.

If the instrument consolidates above 1.1680 in the coming hours, the outlook could be positive, and we could expect EUR/USD to reach 1.1750, an area where it left the gap in early October.

On the other hand, if EUR/USD settles below 1.1650, we could expect a bearish acceleration, which could push the price down to 1.1596 and even the psychological level of 1.1500.

The eagle indicator is showing overbought signals on the H4 chart. So, a technical correction is likely to follow in the coming days, hence we should be vigilant.

Our trading plan for the next few hours will be to sell the euro while the instrument trades below 1.1750. Any rebound towards this area will be seen as a signal to open short positions.