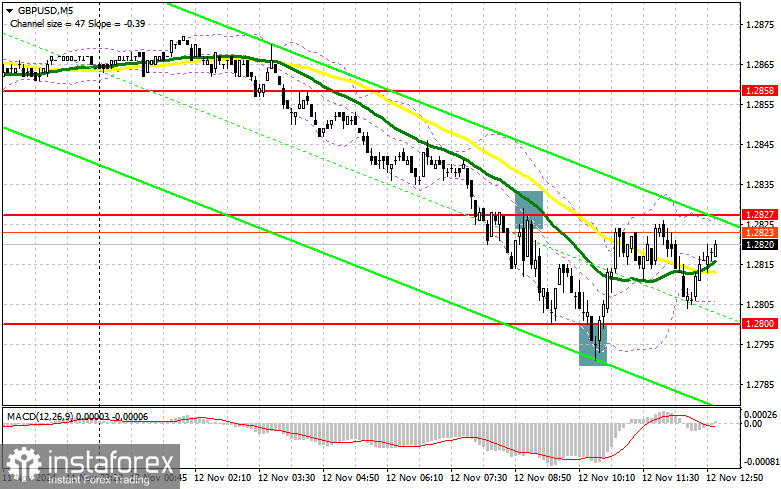

In my morning forecast, I highlighted the level of 1.2827 and planned to base market entry decisions around it. Let's analyze the 5-minute chart to see what happened. A breakout and subsequent retest of 1.2827 generated a sell signal for the pound, aligning with the trend. This led to a decline toward the 1.2800 area. The formation of a false breakout there provided a strong buy signal, resulting in a correction and a return to 1.2827. The technical outlook was slightly revised for the second half of the day.

To Open Long Positions on GBP/USD:

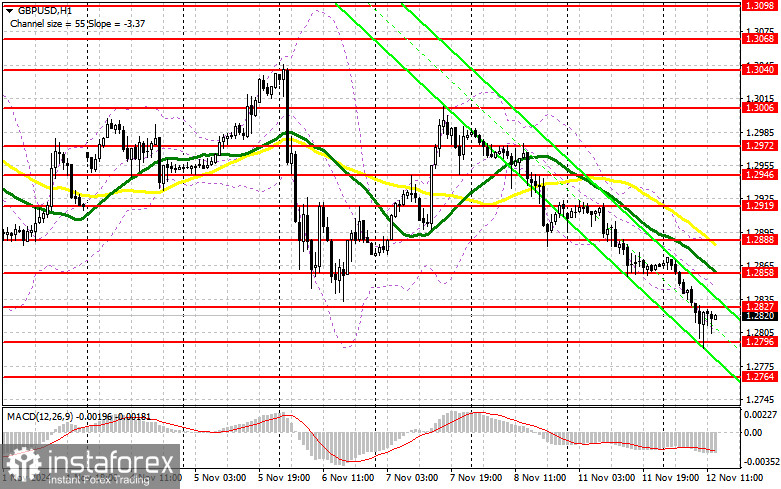

The pound's continued weakness was in line with market expectations. A sharp rise in the unemployment rate, from 4.0% to 4.3%, supported bearish sentiment and resulted in a break below the key support at 1.2800, which has now shifted to 1.2796. This level will serve as the focal point for the second half of the day.

Only after speeches by Federal Reserve officials, the formation of a false breakout near support at 1.2796 will confirm a viable setup for opening long positions. This move could aim for a recovery toward 1.2827, where trading is currently centered. A breakout and subsequent retest of this range would provide an additional buying opportunity, with targets at 1.2858. The final target for this strategy would be the 1.2888 area, where I plan to take profits.

If GBP/USD continues to decline and there's no bullish activity near 1.2796, which seems more likely, the pair could drop toward 1.2764. Only the formation of a false breakout there would justify opening long positions. Alternatively, I plan to buy GBP/USD on a rebound from 1.2731, targeting an intraday correction of 30–35 points.

To Open Short Positions on GBP/USD:

Sellers remain firmly in control of the market. If the pair rises, the formation of a false breakout near resistance at 1.2827 will present an ideal entry point for selling, targeting a decline toward support at 1.2796, the new monthly low.

A breakout and retest from below this range could further weaken bullish positions, triggering stop-loss orders and paving the way for a decline toward 1.2764. The final target would be 1.2731, achievable only if Federal Reserve officials adopt a particularly hawkish tone on further rate cuts following Donald Trump's election victory.

If GBP/USD rises and no bearish activity occurs near 1.2827, buyers may attempt to initiate a larger-scale correction early in the week. In this case, sellers would likely retreat toward resistance at 1.2858, where moving averages favor short positions. I'll sell at this level only after a failed consolidation attempt. If there's no downward movement at 1.2858, I'll seek short positions on a rebound from 1.2888, targeting an intraday decline of 30–35 points.

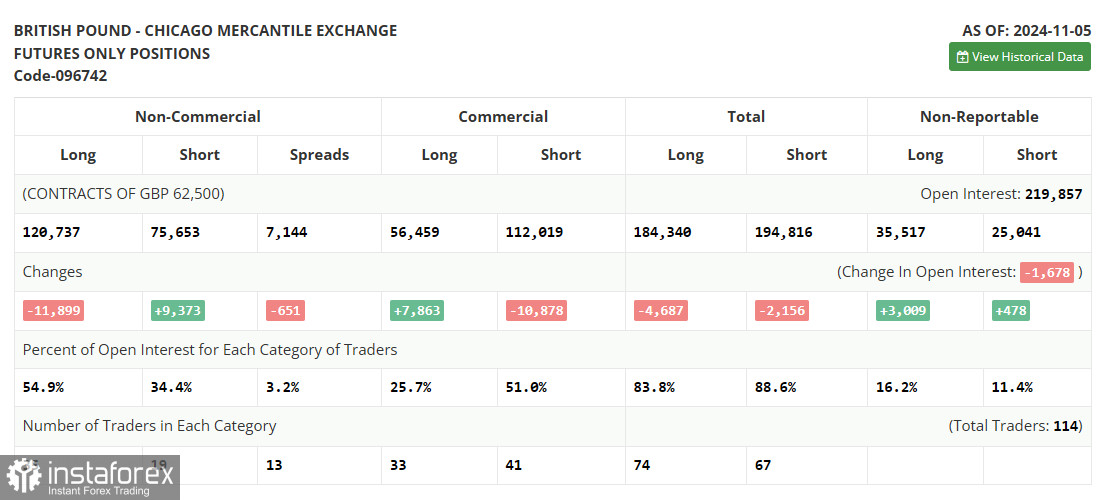

Key Insights from the Commitment of Traders (COT) Report:

The COT report for November 5 indicated a reduction in long positions and a significant increase in short ones. However, the report does not account for Donald Trump's victory in the U.S. presidential election or the Bank of England's rate cuts during the November meeting. As such, the data may hold limited relevance.

Considering the strong pressure on risk assets, the prospects for a short-term recovery in the British pound remain limited. According to the latest COT report, long non-commercial positions decreased by 11,899, to 120,737, while short non-commercial positions increased by 9,373, to 75,653. This led to a rise in the net position gap by 1,079.

Indicator Signals:

Moving Averages:

The pair trades below the 30-day and 50-day moving averages, signaling further declines for the pound.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.2830 will act as support.

Indicator Descriptions:

- Moving Average (MA): Determines the current trend by smoothing volatility and noise.

- Period: 50 (yellow line on the chart)

- Period: 30 (green line on the chart)

- MACD: Moving Average Convergence/Divergence.

- Fast EMA: period 12

- Slow EMA: period 26

- SMA: period 9

- Bollinger Bands: Period: 20

- Non-commercial traders: Speculators such as retail traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: Total long positions held by non-commercial traders.

- Short non-commercial positions: Total short positions held by non-commercial traders.

- Net non-commercial position: Difference between short and long positions of non-commercial traders.