The GBP/USD currency pair avoided a fresh decline on Wednesday, but the pause may be short-lived. We previously warned that the increase in U.S. inflation could already be priced in, as it's common practice for market makers to anticipate well-known news in advance. The rise in inflation was evident last week, leaving the question of how the actual data would differ from the forecast. As it turned out, there was no deviation, and traders had no solid basis for buying or selling.

However, the fact that U.S. inflation is rising rather than falling is another reason to buy the U.S. dollar. We believe the dollar's strengthening will continue. What has the market priced in so far? It has factored in 6-7 rate cuts since the beginning of the year, followed by two consecutive 0.5% cuts. This means the market worked with a scenario that is now highly unlikely. Moreover, it was widely assumed in 2024 that the "neutral" rate for the Federal Reserve was around 3%. However, recent information suggests the Fed may cut rates less aggressively as a precautionary measure ahead of Donald Trump's presidency.

Trump has already accused Europe of unfair treatment toward the U.S. and is preparing to raise tariffs, leading to higher prices in the U.S. and, consequently, higher inflation. Jerome Powell and the Fed cannot ignore this, making it likely that easing will be less aggressive than the market anticipated earlier this year. What does this mean?

The market has priced in a Fed rate cut to as low as 2%, but it might not even see 3%. At the same time, the market has overlooked and continues to ignore the easing of monetary policy in the UK, which has yet to be fully priced. The pound remains overbought, and the global trend remains bearish. Thus, the conclusion is the same as for the euro: the pound should continue to decline through corrections and pullbacks.

At the moment, we do not expect a significant correction. Despite the CCI indicator showing numerous bullish divergences and repeatedly entering the oversold zone, such signals mean little in a downtrend. They only hint at a possible correction. The fact that no correction has occurred, despite multiple opportunities, indicates the market is set on further selling without any pause. The U.S. inflation report could have triggered a minor dollar decline since the inflation increase was already priced in, but it did not. Under current circumstances, further decline seems likely.

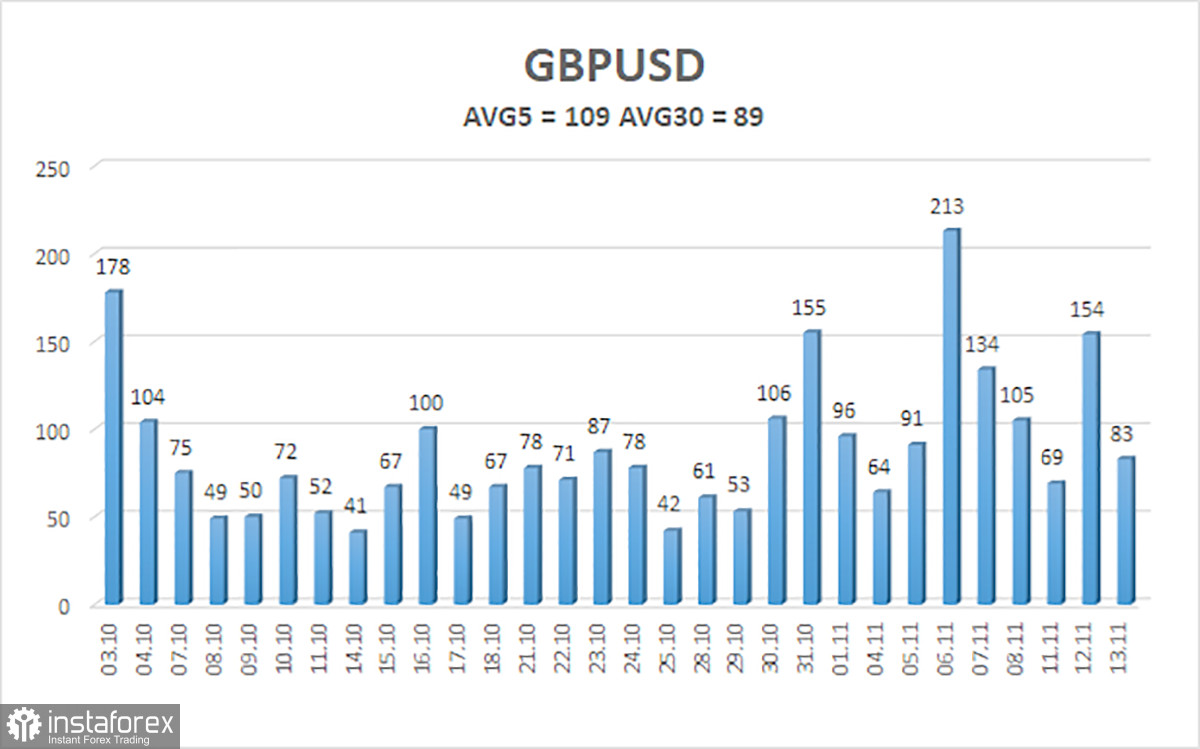

Over the past five trading days, GBP/USD's average volatility has been 109 pips, which is considered "high." On Thursday, November 14, we anticipate movement between 1.2604 and 1.2822. The higher linear regression channel points downward, signaling a continued bearish trend. The CCI indicator has formed a bullish divergence, but any correction was brief, and the price is falling again.

Support Levels:

S1: 1.2695

S2: 1.2634

S3: 1.2573

Resistance Levels:

R1: 1.2756

R2: 1.2817

R3: 1.2878

Trading Recommendations:

The GBP/USD pair maintains its bearish trend. We continue to avoid long positions as we believe the market has repeatedly priced in all potential growth factors for the British currency. If trading purely based on technicals, long positions are possible only if the price consolidates above the moving average (MA), targeting 1.3000 and 1.3062. Short positions remain the more relevant strategy, with targets at 1,2634 and 1,2604, as long as the price remains below the MA.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.