The Federal Reserve has a ready playbook, but markets are questioning whether the European Central Bank has one. Donald Trump's protectionist policies will likely present the ECB with a tough decision: either throw a lifeline to the sinking eurozone economy or continue battling the dormant beast of inflation, which could easily awaken. A misstep risks being critical, prompting investors to double down on selling EUR/USD.

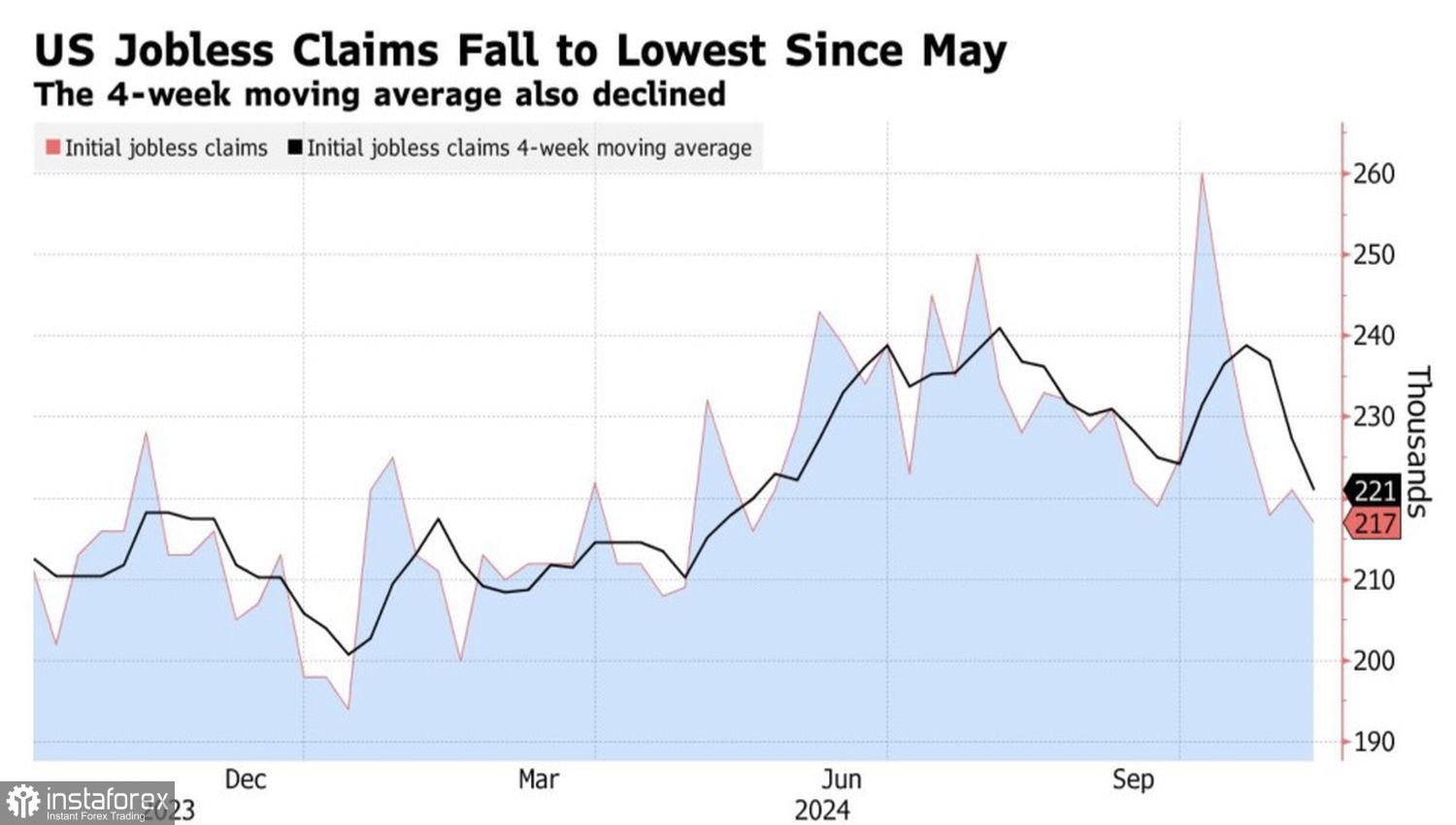

FOMC member Adriana Kugler clearly outlined the Fed's future steps. If risks arise that halt progress in combating and accelerating inflation, the Fed will pause its monetary policy easing. To resume the easing process, a cooling labor market would be necessary. Judging by the decline in unemployment benefit claims to the lowest levels since May, the acceleration of producer prices to 2.4%, and core PPI inflation to 3.1% in October, the central bank might want to sit back and observe how the situation unfolds.

Unemployment Benefit Claims Trend

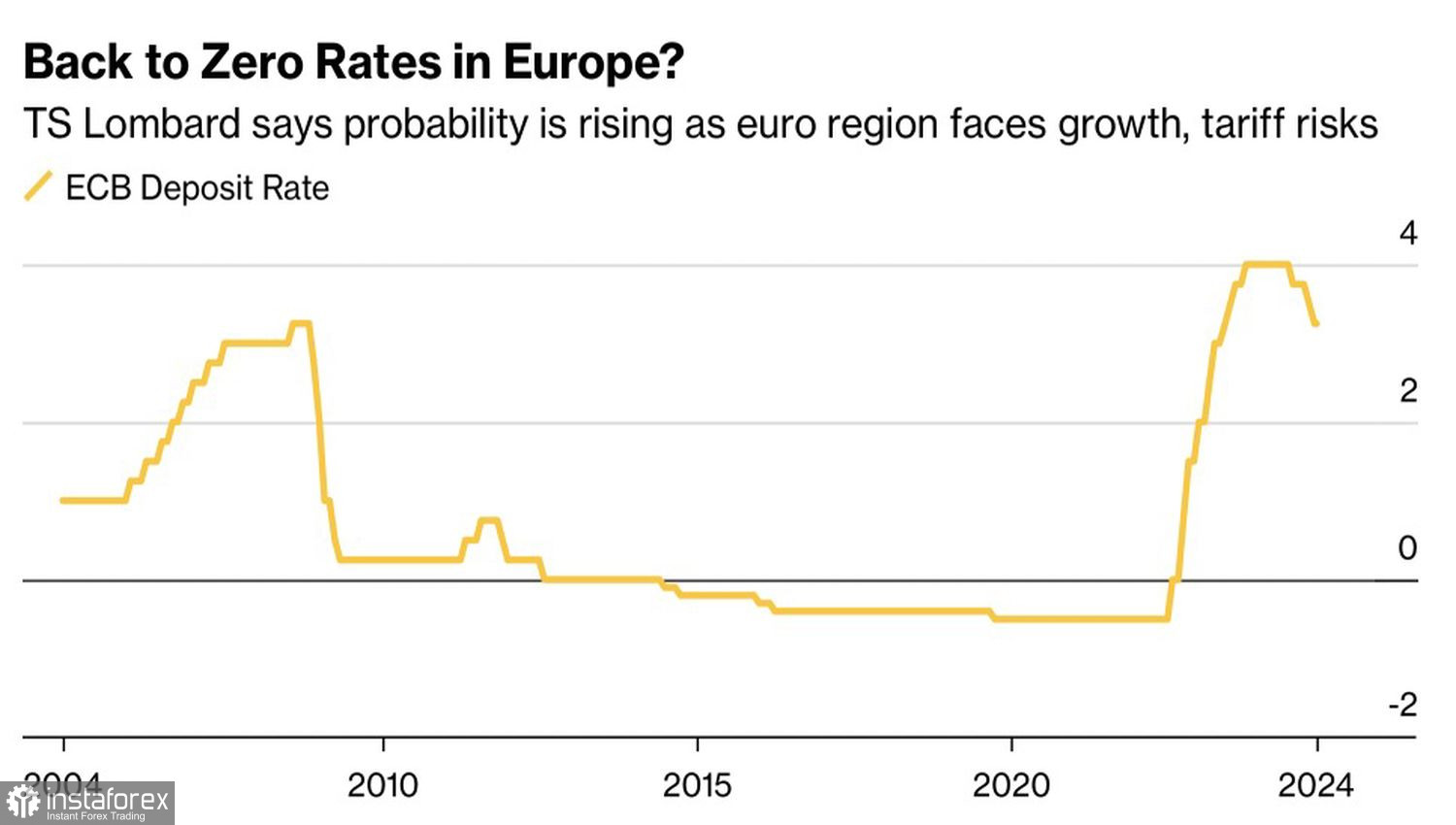

The ECB, however, cannot afford such luxury. Donald Trump's trade tariffs will reshape international trade, disrupt supply chains, and, alongside the economic slowdown, could bring higher inflation to the eurozone. Currency wars will only add fuel to the fire—competitive devaluation might offset the negative impact of import tariffs.

As a result, stagflation – a combination of extremely low or negative economic growth and high prices – could return to the eurozone. How will the ECB respond? Minutes from its October meeting suggest the central bank might act preemptively. Signs of weakening GDP and inflation prompted the unexpected cut to the deposit rate. The Governing Council admitted that easing monetary policy was a preventive measure. If conditions stabilize, a December rate cut might be skipped.

ECB Deposit Rate Dynamics

Thus, monetary policy remains the primary driver of exchange rates on Forex, and Donald Trump's new presidency has merely reshaped the political landscape on both sides of the Atlantic.

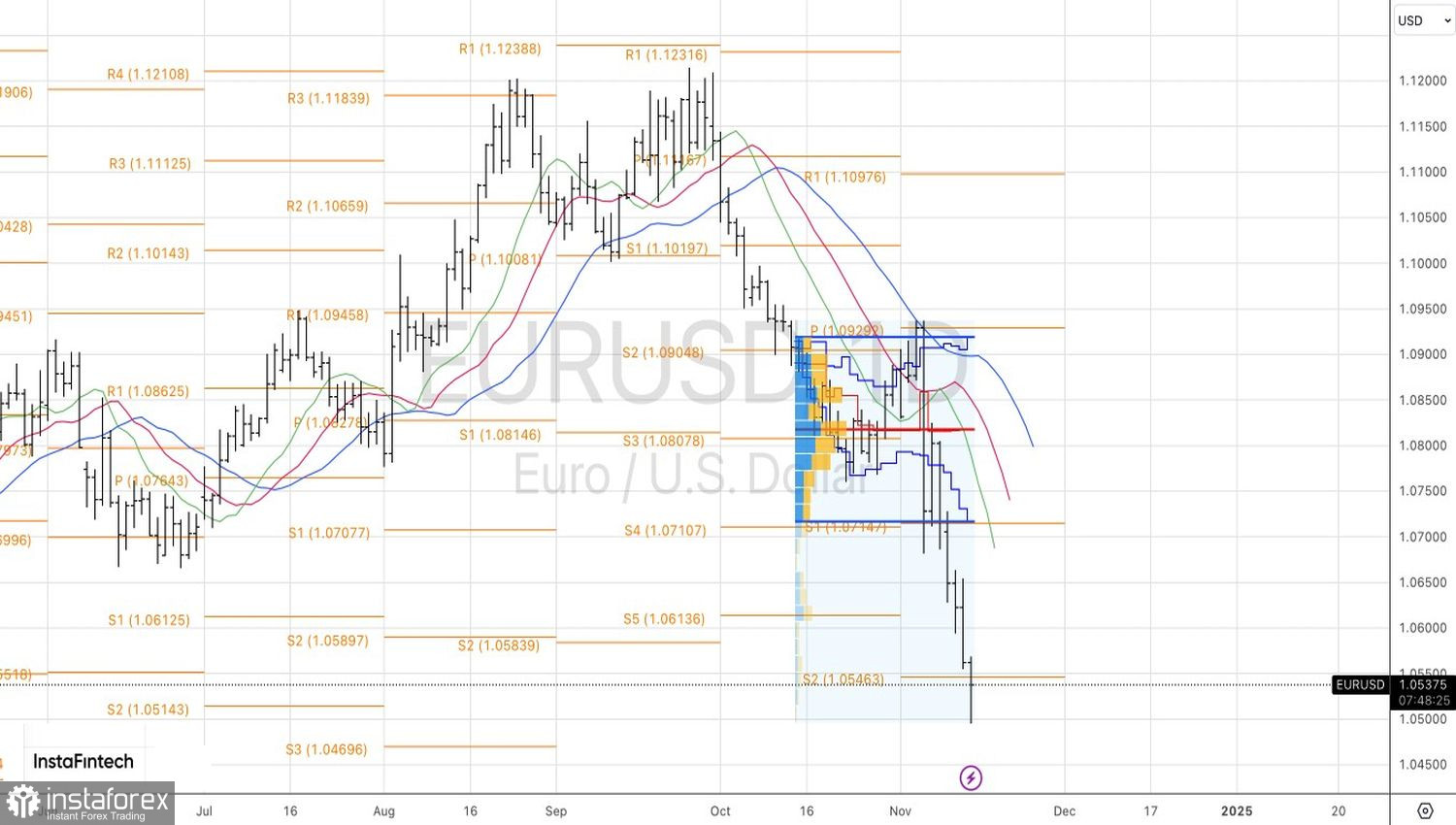

On the daily chart, EUR/USD bulls attempt to consolidate above the pivot level at 1.055. A pin-bar formation may occur if successful, presenting a buying opportunity from the 1.057 level. However, caution is advised against overcommitting to such positions.