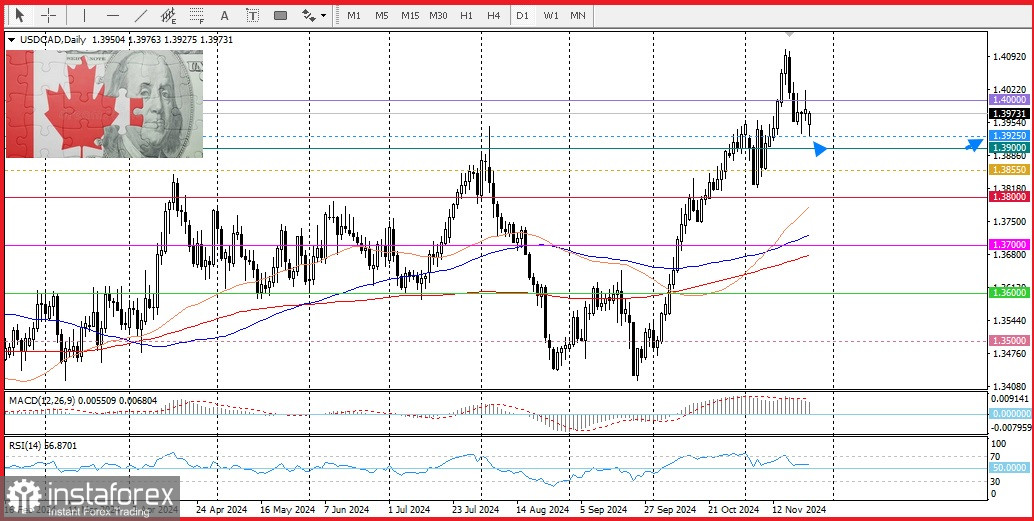

The USD/CAD pair is strengthening after a pullback to 1.3925.

The intraday growth is supported by several factors, with a key one being the drop in crude oil prices. Falling oil prices weaken the Canadian dollar, which is closely tied to oil market performance.

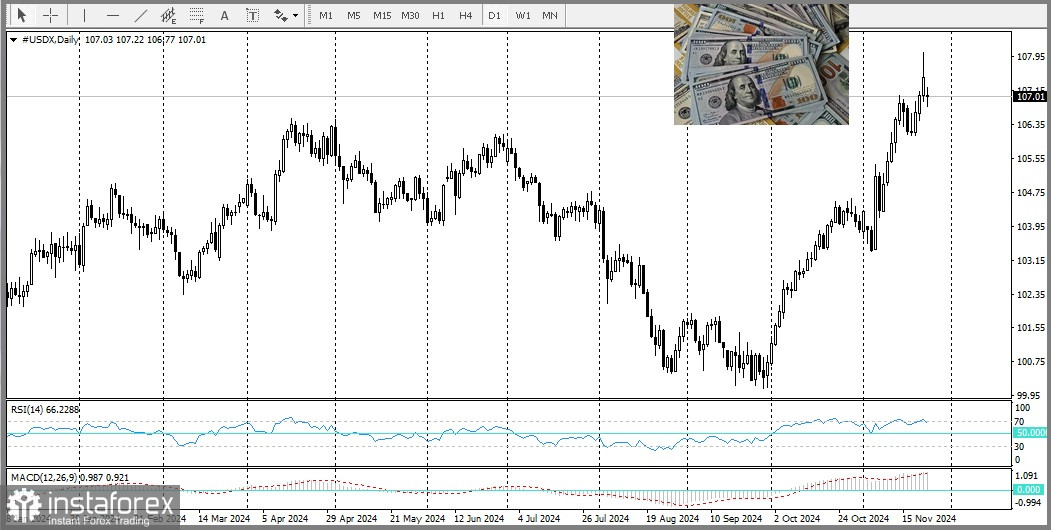

At the same time, the US dollar remains steady after an initial reaction to Scott Bessent's appointment as US Treasury Secretary. Expectations of a less accommodative Federal Reserve policy have further supported the dollar.

This combination of factors has pushed the USD/CAD pair upward, but its upward potential appears limited. Geopolitical risks from ongoing Middle Eastern conflicts continue to concern investors, as they could disrupt oil supplies. Meanwhile, rising fuel demand from China and India is expected to cushion the global decline in crude oil prices.

However, Bessent's conservative fiscal policy stance could lower US Treasury yields, causing caution among dollar buyers and potentially slowing further gains for USD/CAD. At this point, investors are cautiously waiting for clear signs of increased buying activity before concluding that prices have bottomed out.

From a technical perspective, oscillators on the daily chart remaining in positive territory suggest that buyers still have control.