Analysis of Trades and Trading Recommendations for the British Pound

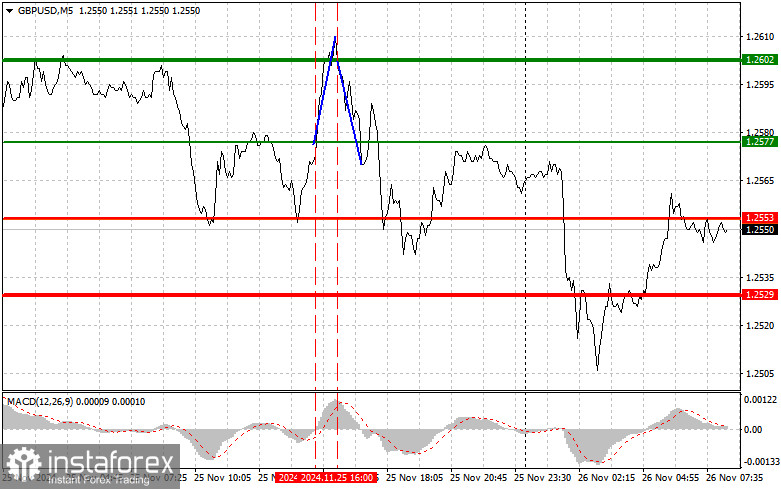

The test of the 1.2577 price level coincided with the moment when the MACD indicator started rising from the zero line, confirming a valid entry point for buying the pound. As a result, the pair rose by more than 30 pips, reaching the target level of 1.2602. Selling on a rebound from 1.2602 also allowed an additional profit of around 20 pips.

The pound is facing challenges, and given the current market situation, retail sales data from the Confederation of British Industry are unlikely to support a strong recovery. A speech by Bank of England representative Huw Pill, who will likely limit his remarks to general comments about the need for a cautious approach to monetary policy interventions, will also fail to boost confidence among risk asset buyers. Therefore, it's better to focus on short-term strategies today.

With market sentiment remaining pessimistic, the bearish trend is likely to continue. Be prepared for volatility during a breakout of the monthly low, and exercise caution in your decisions. As for intraday strategy, I will rely more on executing scenarios #1 and #2.

Buy Scenarios

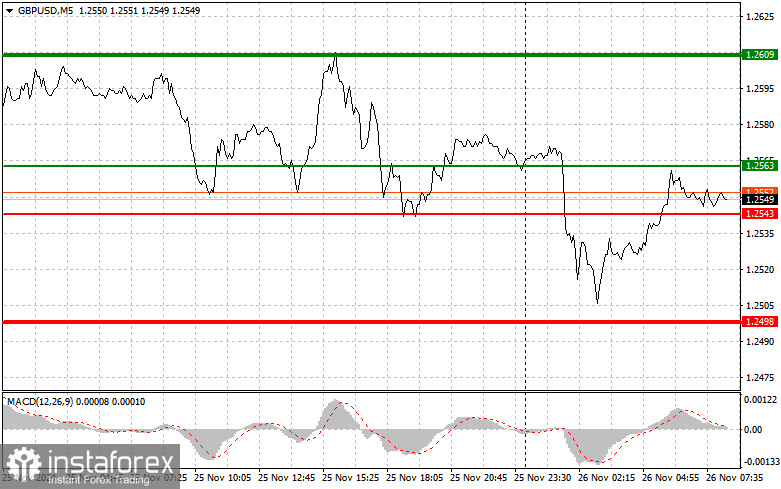

Scenario #1: I plan to buy the pound today if the entry point reaches the area of 1.2563 (green line on the chart) with a target of rising to 1.2609 (thicker green line on the chart). Around 1.2609, I intend to exit purchases and open short positions in the opposite direction (expecting a 30-35 pip movement in the opposite direction from the level). The rise of the pound today can be expected following a dovish stance by policymakers. Important! Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the 1.2543 price level, provided the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. Growth can be expected toward the opposing levels of 1.2563 and 1.2609.

Sell Scenarios

Scenario #1: I plan to sell the pound today after the 1.2543 (red line on the chart) is updated, leading to a rapid decline in the pair. The key target for sellers will be 1.2498, where I plan to exit sales and immediately open long positions in the opposite direction (expecting a 20-25 pip movement in the opposite direction from the level). Selling the pound is possible, but doing so from higher levels is better. Important! Before selling, make sure the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.2563 price level, provided the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected toward the opposing levels of 1.2543 and 1.2498.

What's on the Chart:

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Notes for Beginner Forex Traders:

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.