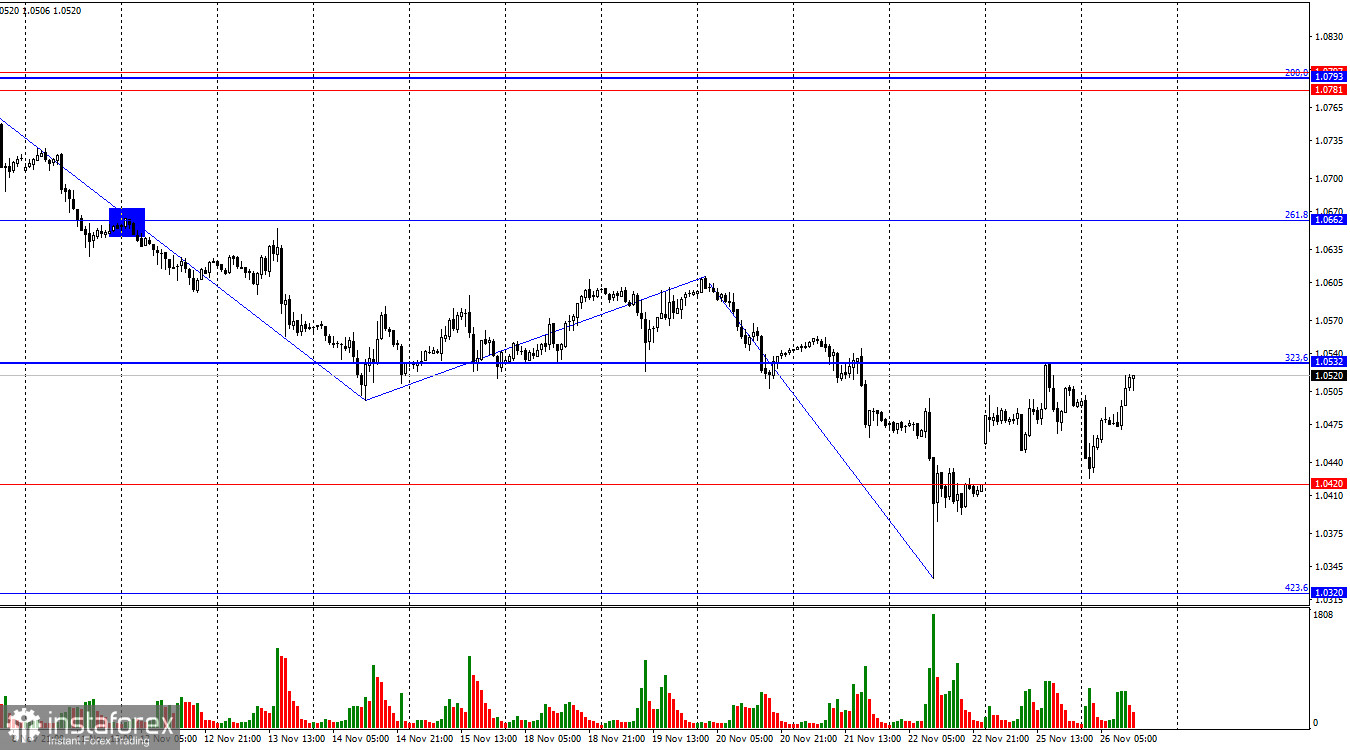

On Tuesday, the EUR/USD pair reversed direction near the 1.0420 level, favoring the euro, and resumed its upward movement. A rebound from the 1.0532 level could strengthen the US dollar, leading to a renewed decline toward the 1.0420 level. However, if the pair consolidates above the 1.0532 level, the likelihood of continued growth toward the next Fibonacci level of 261.8% at 1.0662 will increase.

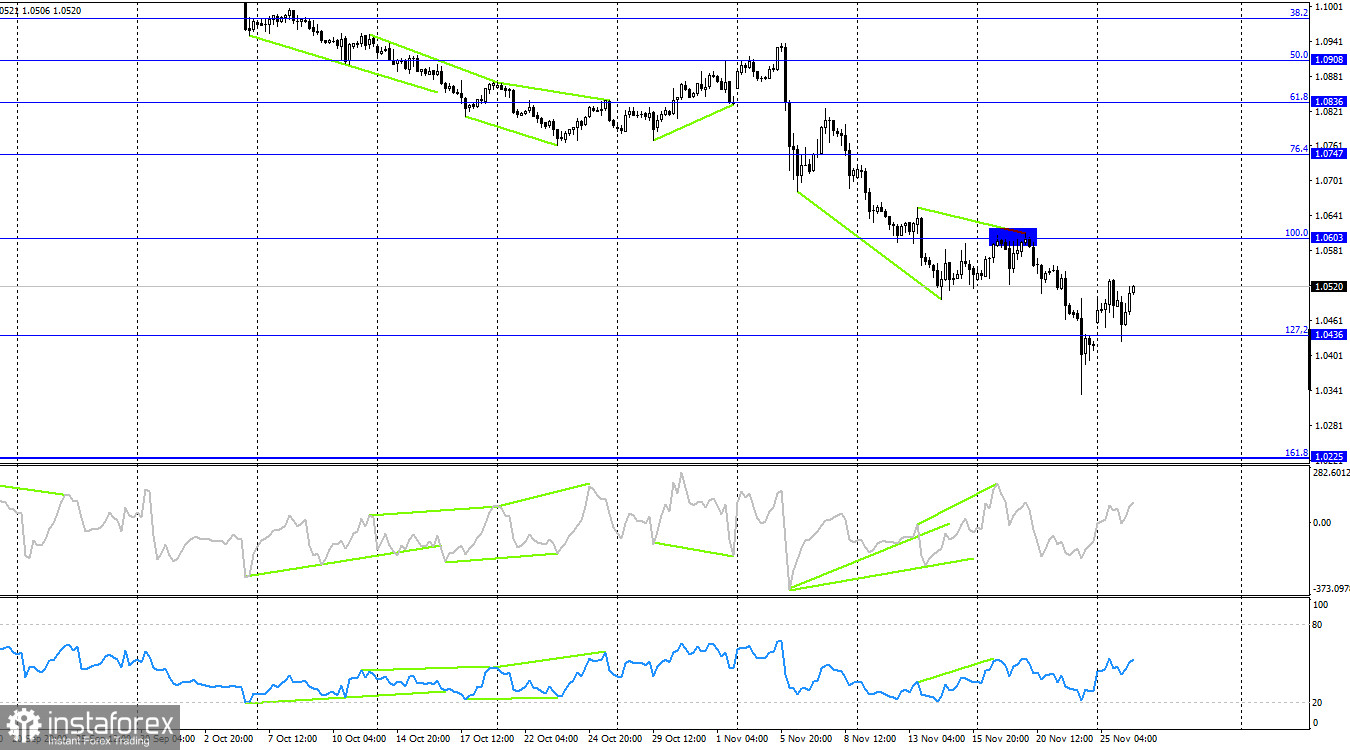

The wave structure is straightforward. The last completed upward wave failed to surpass the peak of the previous wave, while the most recent downward wave easily broke through the previous low. This suggests that the pair continues to develop a "bearish" trend. Bulls have entirely lost control of the market. Regaining momentum will require significant effort. To reverse the current trend, the pair must rise above the 1.0611 level.

Tuesday's informational background was minimal, with none of the reports having a noticeable impact on traders. In my view, technical chart analysis currently holds greater significance for market participants. Even today's release of the FOMC minutes cannot be considered a pivotal event, as such reports typically provide general insights into the meeting and the sentiment of Federal Reserve members. While this sentiment may be of interest, it is not influential enough to justify opening trading positions based on it. Therefore, the critical level to watch today is 1.0532. If the bulls manage to break through it, we may see a reversal of the "bearish" trend and a rise in the euro to at least the 1.0662 level. However, I do not expect this growth to be rapid, and I remain skeptical that bulls will manage to breach the 1.0532 level given the absence of significant economic data today.

On the 4-hour chart, the pair rebounded from the 127.2% retracement level at 1.0436, reversed in favor of the euro, and began a new upward movement toward the 100.0% retracement level at 1.0603. No new divergences are forming on any indicators today. A consolidation below the 1.0436 level would support the US dollar, potentially resuming the decline toward the 161.8% Fibonacci level at 1.0225.

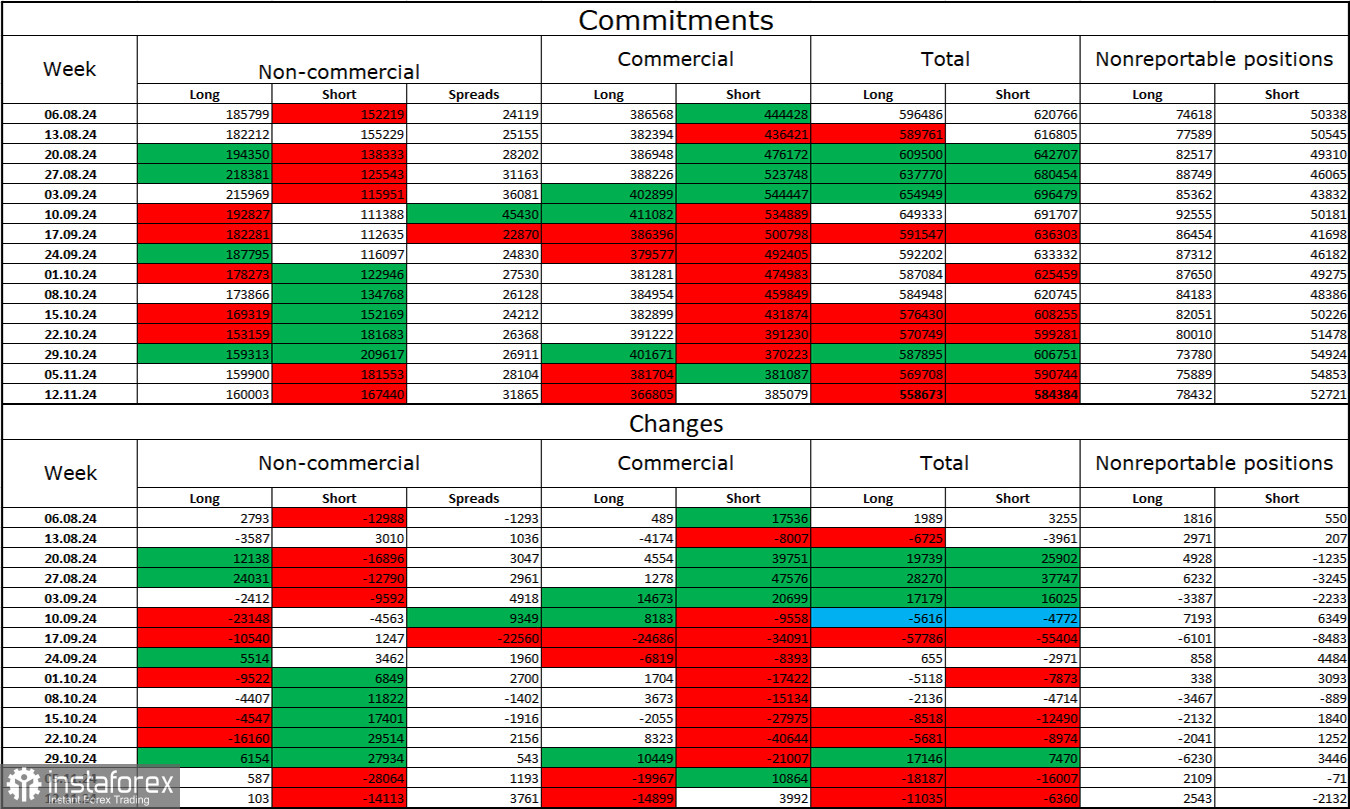

Commitments of Traders (COT) Report

During the latest reporting week, speculators opened 103 long contracts and closed 14,113 short contracts. Sentiment among the "Non-commercial" group has shifted to bearish. Speculators now hold a total of 160,000 long contracts and 167,000 short contracts.

For eight consecutive weeks, major players have been reducing their positions in the euro. In my view, this indicates the development of a new "bearish" trend or, at the very least, a strong global correction. The primary driver for the dollar's earlier decline—expectations of a softer Federal Open Market Committee (FOMC) monetary policy—has already been priced in, leaving the market with no immediate reason to continue selling the dollar. While new factors may emerge over time, the likelihood of continued strength in the US dollar remains higher. Technical chart analysis also supports the beginning of a long-term "bearish" trend. I am, therefore, preparing for a prolonged decline in the EUR/USD pair. The latest COT report does not indicate a shift toward bullish sentiment.

Economic Calendar for the US and Eurozone

- US: New Home Sales (15:00 UTC).

- US: FOMC Minutes (19:00 UTC).

The November 26 economic calendar includes only two entries, neither of which are particularly significant. As a result, the impact of today's informational background on market sentiment is expected to be minimal.

EUR/USD Forecast and Trading Recommendations

New short positions for the pair are advisable if a rebound from the 1.0532 level is observed on the hourly chart, with targets at 1.0420 and 1.0320. Long positions could have been considered after a rebound from the 1.0420 level on the hourly chart (although no clear rebound occurred) or after a close above the 1.0532 level, targeting 1.0662.

Fibonacci levels are plotted from 1.1003 to 1.1214 on the hourly chart and from 1.0603 to 1.1214 on the 4-hour chart.