Analysis of Trades and Tips for Trading the Euro

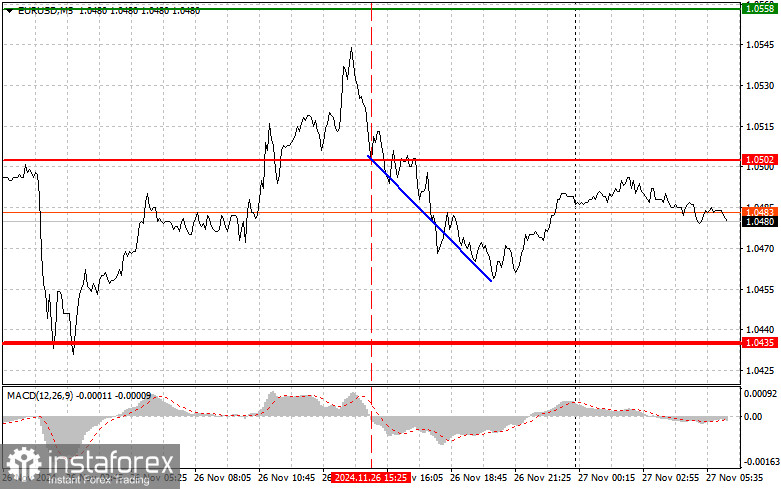

The test of the 1.0502 price level occurred when the MACD indicator had just started moving downward from the zero mark. This confirmed a valid entry point for selling the euro. As a result, the pair dropped by more than 40 points; however, it failed to reach the target level of 1.0435.

Market participants observed that the central bank favors a cautious approach. This conclusion was drawn from strong US economic data and the minutes of the November Federal Reserve meeting. The emphasis on assessing economic indicators before making decisions about potential rate cuts in December demonstrates this caution. Currently, the likelihood of a rate cut stands at only about 60%, indicating that sharp actions are unlikely in the short term.

Concerns about increasing market instability and geopolitical tensions have further contributed to sustained demand for the US dollar. Nevertheless, there is an expectation that the Federal Reserve will adapt to new realities should economic conditions worsen.

Today's data includes Germany's Consumer Climate Indicator, often considered an important gauge of sentiment. An increase in this indicator may signal growing consumer confidence, which could, in turn, boost consumer spending and strengthen the euro. If the current forecasts are accurate and the indicator shows positive dynamics, the euro could gain further support in the forex market. Conversely, any unexpected changes or deviations in the data might trigger the opposite reaction. However, if consumer sentiment remains strong, the ongoing upward trend in the euro is likely to continue. Regarding intraday strategy, I will focus on implementing Scenarios #1 and #2.

Scenarios for Buying

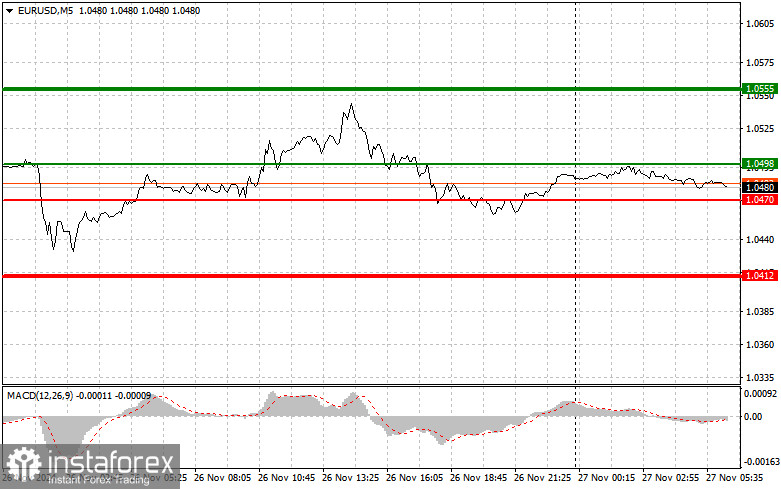

Scenario #1: Buying the euro is possible at the 1.0498 level (green line on the chart), with a target of 1.0555. At this level, I plan to exit the market and sell the euro in the opposite direction, aiming for a movement of 30-35 points. A rise in the euro during the first half of the day can only be expected as part of an upward correction.Important: Before buying, ensure that the MACD indicator is above the zero mark and is just beginning to rise from it.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.0470 level, provided the MACD indicator is in the oversold zone. This setup is likely to limit the pair's downward movement and result in a market reversal upward. Growth toward the levels of 1.0498 and 1.0555 can be expected.

Scenarios for Selling

Scenario #1: I plan to sell the euro upon reaching the 1.0470 level (red line on the chart), with a target of 1.0412. At this point, I will exit the market and immediately buy in the opposite direction, anticipating a movement of 20-25 points upward. Selling pressure on the pair could return at any time, but it is advisable to sell at higher levels.Important: Before selling, ensure that the MACD indicator is below the zero mark and is just beginning to decline from it.

Scenario #2: Selling the euro is also an option if there are two consecutive tests of the 1.0498 level, with the MACD indicator in the overbought zone. This condition will likely limit the pair's upward movement and lead to a market reversal downward. A decline toward the levels of 1.0470 and 1.0412 can be expected.

Chart Notes

- Thin green line: Entry price for buying the euro.

- Thick green line: Projected price where Take Profit can be set, or profits can be manually secured, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the euro.

- Thick red line: Projected price where Take Profit can be set, or profits can be manually secured, as further decline below this level is unlikely.

- MACD indicator: Consider overbought and oversold zones when entering the market.

Important Note for Beginner Traders

Beginner forex traders should exercise caution when making market entry decisions. It is advisable to stay out of the market before the release of significant fundamental reports to avoid sharp price fluctuations. If you choose to trade during news releases, always set stop-loss orders to minimize potential losses. Without stop-loss orders, you risk losing your entire deposit quickly, especially if you trade large volumes without proper money management.

Successful trading requires a clear plan, such as the one provided above. Making spontaneous trading decisions based on current market conditions is generally a losing strategy for intraday traders.