The EUR/USD pair remained above the moving average line for most of Thursday. While the euro shows some potential for further growth, holding above the moving average line alone does not guarantee an uptrend. It merely signals a possible change in trend. The question now is whether the bulls have sufficient strength and motivation to sustain the upward movement.

To answer this, we must first understand why the euro has been declining over the past two months. In short, the decline can be attributed to either market shortsightedness or potential manipulation by market makers. Although the euro has traded largely within a flat range over the past two years, the critical point is that it has not experienced significant declines during this period. Any upward movement has been interpreted as a correction. Essentially, the euro underwent a prolonged two-year correction without substantial factual justification, primarily driven by the anticipation of monetary policy easing by the Federal Reserve. Once the Fed initiated its policy easing, the euro experienced a sharp decline.

If the market has concluded that there are no longer any valid reasons to buy the euro, and the correction within the 16-year downtrend has ended, the euro's decline could accelerate. At this point, there are no compelling reasons for the euro to return to the 1.12 level or higher.

Previously, we noted that on the weekly timeframe, the price reached the lower boundary of a side channel where it had traded for nearly two years. This explains the current upward pullback. However, unless we see a wave of reports signaling robust economic recovery in the eurozone, a strong rally in the euro is unlikely. Sustained side-channel trading that might push the euro back to the 1.12 level also seems improbable. So far, eurozone economic data has been mediocre, while the U.S. economy remains significantly stronger.

Moreover, the Federal Reserve may lower interest rates more slowly and by smaller increments than the market expects. This gives the U.S. dollar a notable macroeconomic and fundamental advantage. Even within a clear downtrend, prices do not fall every day, and pauses can last for extended periods. Thus, the euro's current appreciation doesn't carry much weight. A move below the moving average line to resume the downtrend could occur with little resistance. Next week, the market is set to receive critical data, such as employment figures or inflation reports, which could support the dollar. In December, the European Central Bank (ECB) may cut rates by 0.5%, while the Federal Reserve might pause its adjustments. Under favorable conditions, the euro could potentially return to parity with the dollar before the end of the year.

Key Levels and Indicators

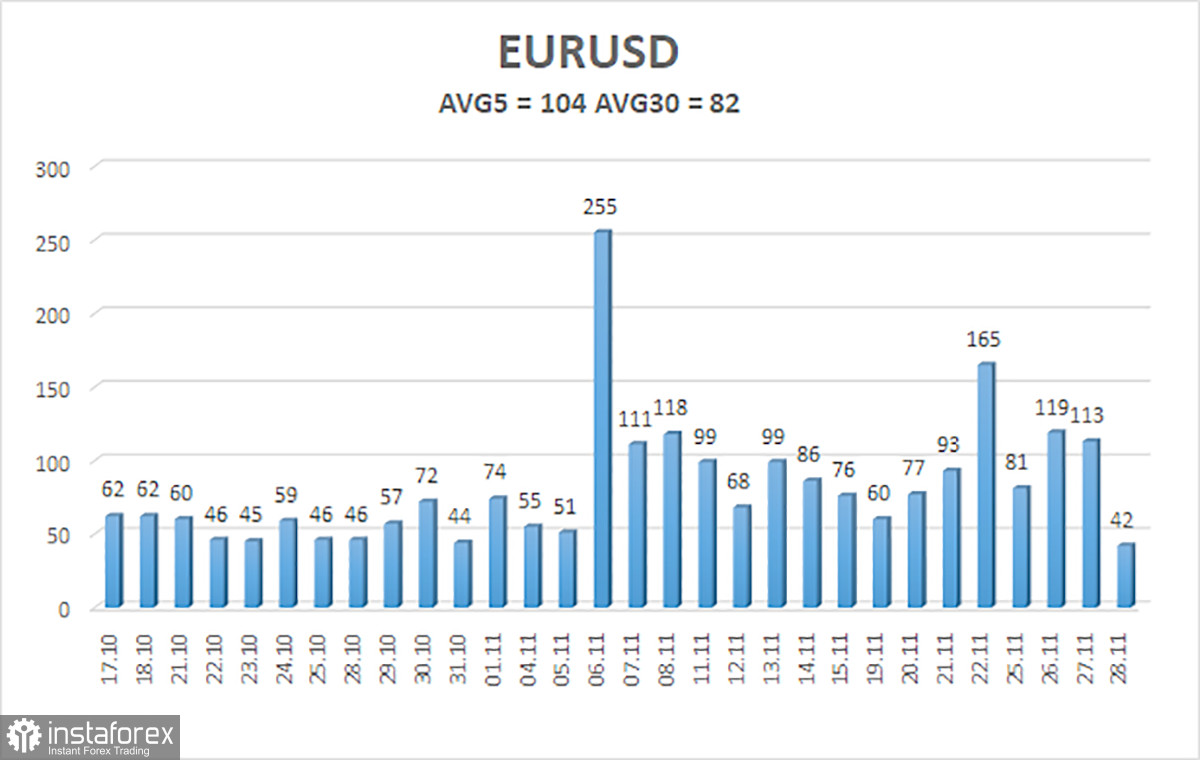

- Average Volatility: Over the last five trading days, the EUR/USD pair has shown an average daily volatility of 115 points, which is classified as "high." On Friday, the pair is expected to move between 1.0459 and 1.0667.

- Linear Regression Channels: The downward slope of these channels confirms the ongoing global bearish trend.

- CCI Indicator: Multiple entries into oversold territory have triggered the current corrective upswing.

Support Levels

- S1: 1.0498

- S2: 1.0376

- S3: 1.0254

Resistance Levels

- R1: 1.0620

- R2: 1.0742

- R3: 1.0864

Trading Recommendations

The EUR/USD pair continues its downward movement. Over the past few months, we have consistently forecasted a medium-term decline for the euro, fully supporting the bearish trend. It is likely that the market has already priced in most, if not all, of the expected future Federal Reserve rate cuts. Consequently, there remains little reason for the dollar to weaken in the medium term.

- Short Positions: Traders could target 1.0376 and 1.0254 if the price moves below the moving average.

- Long Positions: For those strictly following technical analysis, consider long positions above the moving average with targets at 1.0620 and 1.0695. However, we currently advise against taking long positions.

Explanation of the illustrations:

- Linear Regression Channels: Indicate the prevailing trend. When both channels point in the same direction, it signals a strong trend.

- Moving Average Line: (Settings: 20, smoothed) Determines short-term trends and provides guidance for trade direction.

- Murray Levels: Act as target levels for price movements and corrections.

- Volatility Levels: Represent the expected daily price range based on current volatility metrics.

- CCI Indicator: Entry into overbought (above +250) or oversold (below -250) zones signals potential trend reversals.