Analysis of Trades and Trading Tips for the British Pound

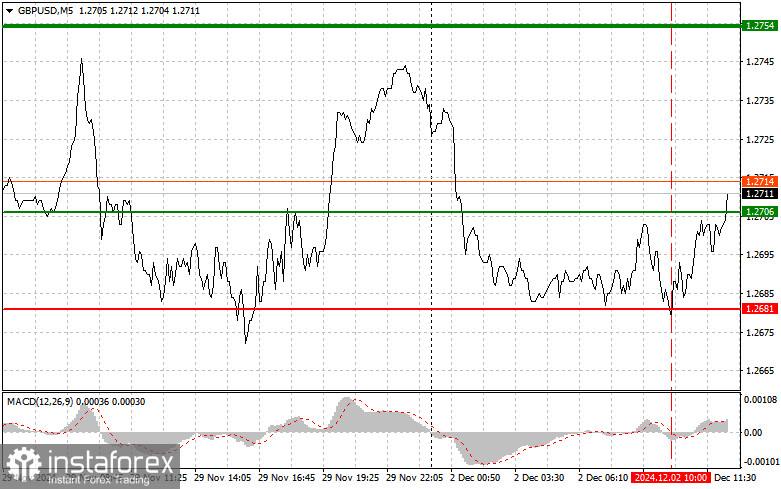

Testing the 1.2681 level occurred when the MACD indicator was already significantly below zero, limiting the pound's bearish potential. For this reason, I refrained from selling.

Recent manufacturing activity data highlights ongoing uncertainty in the UK economy, putting pressure on the pound. The data showed a contraction in manufacturing activity, which may also negatively affect consumer demand. This decline in the manufacturing sector raises concerns about broader economic challenges. Additionally, inflation remains dangerously high, prompting the Bank of England to reassess its monetary policy approach. A lack of response to these realities could worsen the situation. In such conditions, investors exercise caution, impacting demand for the pound.

However, the reluctance to sell the pound below the critical 1.2680 level suggests market participants may be awaiting positive signals from the Bank of England.

In the second half of the day, focus will shift to developments in the US manufacturing sector. This index significantly impacts both the current economic situation and market participants' future expectations. Recent news suggests declining business activity in certain industries, which may lead to weak report figures. This could support the pound, which remains under pressure from the UK's internal economic issues. Traders should prepare for significant price movements and potential position adjustments based on the published data.

Signal for Buying

Scenario #1

I plan to buy the pound today at the entry point near 1.2723 (green line on the chart) with a target of reaching 1.2754 (thicker green line on the chart). Near 1.2754, I will exit purchases and open sales in the opposite direction, expecting a 30-35 point downward movement. A rise in the pound today is likely only if the US data is very weak.

Important: Before buying, ensure the MACD indicator is above zero and just beginning to rise.

Scenario #2

I also plan to buy the pound today if the 1.2695 level is tested twice consecutively, with the MACD indicator in the oversold area. This should limit the pair's bearish potential and trigger an upward reversal. Growth toward the 1.2723 and 1.2754 levels is expected.

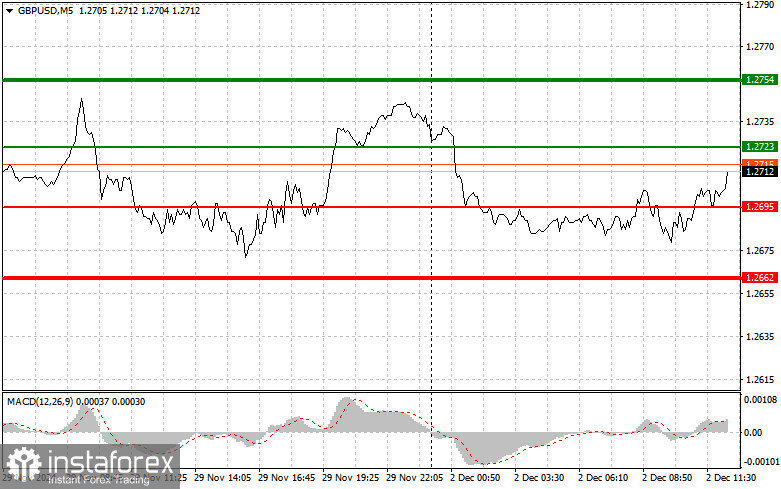

Signal for Selling

Scenario #1

I plan to sell the pound after breaking below the 1.2695 level (red line on the chart), expecting a quick decline. The key target for sellers will be 1.2662, where I will exit sales and immediately open purchases in the opposite direction, expecting a 20-25 point upward movement. Sellers are likely to show strength if the daily high is breached.

Important: Before selling, ensure the MACD indicator is below zero and just beginning to decline.

Scenario #2

I also plan to sell the pound today if the 1.2723 level is tested twice consecutively, with the MACD indicator in the overbought area. This should limit the pair's bullish potential and trigger a downward reversal. A decline toward the 1.2695 and 1.2662 levels is expected.

What's on the Chart

- Thin Green Line: Entry price for buying the instrument.

- Thicker Green Line: Expected price for Take Profit or securing profits, as growth beyond this level is unlikely.

- Thin Red Line: Entry price for selling the instrument.

- Thicker Red Line: Expected price for Take Profit or securing profits, as further declines beyond this level are unlikely.

- MACD Indicator: Use overbought and oversold zones to confirm trades.

Important Notes for BeginnersBeginner traders in the Forex market should cautiously make trading decisions. Before significant fundamental reports are released, it is advisable to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you risk quickly losing your entire deposit, especially when trading large volumes without proper money management.

Remember, successful trading requires a clear trading plan, like the one outlined above. Spontaneous trading decisions based on current market conditions are a losing strategy for intraday traders.