Analysis of Trades and Trading Tips for the Euro

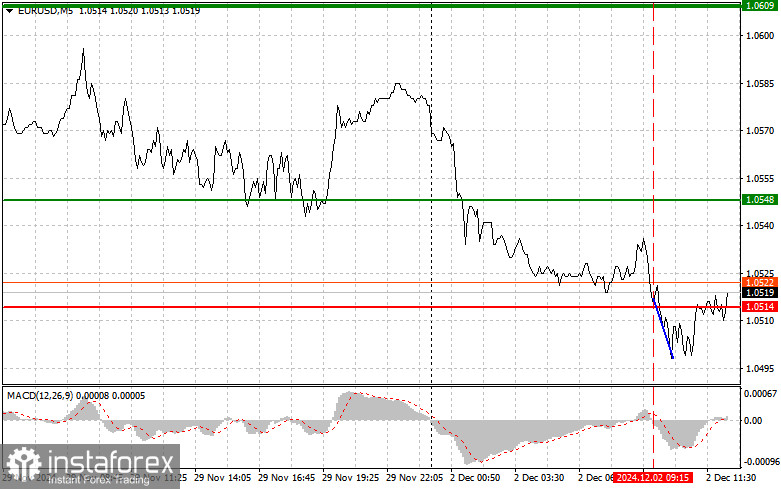

Testing the 1.0514 level in the first half of the day occurred as the MACD indicator started moving downward from zero, confirming a valid entry point for selling the euro. As a result, the pair declined by about 20 points, reacting to weak manufacturing data from Germany. After this, the pressure on the euro eased.

Despite the current weak economic performance, the risk of further decline remains. Countries with struggling manufacturing sectors, such as Italy and Spain, could face additional pressure if this trend continues. Investors should monitor news closely and respond to changes in sectors that could influence the region's overall economic climate.

In the second half of the day, the US ISM Manufacturing Index report is expected, which could trigger significant movement in the pair. Weak data may support a euro recovery, while strong statistics could push EUR/USD further downward. Additionally, Christopher Waller's FOMC speech on monetary policy and future projections could further drive market volatility. Traders should look for cues on the authorities' commitment to combating inflation, which could provide insight into potential interest rate adjustments in the coming months.

For my intraday strategy, I will focus on implementing Scenarios #1 and #2 for selling.

Signal for Buying

Scenario #1

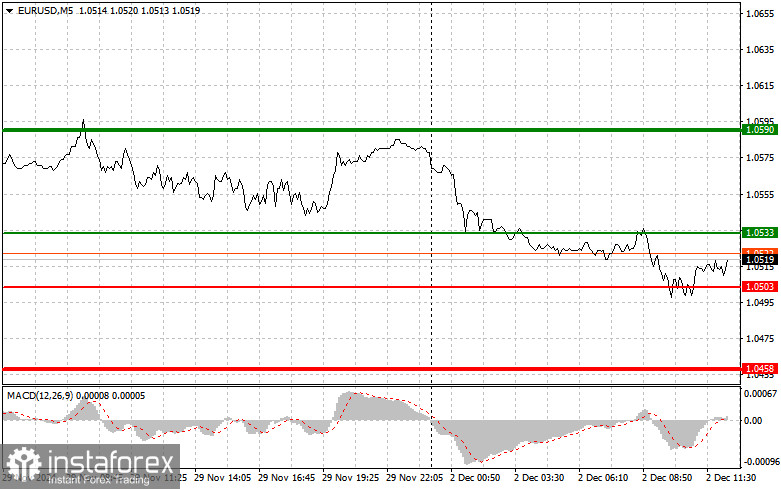

Today, I plan to buy the euro at the entry point near 1.0533 (green line on the chart), targeting a rise to 1.0590. At 1.0590, I will close my position and initiate a short trade on the euro, aiming for a 30-35 point downward movement. A significant upward movement in the euro is unlikely under current conditions.

Important; before buying, ensure the MACD indicator is above zero and just starting to rise.

Scenario #2

I also plan to buy the euro today if the 1.0503 level is tested twice consecutively, with the MACD indicator in the oversold area. This should limit the pair's bearish momentum and trigger an upward reversal, targeting 1.0533 and 1.0590.

Signal for Selling

Scenario #1

I plan to sell the euro if the price breaks below 1.0503 (red line on the chart). The target is 1.0458, where I will close my position and open a buy trade in the opposite direction, aiming for a 20-25 point upward movement. Selling pressure on the pair is likely to persist if the US report shows strong data.

Important; before selling, ensure the MACD indicator is below zero and just starting to decline.

Scenario #2

I also plan to sell the euro today if the 1.0533 level is tested twice consecutively, with the MACD indicator in the overbought area. This should limit the pair's bullish momentum and trigger a downward reversal, targeting 1.0503 and 1.0458.

Key Chart Levels

- Thin Green Line: Entry price for buying the instrument.

- Thicker Green Line: Target price for setting Take Profit or securing profits, as growth beyond this level is unlikely.

- Thin Red Line: Entry price for selling the instrument.

- Thicker Red Line: Target price for setting Take Profit or securing profits, as further decline beyond this level is unlikely.

- MACD Indicator: Use overbought and oversold zones to guide entry and exit decisions.

Important Notes for Beginners

Beginner traders in the Forex market should make trading decisions cautiously. Before significant fundamental reports are released, it is advisable to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you risk quickly losing your entire deposit, especially if trading large volumes without proper money management.

Remember, successful trading requires a clear plan, like the one outlined above. Making spontaneous trading decisions based on market conditions is generally a losing strategy for intraday traders.