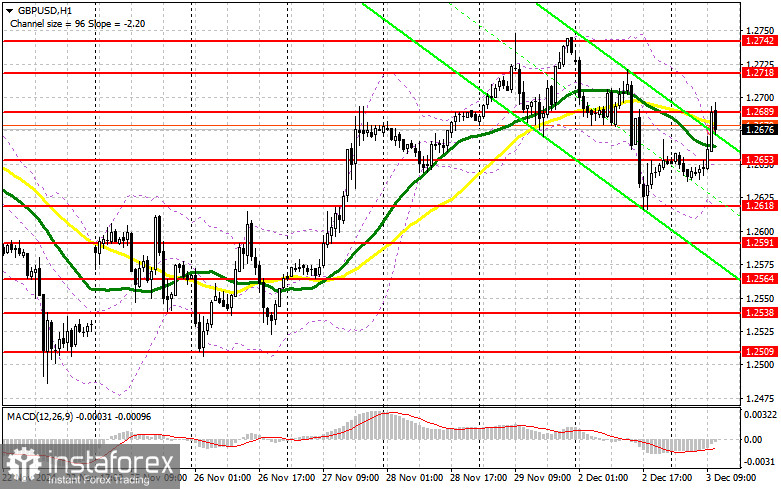

In my morning forecast, I focused on the 1.2689 level and planned market entry decisions around it. Let's examine the 5-minute chart to analyze what occurred. The pair's rise and the formation of a false breakout at this level offered a viable selling opportunity. By the time of writing, this resulted in a 15-point decline, prompting a revision of the technical outlook for the second half of the day.

To Open Long Positions on GBP/USD

The absence of significant data has sparked renewed demand for the British pound, alongside a broader appetite for riskier assets. For the bulls to dominate in the second half of the session, weak results from the JOLTS job openings report and the Economic Optimism Index, coupled with dovish comments from FOMC members Adriana D. Kugler and Austan D. Goolsbee signaling the possibility of US rate cuts in December, would be required.

If GBP/USD declines, I would act after a failed breakout near the 1.2653 support level, which earlier acted as resistance. The initial target would be 1.2689, where buyers previously struggled. A breakout and retest of this level from above would create a new buying opportunity, targeting 1.2718. If bullish momentum continues, the ultimate target would be 1.2742, where I plan to lock in profits.

If GBP/USD drops further and bulls show no activity around 1.2653, sellers may gain momentum for a deeper decline. In this case, a failed breakout near 1.2618 would justify long positions. Alternatively, immediate long trades could be initiated at 1.2591, aiming for a 30-35 point intraday correction.

To Open Short Positions on GBP/USD

Pressure on the pound could resurface at any time, particularly in response to strong US statistics. I plan to enter short positions after a failed breakout at 1.2689, as observed earlier. This setup would offer a selling opportunity targeting the 1.2653 support level, where the moving averages lie.

A breakout and retest of this range from below could trigger stop-loss orders, opening the way toward 1.2618. The ultimate target would be 1.2591, where I plan to secure profits.

If demand for the pound persists following weak US data and GBP/USD rises, and sellers show no activity around 1.2689, buyers could push the pair higher toward 1.2718. In such a scenario, I would consider selling only after a failed breakout at this level. If there is no downward movement even at 1.2718, I will look for short positions near 1.2742, targeting a 30-35 point downward correction.

COT Report Overview

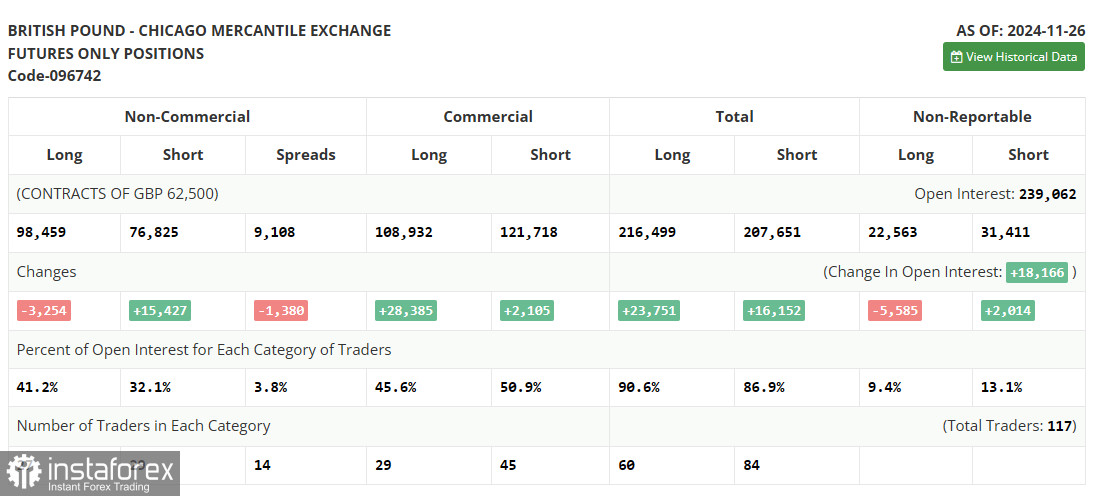

The Commitments of Traders (COT) report, which tracks speculative trader positions, revealed the following for November 26:

- Non-commercial long positions decreased by 3,254 to 98,459.

- Non-commercial short positions increased by 15,427 to 76,825.

- The net gap between long and short positions narrowed by 1,380.

The Bank of England's pause in rate cuts has added pressure on pound buyers. Weak UK economic data continues to weigh on the currency, with recession risks looming for 2024. Rising inflation and potential US trade tariffs have also heightened uncertainty, contributing to the bearish outlook.

Indicator Signals

Moving Averages

Trading occurs near the 30- and 50-day moving averages, indicating market uncertainty.

Bollinger Bands

The lower Bollinger Band boundary near 1.2618 serves as support during declines.

- Description of the indicators

- • Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart;

- • Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the chart;

- • MACD indicator (Moving Average Convergence/Divergence – convergence/divergence of moving averages) Fast EMA – period 12. Slow EMA – period 26. SMA – period 9;

- • Bollinger Bands. Period – 20;

- • Non–profit speculative traders, such as individual traders, hedge funds and large institutions that use the futures market for speculative purposes and meet certain requirements;

- • Long non-commercial positions represent the total long open position of non-commercial traders;

- • Short non-commercial positions represent the total short open position of non-commercial traders;

- • The total non-commercial net position is the difference between the short and long positions of non-commercial traders.