To Open Long Positions on EUR/USD:

The euro predictably declined in response to weak Eurozone PMI data. However, since the data slightly exceeded economists' forecasts, a significant sell-off was avoided. In the afternoon, attention will shift to the US ISM Services PMI and the more critical ADP Employment Change report. A particularly weak labor market report could quickly erode the dollar's advantage. Federal Reserve Chair Jerome Powell's speech will be a key event, as it is one of the final opportunities for communication before the Fed enters its blackout period ahead of the December meeting.

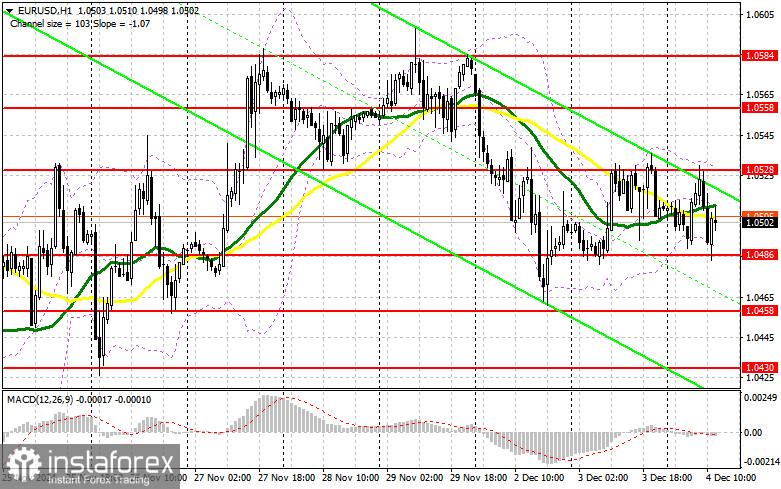

If pressure on the euro persists, I plan to act around the 1.0486 support formed earlier today. A false breakout at this level will provide a favorable condition for initiating long positions, targeting 1.0528. A breakout and retest of this range from above will confirm an appropriate entry point, aiming for a move toward 1.0558. The ultimate goal will be the 1.0584 high, where I will lock in profits.

If EUR/USD declines further and there is no significant activity around 1.0486 in the afternoon, selling pressure is likely to intensify, increasing the chance of a larger drop. In this case, I will only act after a false breakout near the 1.0458 support. Alternatively, I plan to open long positions immediately upon a rebound from 1.0430, aiming for a 30–35 point intraday correction.

To Open Short Positions on EUR/USD:

If weak data causes a rally in the pair, defending the 1.0528 resistance will be sellers' primary objective in the second half of the day. A false breakout at this level, combined with Powell's remarks, will signal an opportunity to open short positions with a target at 1.0486. A breakdown below this range and a retest from below will provide another selling opportunity, aiming for the 1.0458 low, which would entirely reverse the pair's earlier correction. The ultimate target will be the 1.0430 area, where I will lock in profits.

If EUR/USD rises in the afternoon and bears show no activity around 1.0528, I will delay short positions until the next resistance at 1.0558 is tested. I also plan to sell from there, but only after a failed breakout. I will open short positions immediately upon a rebound from 1.0584, targeting a 30–35 point downward correction.

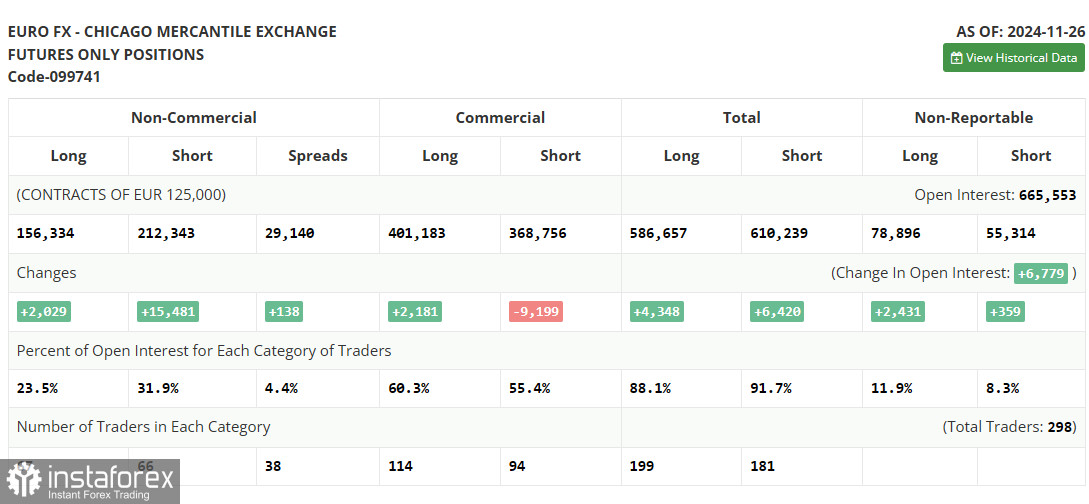

COT Report Analysis:The Commitment of Traders (COT) report from November 26 showed a notable increase in short positions and only a minor increase in long positions. Fed representatives are increasingly leaning toward a more cautious approach to rate cuts, making the US dollar more attractive than risky assets like the euro. Even before taking office, Trump introduced protectionist tariff proposals, including a recent threat of 100% tariffs on BRICS countries. These developments have added further pressure on investors and traders, boosting demand for the dollar.

The COT report indicates that long non-commercial positions rose by 2,029 to 156,334, while short non-commercial positions increased by 15,481 to 212,343. As a result, the gap between long and short positions widened by 138.

Indicator Signals:

- Moving Averages: Trading is taking place near the 30- and 50-period moving averages, indicating market uncertainty.

- Bollinger Bands: The lower band at 1.0486 will act as support in case of a decline.

Indicator Descriptions:

- Moving Average (MA): Determines the current trend by smoothing out volatility and noise. Periods: 50 (yellow) and 30 (green).

- MACD Indicator (Moving Average Convergence/Divergence): Measures the difference between a fast EMA (12), slow EMA (26), and a signal SMA (9).

- Bollinger Bands: Bands around the price indicating volatility, with a period of 20.

- Non-Commercial Traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long Non-Commercial Positions: Total open long positions held by non-commercial traders.

- Short Non-Commercial Positions: Total open short positions held by non-commercial traders.

- Net Non-Commercial Position: The difference between short and long positions held by non-commercial traders.