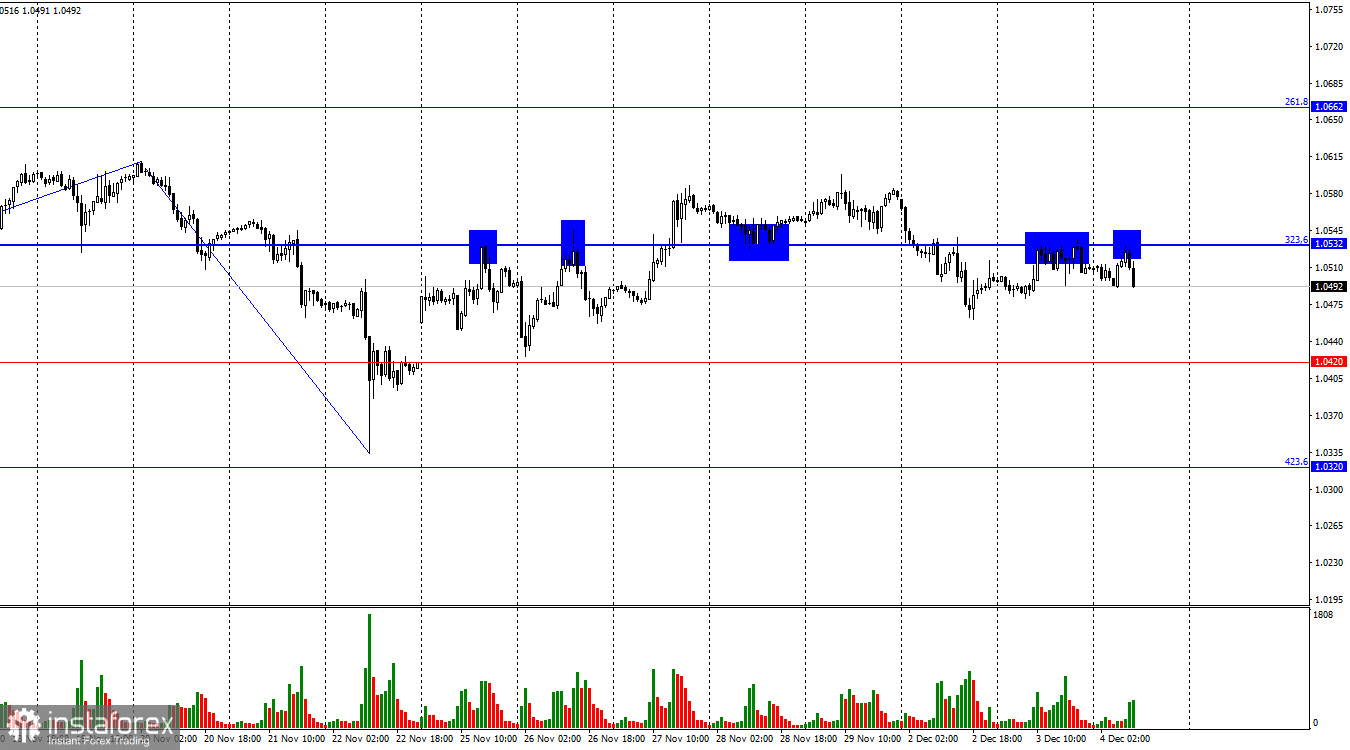

On Tuesday, the EUR/USD pair returned to the 323.6% Fibonacci corrective level at 1.0532 and did so again on Wednesday morning. The pair rebounded from this level twice, reversing in favor of the US dollar. As a result, the decline may continue today toward the 1.0420 level. A consolidation above 1.0532 would suggest stronger growth for the euro toward the next corrective level of 261.8% at 1.0662, but bulls remain too weak at the moment.

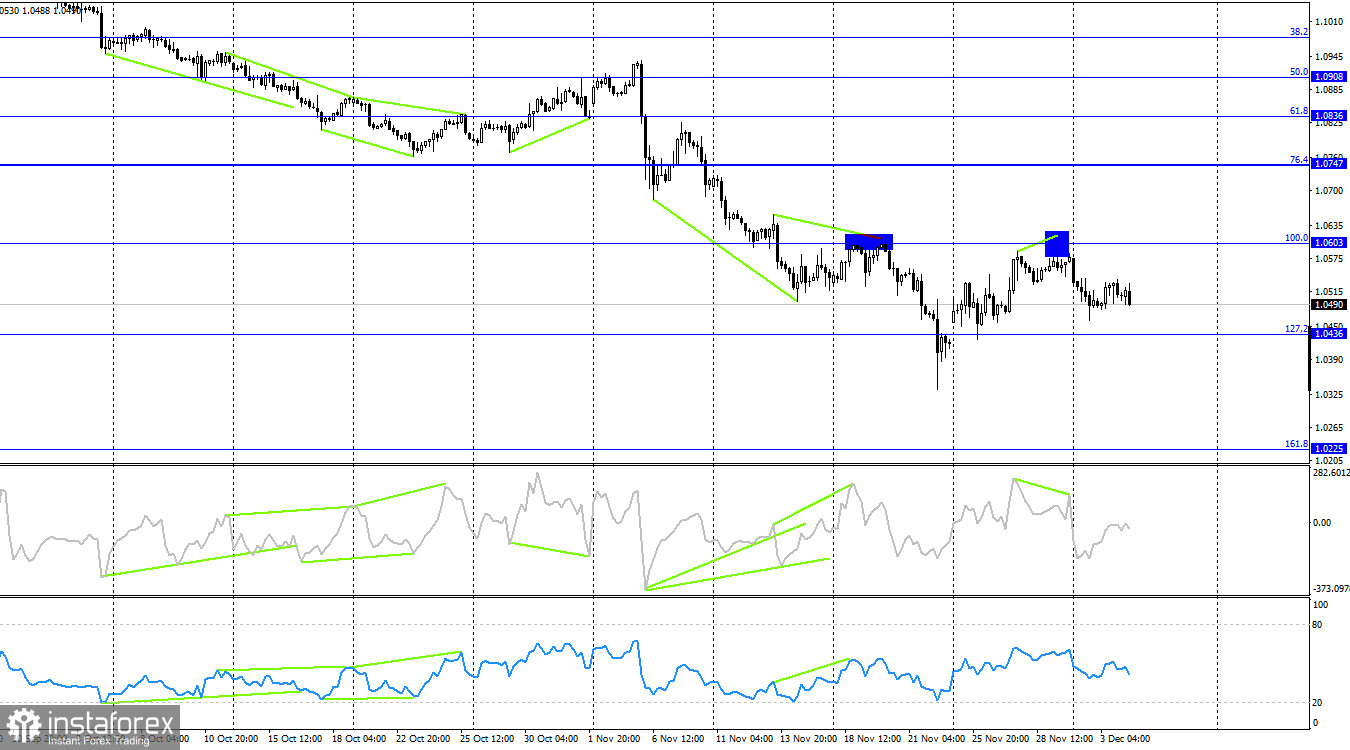

The wave structure raises no questions. The last completed downward wave broke below the low of the previous wave, while the new upward wave failed to break the previous peak. The pair is currently continuing its bearish trend formation. Bulls have lost their market initiative. Breaking the bearish trend requires the pair to rise above the 1.0611 level, which it failed to achieve last week.

Tuesday's economic data supported the bears. The only notable report, the JOLTS report, revealed 7.744 million job openings in October, surpassing market expectations of 7.38–7.48 million. This data highlighted the strength of the labor market and marked the second significant report this week favoring the bears. However, the bears either did not capitalize on this news or chose not to.

The fundamental backdrop continues to pressure the euro, and it seems only a matter of time before the bears resume daily attacks. While the remainder of the week holds three trading days, today's significant events could provide some support for the bulls. However, the current positions of the Fed and ECB suggest that Jerome Powell is unlikely to deliver a dovish tone, nor Christine Lagarde a hawkish one. Therefore, neither president is likely to support the euro today.

a bearish divergence on the CCI. This led to a reversal in favor of the US dollar and initiated a decline toward the 127.2% Fibonacci level at 1.0436. The probability of further euro declines remains high. Consolidation below 1.0436 would increase the likelihood of continued movement toward the 161.8% Fibonacci level at 1.0225.

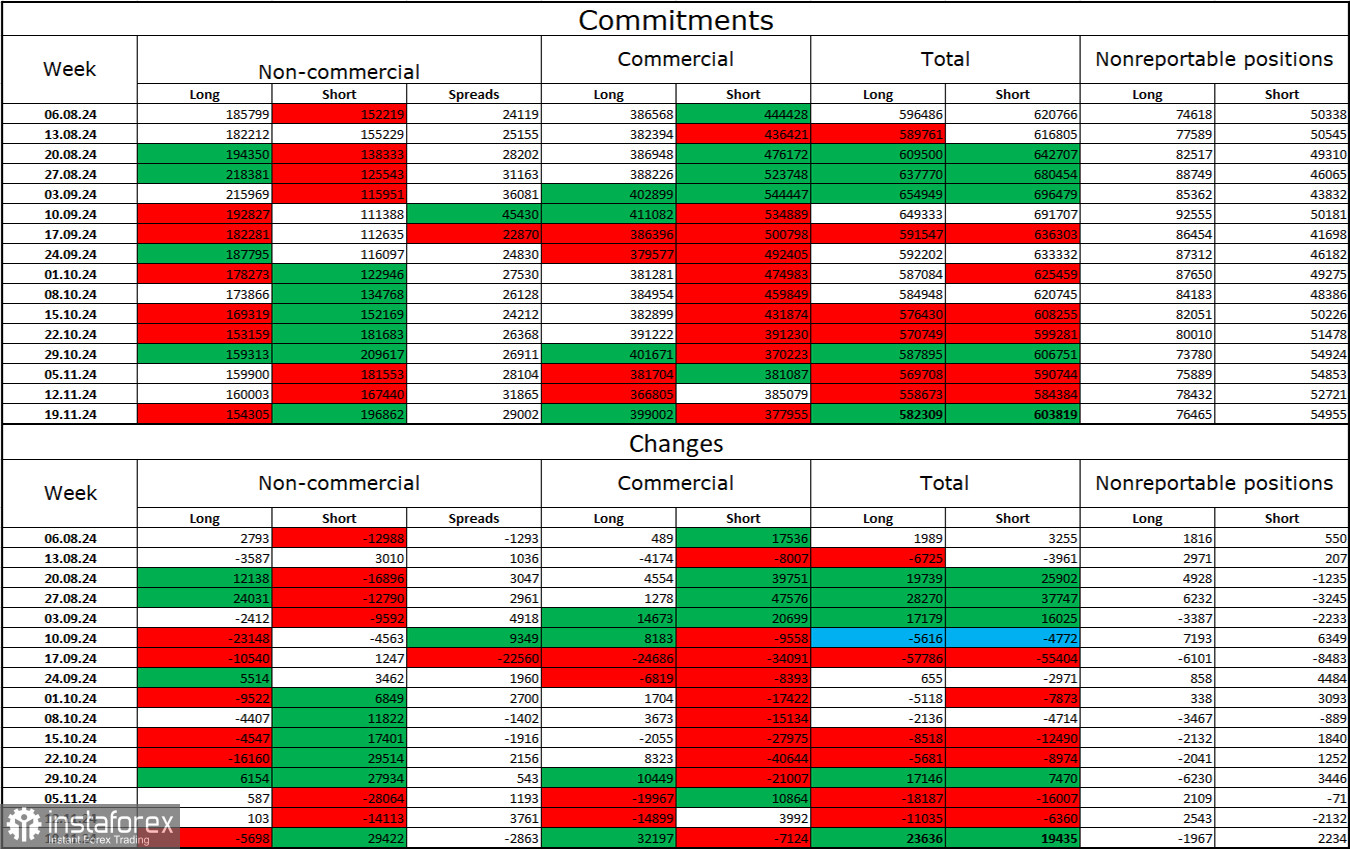

COT Report

During the latest reporting week, speculators closed 5,698 long positions and opened 29,422 short positions. The Non-commercial group remains bearish, suggesting further declines for the pair. Speculators now hold 154,000 long positions compared to 197,000 short positions.

For ten consecutive weeks, major players have been reducing their holdings in the euro. This indicates the onset of a new bearish trend. While the primary factor behind the dollar's earlier decline—expectations of a Fed policy easing—has already been priced in, the market currently lacks strong reasons to sell the dollar further. Graphical analysis also suggests the beginning of a long-term bearish trend, reinforcing the likelihood of a prolonged EUR/USD decline. The latest COT report does not indicate a reversal toward a bullish trend.

News Calendar for the US and Eurozone

- Eurozone: Germany Services PMI (08:55 UTC).

- Eurozone: Eurozone Services PMI (08:55 UTC).

- US: ADP Employment Change (13:15 UTC).

- Eurozone: ECB President Christine Lagarde Speech (13:30 UTC).

- US: S&P Services PMI (14:45 UTC).

- US: ISM Services PMI (15:00 UTC).

- Eurozone: ECB President Christine Lagarde Speech (15:30 UTC).

- US: FOMC Chair Jerome Powell Speech (18:45 UTC).

The economic calendar for December 4 includes several significant entries. The fundamental backdrop could strongly influence market sentiment today.

EUR/USD Forecast and Trading Advice

Short positions on the pair were recommended after a 4-hour chart rebound from the 1.0603 level, with targets at 1.0420 and 1.0320. These trades can remain open. Additionally, the price twice rebounded from the 1.0532 level yesterday and today.

Long positions could have been considered on a rebound from the 1.0420 level on the hourly chart (although no clear rebound occurred) or from the 1.0532 level, targeting 1.0662, which also did not materialize. Today, I would refrain from considering long positions.

Fibonacci levels are constructed from 1.1003–1.1214 on the hourly chart and 1.0603–1.1214 on the 4-hour chart.