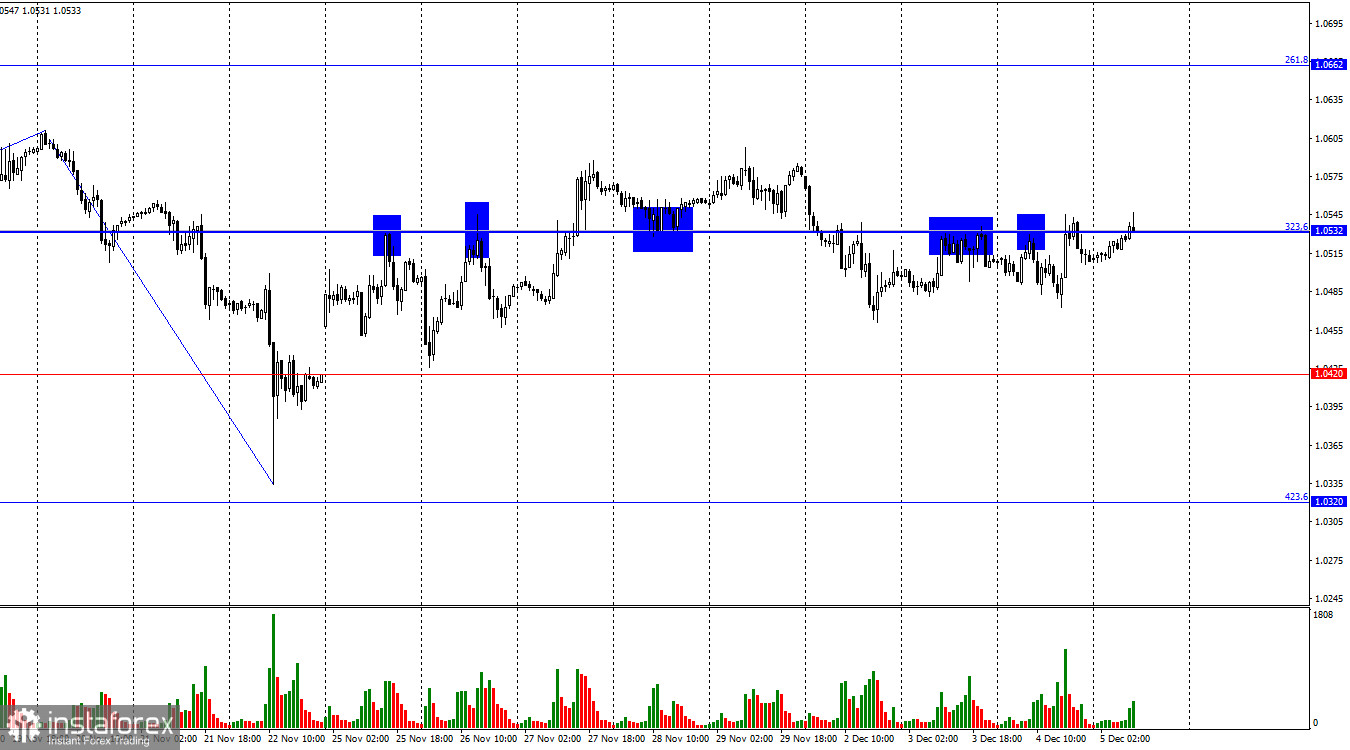

On Wednesday, the EUR/USD pair traded sideways below the 323.6% corrective level at 1.0532. Despite strong economic data, no clear dominance was established by either bears or bulls. In my opinion, the market is currently calm before the storm, as recent news should have influenced traders' sentiment. However, technical signals remain ineffective, and the market seems unresponsive to almost all incoming information. The price has rebounded from 1.0532 three or four times but remains stationary.

The wave structure is clear. The most recent downward wave broke the previous low, while the latest upward wave failed to break the last peak. This suggests that the pair is still forming a bearish trend. Bulls have lost their initiative. To reverse this trend, the pair would need to rise above 1.0611, which it failed to do last week and has yet to achieve this week.Wednesday's news backdrop included speeches from Christine Lagarde and Jerome Powell, along with the ISM Services PMI. These events could have caused a price movement of 100–120 points, yet the market failed to respond to this data.

Jerome Powell stated that the Federal Reserve could afford to be patient in lowering interest rates. He repeated his recent remarks that the Fed does not need to ease monetary policy quickly. This raises doubts about a December rate cut. Within the FOMC, opinions remain divided. Some policymakers believe another cut is feasible, while others, concerned about potential inflation, suggest pausing further cuts.

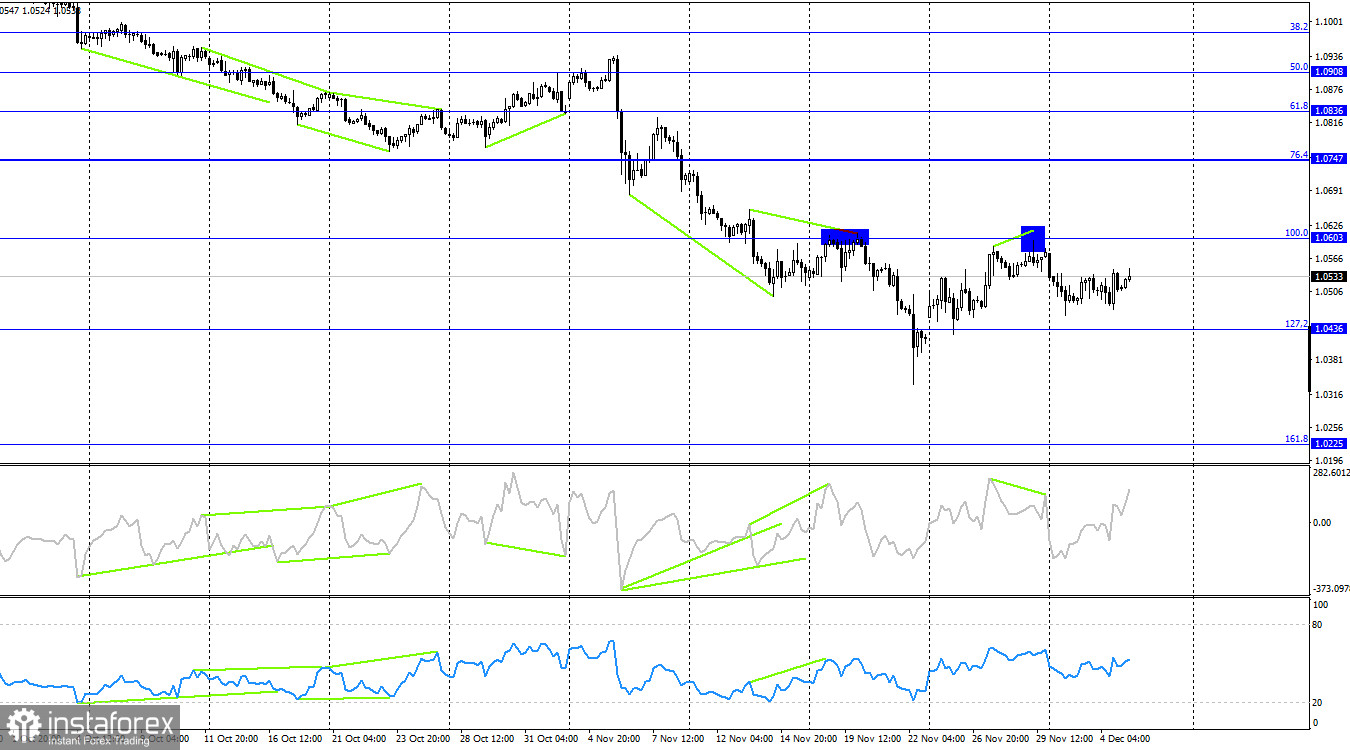

On the 4-hour chart, the pair rebounded from the 100.0% corrective level at 1.0603, forming a bearish divergence on the CCI indicator. This led to a reversal in favor of the US dollar, with the pair declining toward the 127.2% Fibonacci level at 1.0436. If the price consolidates below 1.0436, it could signal further declines toward the 161.8% corrective level at 1.0225.

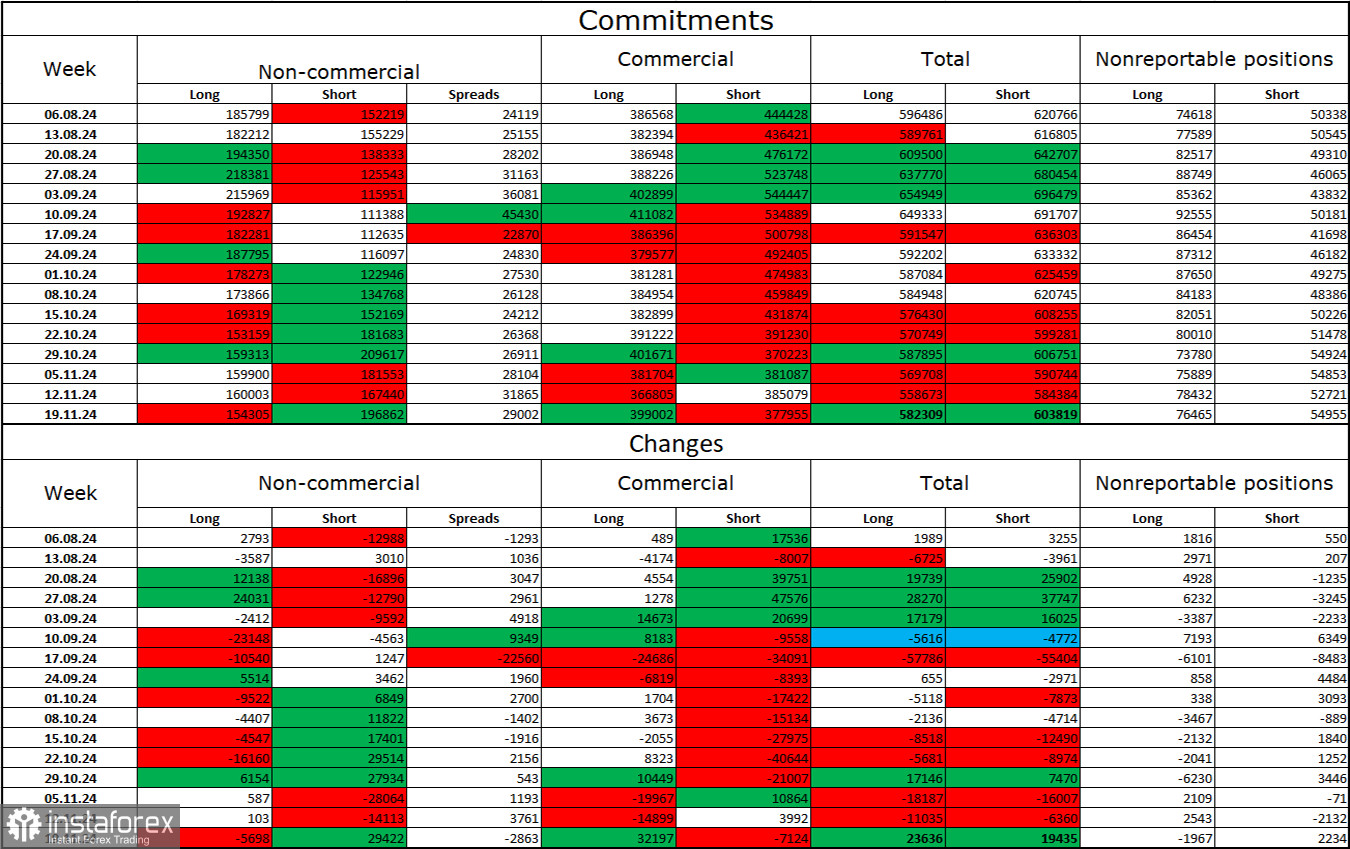

COT Report

Speculators closed 5,698 long positions and opened 29,422 short positions in the latest reporting week. Non-commercial sentiment remains bearish, with speculators holding 154,000 long positions compared to 197,000 short positions.

Major players have been reducing euro holdings for ten consecutive weeks, confirming the start of a bearish trend. The primary driver of the dollar's decline—expectations of a dovish FOMC policy—has already been priced in. While new factors could emerge, the dollar's growth appears more likely. Technical analysis also supports the onset of a long-term bearish trend.

Forecast and Trading TipsShort positions remain valid on a 4-hour chart rebound from 1.0603, with targets at 1.0420 and 1.0320. The price has also rebounded from 1.0532 three times recently. Long positions could have been considered on a rebound from 1.0420 or 1.0532, but no clear signals were present. Today, I would not consider long positions due to the lack of viable signals.

Fibonacci levels are plotted from 1.1003–1.1214 on the hourly chart and 1.0603–1.1214 on the 4-hour chart.