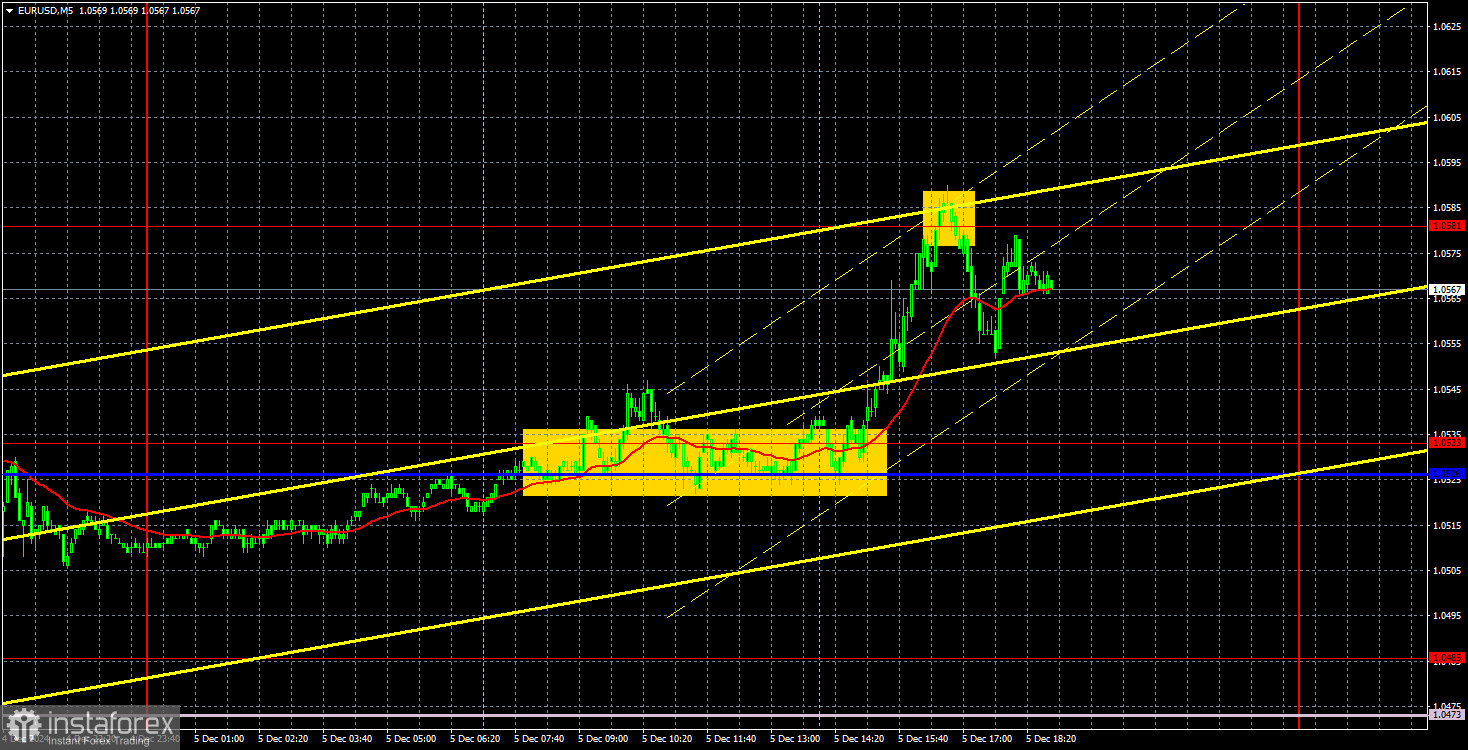

EUR/USD 5-Minute Analysis

The EUR/USD currency pair traded with slight gains on Thursday, but this upward movement of the euro is essentially insignificant. The pair remains within a horizontal channel between the levels of 1.0485 and 1.0581. It has tested the upper boundary of this channel, which had previously been tested three times. Therefore, traders can reasonably anticipate a fourth rebound, after which the price may head downward toward the Senkou Span B line. This would hold true if the flat scenario continues to develop. The downward trend persists on a broader scale, making it possible to expect a renewed decline below the 1.0340 level.

The macroeconomic background on Thursday was quite weak, as was the euro's rise. The retail sales report cannot be classified as positive or negative since its monthly figure was worse than forecasts, while the annual figure was better. The number of initial jobless claims in the U.S. was slightly higher than expected, but it is neither a significant figure nor a report likely to trigger a dollar selloff. In any case, the most important day of the week is still ahead, and tomorrow, the U.S. dollar could either make up for its losses or continue its decline.

Two trading signals were formed during yesterday's session. Initially, the pair bounced off the Kijun-sen line and the 1.0533 level for an entire session but eventually rebounded. A few hours later, the euro was already near the 1.0581 level, forming a somewhat imprecise rebound and generating a sell signal. As a result, traders could have opened two trades yesterday, both of which were profitable.

COT Report

The latest Commitments of Traders (COT) report is dated November 19. The data clearly shows that the net position of non-commercial traders has been bullish for a long time, but the bearish sentiment is gradually gaining strength. A month ago, the number of short positions among professional traders surged, and for the first time in a long time, the net position turned negative. This indicates that the euro is now being sold more frequently than bought.

We continue to see no fundamental factors supporting euro strengthening, and technical analysis points to consolidation—a flat movement. On the weekly timeframe, the pair has been trading between 1.0448 and 1.1274 since December 2022. Thus, further decline remains likely. A break below 1.0448 would open up new space for a downward move.

The red and blue lines have crossed and changed their relative positions. During the last reporting week, the number of long positions in the non-commercial group fell by 5,700, while short positions rose by 29,400, leading to a net position decrease of 35,100.

EUR/USD 1-Hour Analysis

On the hourly timeframe, the pair continues to correct. As we anticipated, the correction remains complex and slow. We still believe there are no grounds for a significant rise in the euro, so we will wait for the correction to end and for the pair to resume its decline toward price parity. For example, consolidation below the Senkou Span B line would signal a potential resumption of the downward trend.

For December 6, we highlight the following trading levels: 1.0269, 1.0340-1.0366, 1.0485, 1.0581, 1.0658-1.0669, 1.0757, 1.0797, 1.0843, 1.0889, 1.0935, as well as the Senkou Span B line (1.0473) and the Kijun-sen line (1.0526). Note that the lines of the Ichimoku indicator may shift during the day, which should be considered when identifying trading signals. Remember to set a Stop Loss order to break even if the price moves 15 pips in the desired direction. This will help protect against potential losses if the signal is false.

On Friday, the U.S. will release the NonFarm Payrolls and unemployment rate reports, significant enough to drive the EUR/USD pair 100 pips in either direction. The Eurozone GDP report for the third quarter (final estimate) is less impactful. Reports on wages and U.S. consumer confidence will also take a back seat to the unemployment and labor market data.

Illustration Explanations:

- Support and Resistance Levels (thick red lines): Key areas where price movement might stall. Not sources of trading signals.

- Kijun-sen and Senkou Span B Lines: Ichimoku indicator lines transferred from the H4 timeframe to the hourly chart, serving as strong levels.

- Extreme Levels (thin red lines): Points where the price has previously rebounded. They can serve as trading signal sources.

- Yellow Lines: Trendlines, channels, or other technical patterns.

- Indicator 1 on COT Charts: Reflects the net position size of each trader category.