The EUR/USD currency pair traded sluggishly and narrowly on Thursday. This was somewhat understandable, as there were virtually no significant fundamental or macroeconomic events during the day. However, Wednesday was packed with events, including speeches by the heads of the European Central Bank and the Federal Reserve and the release of ADP and ISM reports. Despite this, the pair remained largely stagnant throughout the day.

In other analyses, we have already noted that the euro has essentially been trading in a range for several weeks. While not a classic flat, the price initially fell to 1.0350 before entering a range. Excluding the dip to 1.0350, the pair has been trading between 1.0450 and 1.0600 since November 14. With current low volatility and a lack of trend movements, the price may continue to trade within this horizontal channel for some time.

The most significant observation is that the euro is not rising. The last downward move lasted two months, and since its conclusion, the market has shown no intention of buying the euro. Weeks ago, we warned that any correction could be weak and slow. This prediction has primarily been accurate. When a trend ends, we typically see a sharp price rebound. Now, however, we see only lethargic upward movement. From a technical perspective, we believe the euro will continue to decline in the medium term.

On Wednesday, ECB President Christine Lagarde stated that economic growth in the European Union could slow down in the coming months. While her remarks lacked specifics, some of her statements are worth analyzing. First, Lagarde noted an ongoing contraction in the industrial sector, making it extremely difficult for the economy to grow. She also highlighted declining business activity in the services sector, meaning that both key areas of the EU economy are struggling. Previously, the services sector acted as a stabilizing force, offsetting the manufacturing downturn. Now, however, it, too, is contracting.

Secondly, Lagarde urged an unspecified audience to avoid creating trade barriers, although she was clearly referring to Donald Trump. The former U.S. president promised a new trade war with the EU. If Lagarde is speaking about this publicly, it indicates genuine concern about U.S. tariffs, which pose a threat to the European economy. Should Trump impose tariffs against the EU in 2025, expecting growth from the European economy will become even harder.

The dollar continues to benefit from the situation. The U.S. economy remains significantly stronger than the European economy, and the ECB is cutting rates even faster than the Fed. For context, the ECB's rate was initially 1% lower than the Fed's.

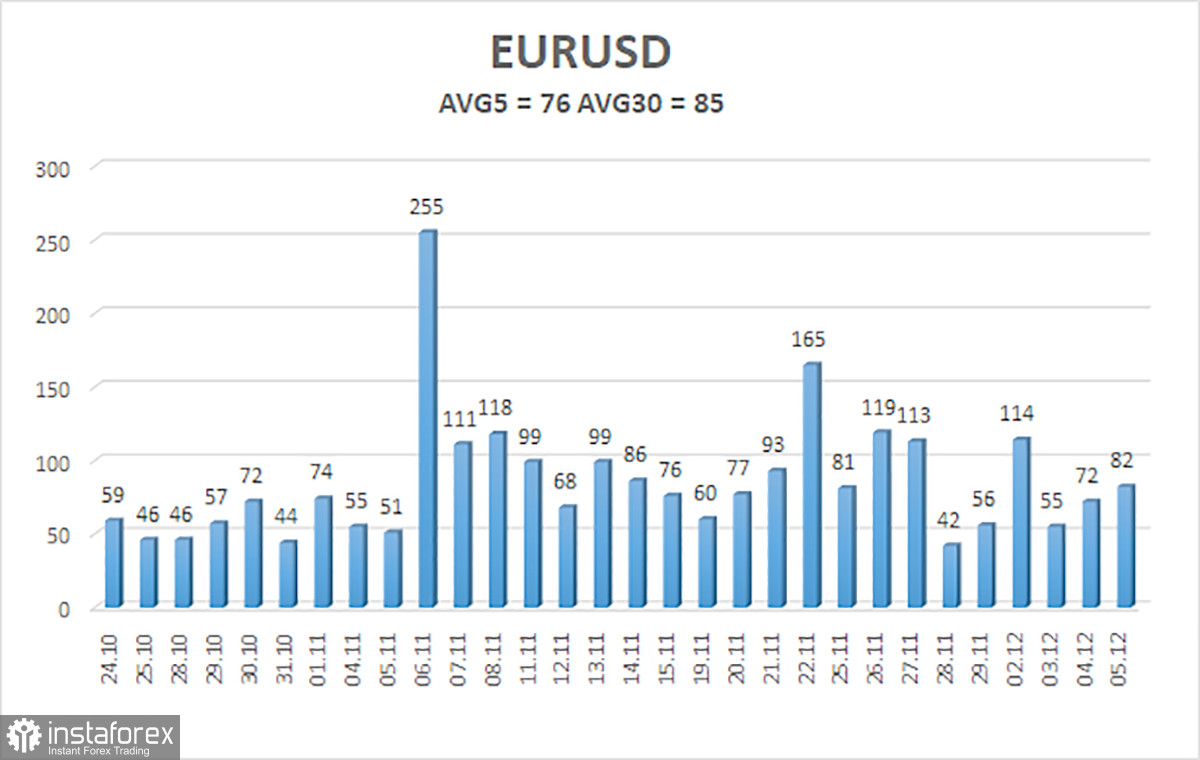

The average volatility of the EUR/USD currency pair over the last five trading days as of December 6 is 76 pips, classified as "medium." On Friday, we expect the pair to move between the levels of 1.0491 and 1.0643. The higher linear regression channel remains downward, reflecting the continuation of the global bearish trend. The CCI indicator has repeatedly entered oversold territory, triggering an upward correction that is still ongoing.

Key Support Levels:

- S1: 1.0498

- S2: 1.0376

- S3: 1.0254

Key Resistance Levels:

- R1: 1.0620

- R2: 1.0742

- R3: 1.0864

Trading Recommendations:

The pair could resume its downward trend. For months, we have maintained that the euro is poised for decline in the medium term, and we continue to support this bearish outlook fully. There is a strong likelihood that the market has already priced in most, if not all, of the anticipated Fed rate cuts. If this is the case, the dollar has little reason for a medium-term decline, as it had few, to begin with. Short positions can be considered with targets at 1.0376 and 1.0254 once the price consolidates below the moving average. For those trading solely on technical analysis, long positions may be considered if the price moves above the moving average, targeting 1.0620 and 1.0643. However, we do not recommend entering long positions.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.