Analysis of Trades and Recommendations for Trading the British Pound

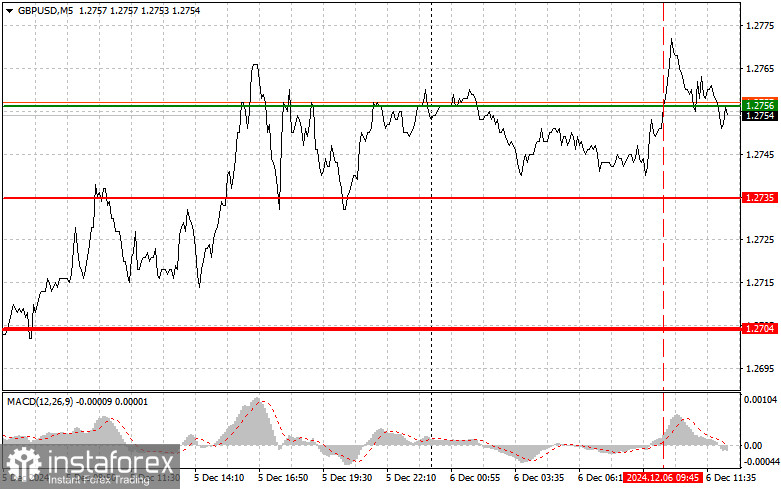

The test of the 1.2756 price level occurred when the MACD indicator had already risen significantly above the zero mark. This limited the pair's upward potential, and for this reason, I did not buy the pound.

The British pound remains stable in currency markets, supported by investor optimism, despite the lack of significant UK statistics. The key factor that may pressure the pound today is U.S. unemployment data and nonfarm payroll changes.

These data points are expected to provide insights into the U.S. economy's current state and indicate trends regarding future interest rate decisions. Unemployment, as a key indicator, sheds light on labor market health and consumer activity. If the figures underperform expectations, they could strengthen the pound by weakening the dollar.

Additionally, attention should be paid to the University of Michigan Consumer Sentiment Index and inflation expectations. The consumer sentiment index measures economic health and confidence, based on household surveys of financial well-being, job stability, and general economic conditions. Lower values in this index could signal consumer pessimism, potentially dampening consumer spending and putting short-term pressure on the dollar.

For intraday strategy, I will focus more on Scenario #1, even considering the MACD indicator readings, as I anticipate strong directional movements.

Buy Signal

Scenario #1

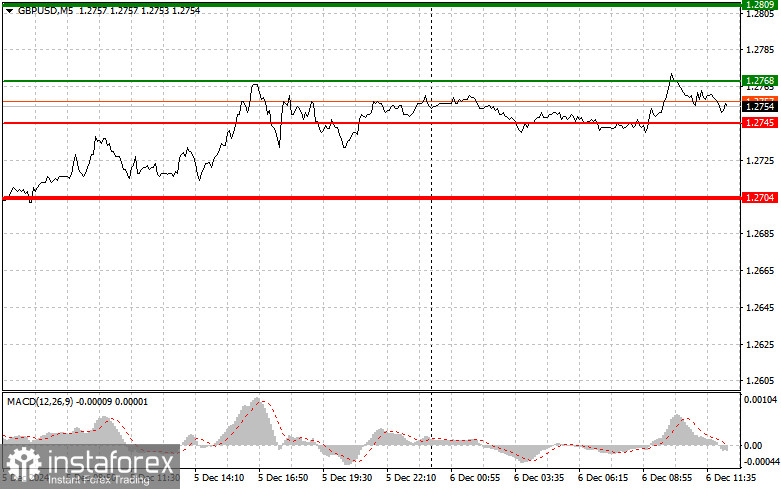

Today, buying the pound is possible at 1.2768 (green line on the chart), targeting a rise to 1.2809 (thicker green line on the chart). At 1.2809, I plan to exit purchases and open sell positions, anticipating a 30–35 point pullback. A strong rise in the pound today is likely only after very weak U.S. data.Important! Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2

I also plan to buy the pound if there are two consecutive tests of 1.2745, with the MACD indicator in the oversold area. This will limit the pair's downward potential and trigger a reversal upward. Target levels are 1.2768 and 1.2809.

Sell Signal

Scenario #1

I plan to sell the pound after it breaks below 1.2745 (red line on the chart), potentially leading to a quick decline in the pair. The key target for sellers is 1.2704, where I will exit sales and immediately open buy positions, anticipating a 20–25 point pullback. Sellers will likely emerge only if U.S. economic data significantly exceed expectations.Important! Before selling, ensure the MACD indicator is below the zero mark and beginning to decline.

Scenario #2

I also plan to sell the pound if there are two consecutive tests of 1.2768, with the MACD indicator in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. Target levels are 1.2745 and 1.2704.

Key Chart Elements

- Thin green line: Entry price for buying the GBP/USD pair.

- Thick green line: Target price for setting Take Profit or manually fixing profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the GBP/USD pair.

- Thick red line: Target price for setting Take Profit or manually fixing profits, as further declines below this level are unlikely.

- MACD Indicator: Use the MACD's overbought and oversold zones for guidance when entering the market.

Important Notes

Beginner Forex traders should approach market entry decisions with caution. Before significant fundamental reports are released, it's best to stay out of the market to avoid sharp price fluctuations. If you choose to trade during news releases, always set stop-loss orders, to minimize losses. Without stop-loss orders, you risk quickly losing your entire deposit, especially when trading large volumes without proper money management.

Remember that successful trading requires a clear trading plan, like the one outlined above. Making impulsive trading decisions based on the current market situation is a losing approach for intraday traders.