Analysis of Friday's Trades

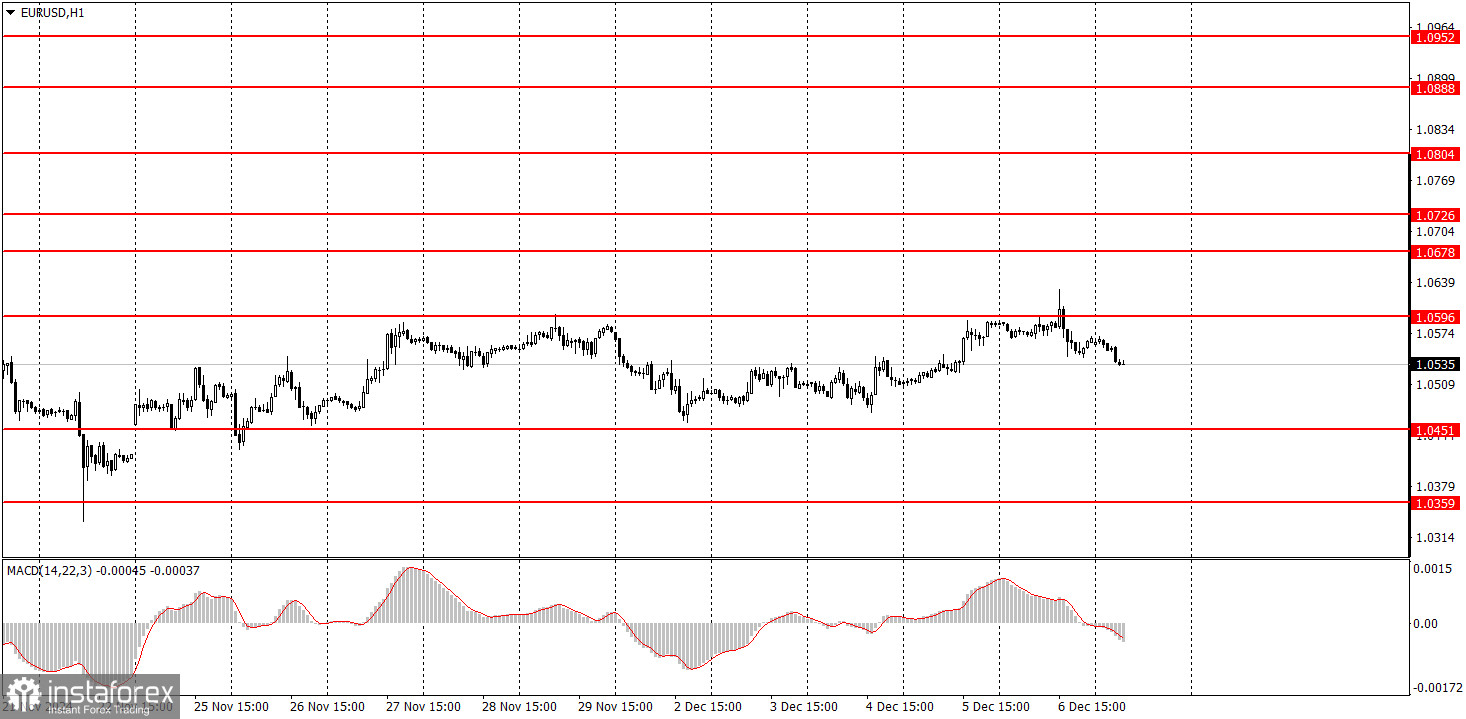

1H Chart of EUR/USD

On Friday, the EUR/USD pair attempted to extend its upward correction again but failed to break above the 1.0596 level. Typically, the longer a price struggles to surpass a certain level, the higher the likelihood it will eventually break through. However, in this case, we believe the bulls are extremely weak and received no support from last week's macroeconomic backdrop. Most U.S. data were positive—maybe not exceptional, but still favorable. Consequently, the market found it challenging to sell the dollar.

Moreover, Friday's key report, the U.S. Non-Farm Payrolls, exceeded expectations, while the current upward movement is a correction. The pair's decline will likely resume this week. The only factor that could disrupt this scenario is the upcoming U.S. inflation report, but even that is unlikely to be so unfavorable as to prolong the correction for another couple of weeks. While possible, it seems improbable for now. The U.S. dollar may appreciate significantly even before Wednesday.

5M Chart of EUR/USD

Three trading signals were generated on Friday's 5-minute timeframe, two of which could have been safely ignored. During the European trading session, the price rebounded from 1.0596, but no downward movement followed. Positions based on this signal should have been closed before the release of U.S. data. Following the release of key reports, two additional signals formed near 1.0596, but neither could be deemed accurate as the price fluctuated erratically during this period.

Trading Strategy for Monday:

On the hourly timeframe, the EUR/USD pair continues to correct, but the euro's prospects are limited to slow or minor upward movement, which has been evident for three weeks. It's worth noting that the price has remained within the 1.0451–1.0596 channel for nearly the entire time. Despite a two-month decline, there is little interest in buying the euro.

On Monday, we expect the pair's decline to resume, as it failed again to break through 1.0596.

On the 5-minute TF, the levels of 1.0269-1.0277, 1.0334-1.0359, 1.0433-1.0451, 1.0526, 1.0596, 1.0678, 1.0726-1.0733, 1.0797-1.0804, 1.0845-1.0851, 1.0888-1.0896 should be considered. No significant or secondary reports are scheduled for release in the Eurozone or the U.S. today. As a result, volatility is likely to remain weak, but both currency pairs may already begin to decline.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.