EUR/USD

Higher Timeframes

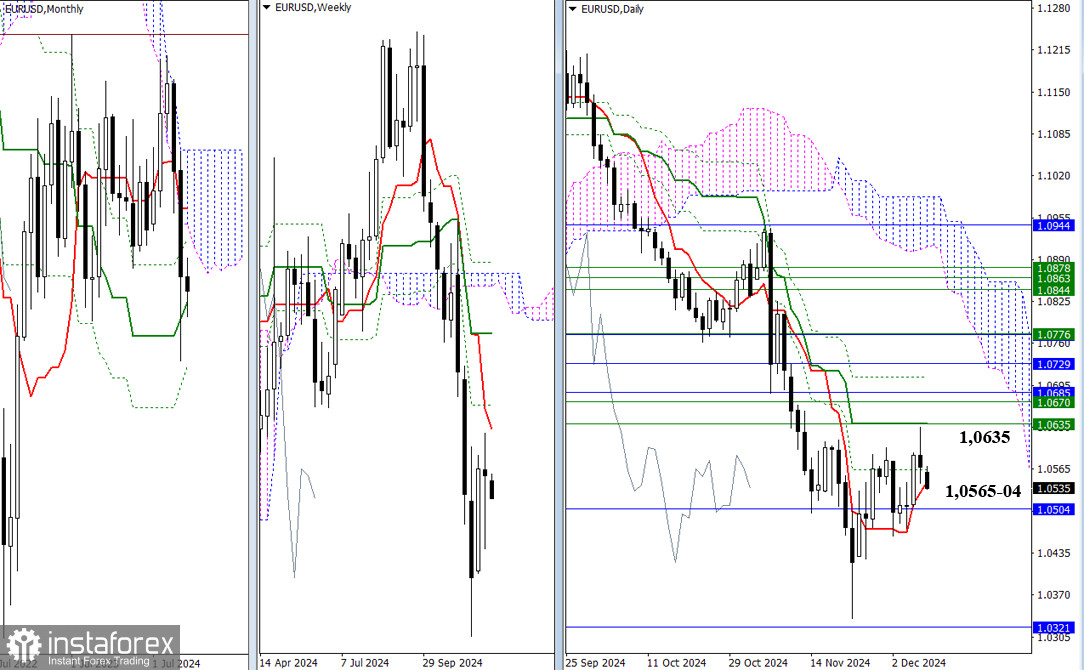

At the end of last week, the bulls managed to extend a long upper shadow on the weekly candle up to the 1.0635 area. Here, two strong resistances converge the daily mid-term trend and the weekly short-term trend. The 1.0635 level and subsequent resistances (1.0670, 1.0685, 1.0707, 1.0729, and 1.0776) form a broad resistance zone. Any of these levels could trigger a rebound, halting the bulls' advance at this stage.

Currently, the pair is influenced by the daily levels (1.0565 – 1.0545), with the monthly mid-term trend support located slightly below 1.0504. For the bears, consolidating below 1.0565–1.0504 is a primary task, while updating the minimum extremum (1.0334) and breaking the monthly Ichimoku golden cross (1.0321) would open new bearish opportunities.

H4 – H1

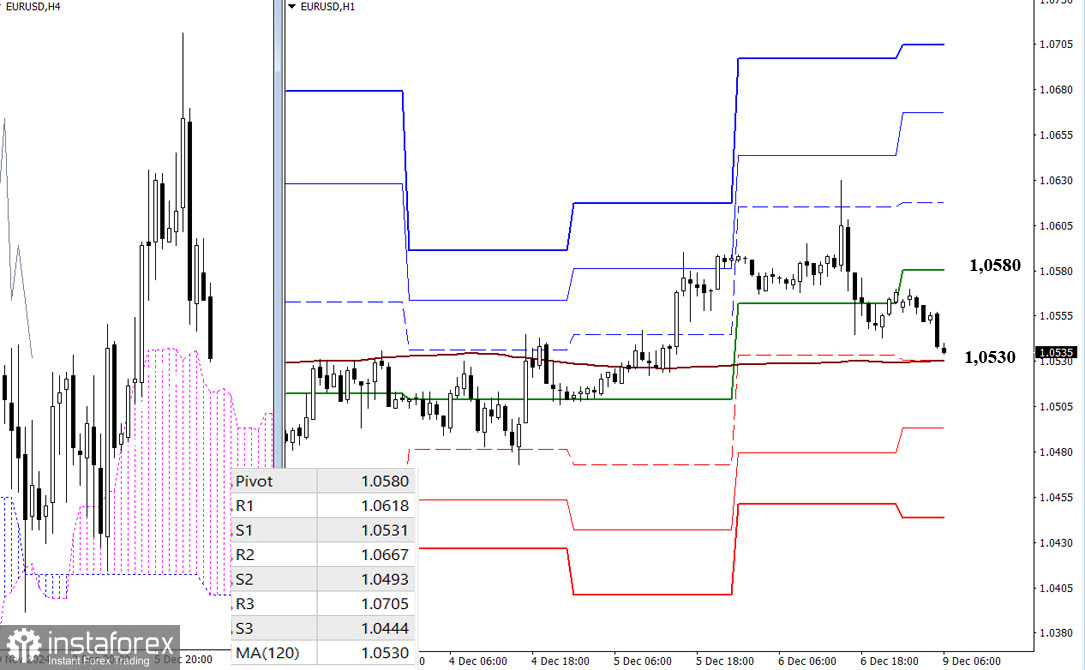

The bulls lost their advantage in lower timeframes and retreated toward the weekly long-term trend (1.0530). This area is pivotal as control of the weekly trend dictates the prevailing sentiment. A breach below 1.0530 could amplify bearish sentiment, with intraday targets at 1.0493 and 1.0444 (classic Pivot support levels). A rebound from 1.0530 and the bulls' recovery would shift focus back to resistance levels at 1.0580, 1.0618, 1.0667, and 1.0705 (classic Pivot levels).

***

GBP/USD

Higher Timeframes

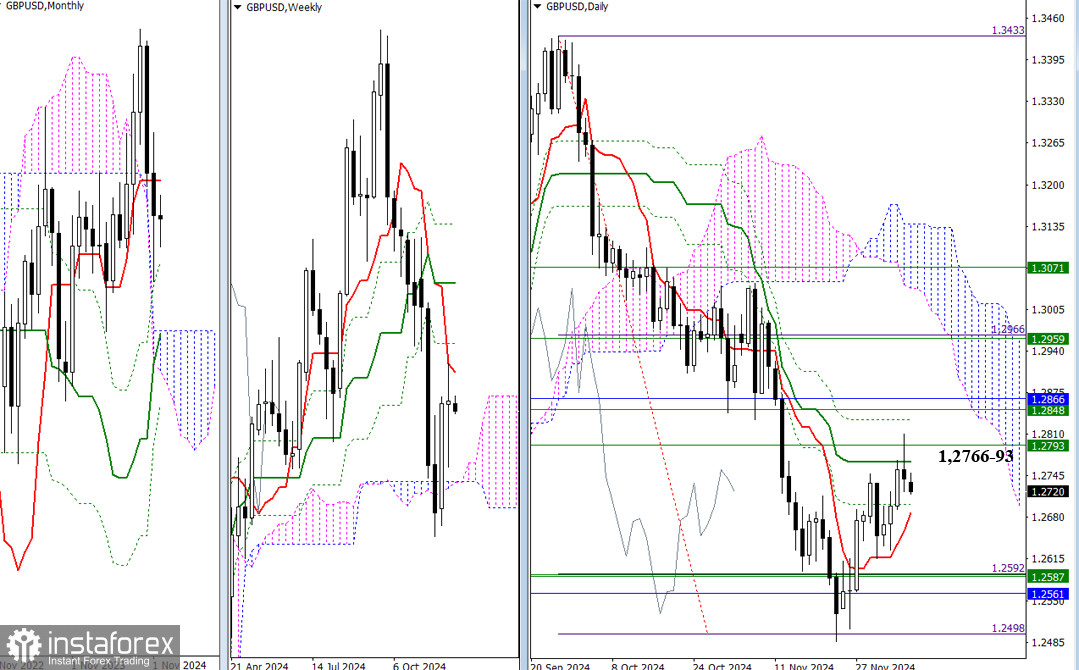

Last week's trading resulted in a corrective rise to the daily mid-term trend (1.2766) and the weekly short-term trend (1.2793). The bulls' task is to break through these resistances to continue the upward correction. The next targets lie near 1.2832-1.2848-1.2866 (the final level of the daily Ichimoku cross, weekly Fib Kijun, and monthly short-term trend).

For the bears to regain control, they need to trigger a rebound from the encountered resistances (1.2766-1.2793) and reclaim the daily short-term trend support at 1.2687. Continuation of the downtrend would then require overcoming a cluster of supports at 1.2561-1.2587 and updating the minimum extremum (1.2486), restoring the bearish trend on both daily and weekly charts.

H4 – H1

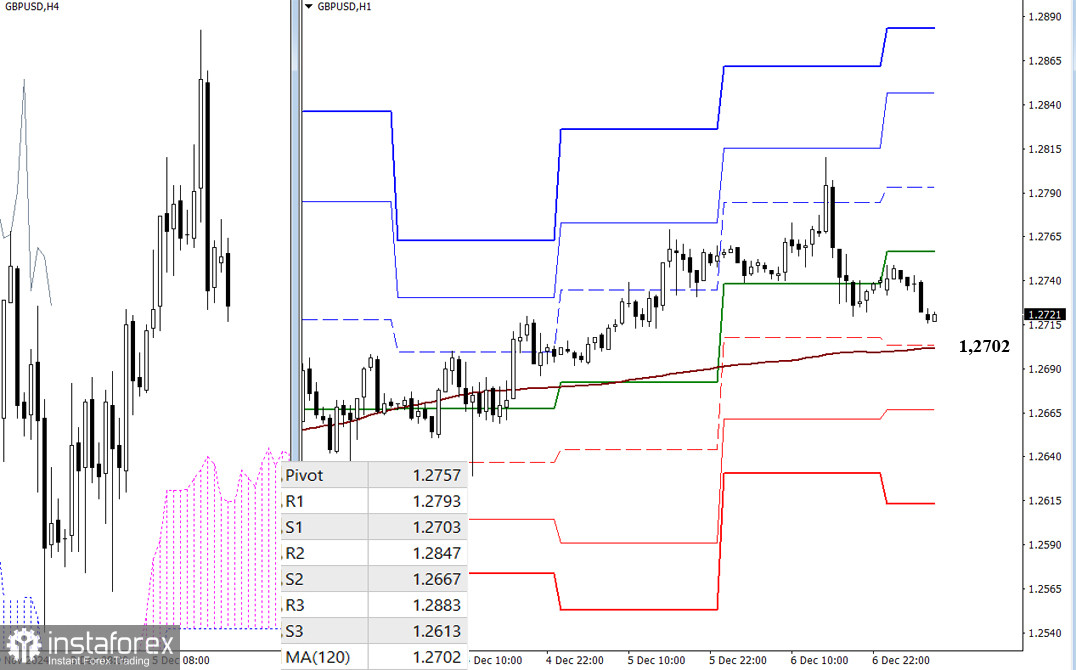

On lower timeframes, the pair has undergone a deep pullback toward the weekly long-term trend (1.2702), which defines the current balance of power. Trading above 1.2702 favors the bulls, while a move below it will strengthen bearish sentiment. The classic Pivot levels provide intraday directional cues. Bears will target supports at 1.2667 and 1.2613 if the price declines further. Conversely, if the bulls regain momentum, they aim for resistance at 1.2757, 1.2793, 1.2847, and 1.2883.

***

Technical Analysis Tools Used

- Higher Timeframes: Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels.

- Lower Timeframes (H1): Classic Pivot Points + Moving Average 120 (weekly long-term trend).