On the monthly chart, the price has reached the Fibonacci channel line (marked with a bold green line from the low to the high).

The Fibonacci grid accurately describes this upward movement, beginning in March 2009, as its levels—23.6%, 38.2%, 50.0%, 61.8%, and even 76.4%—align precisely with the extremes and support levels over the past 15 years. The Marlin oscillator indicates an intention to reverse from the overbought zone.

On the weekly chart, the price reverses from the upper boundary of a rising (reversal) wedge. A divergence has formed between the price and the Marlin oscillator. A deep correction is possible, bringing the index to the 23.6% Fibonacci level at 4817.13, which aligns with the January 2022 peak. Such a decline would correspond to a 20.95% drop from the record high.

On the daily chart, a divergence is also ready to play out. The first target for the decline is the MACD line near 5956.58, corresponding to the November 26 low. The second target is 5709.00, aligned with the nearest embedded line of the green diagonal price channel. This level is close to the support area from November 1–4.

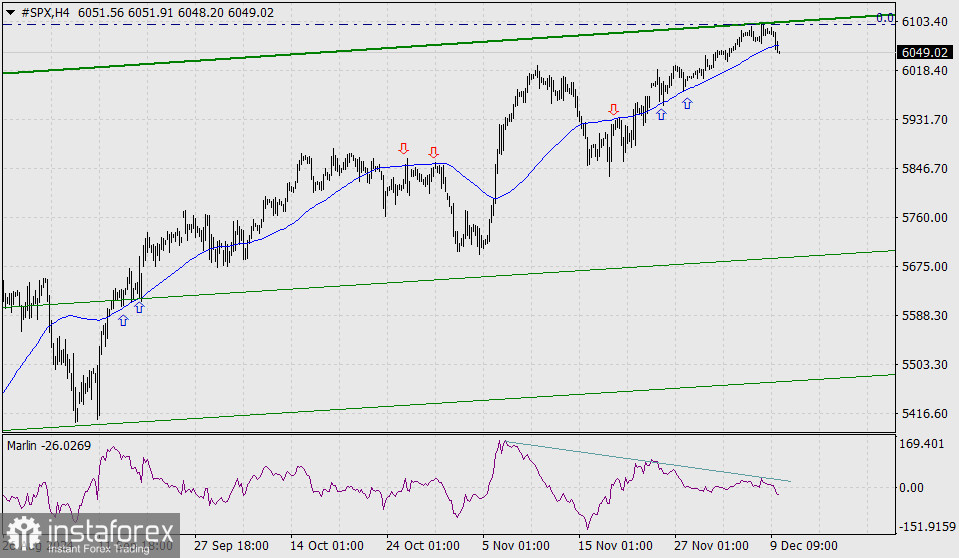

On the four-hour chart, the price has consolidated below the MACD line. A double divergence has formed between the price and the Marlin oscillator, with the oscillator moving into the downward zone. The current situation is definitively bearish. The market's next critical test will be the upcoming Federal Reserve meeting.