Despite a significant correction in Bitcoin and Ethereum observed by the close of the U.S. session yesterday, the dip was quickly bought up, indicating the presence of large players betting on the continued growth of the cryptocurrency market.

This is further confirmed by data pointing to unprecedented interest from institutional investors. According to a CoinShares report published yesterday, digital asset funds received a record inflow of $3.85 billion last week, driven by insatiable demand on Wall Street. Of those inflows, iShares ETFs by BlackRock accounted for $3.2 billion, bringing the total value of crypto assets under their management to $56.7 billion.

Ethereum also saw record-breaking inflows of $1.2 billion last week, surpassing volumes recorded in July when the SEC first approved U.S. spot ETH ETFs.

Recent data highlights that Wall Street ETF issuers collectively hold more Bitcoin than any other entity, including the cryptocurrency's creator, Satoshi Nakamoto. This underscores the growing institutional interest in the crypto market. With large financial institutions now accessing Bitcoin and Ethereum through ETFs, they are becoming key players in shaping market trends and determining price movements. While retail investors often face high risks and volatility, major ETF issuers can more effectively manage portfolios and minimize potential losses.

The total market capitalization of Bitcoin ETFs now stands at $109 billion, surpassing the combined holdings of MicroStrategy and Binance.

Given this backdrop, questions about why the cryptocurrency market remains resilient despite significant Bitcoin and Ethereum sales by long-term holders are fully answered.

For intraday strategies, I plan to continue relying on any significant dips in Bitcoin and Ethereum. I expect the bull market to continue in the medium term, which remains intact.

For short-term trading, the strategy and conditions are outlined below.

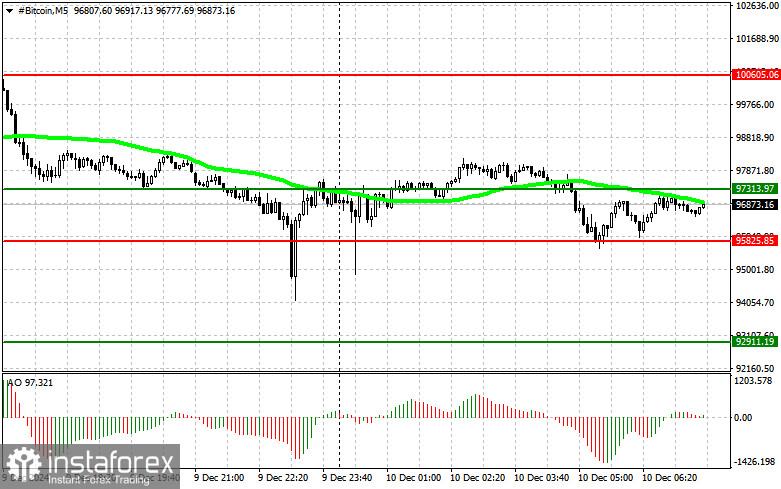

Bitcoin

Buy Scenario

Today, I plan to buy Bitcoin at the entry point around $97,313, targeting a rise to $100,500. At $100,500, I will exit buy positions and immediately sell on the rebound.

Important: Before buying on a breakout, ensure that the 50-day moving average is below the current price and the Awesome Oscillator is in the positive zone (above zero).

Sell Scenario

Today, I plan to sell Bitcoin at the entry point around $95,825, targeting a decline to $92,900. At $92,900, I will exit sell positions and immediately buy on the rebound.

Important: Before selling on a breakout, ensure that the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone (below zero).

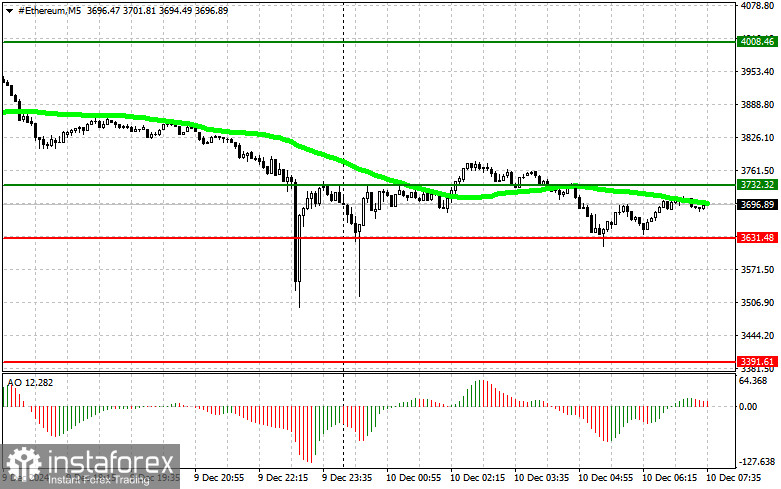

Ethereum

Buy Scenario

Today, I plan to buy Ethereum at the entry point around $3,732, targeting a rise to $4,008. At $4,008, I will exit buy positions and immediately sell on the rebound.

Important: Before buying on a breakout, ensure that the 50-day moving average is below the current price and the Awesome Oscillator is in the positive zone (above zero).

Sell Scenario

Today, I plan to sell Ethereum at the entry point around $3,631, targeting a decline to $3,391. At $3,391, I will exit sell positions and immediately buy on the rebound.

Important: Before selling on a breakout, ensure that the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone (below zero).