Gold has been rising for three consecutive days as traders shift their focus to key U.S. inflation reports scheduled for release this week. These reports are expected to shape expectations ahead of the Federal Reserve's final interest rate decision for the year. This trend also reflects growing investor interest in safe-haven assets amid uncertainty in financial markets and geopolitical tensions. Anticipation of key U.S. inflation data, which could impact economic policy, has prompted traders to buy gold, as the results may bring surprises.

Inflation reports often cause market fluctuations since high readings could push the Federal Reserve toward a more aggressive monetary policy. Any deviation from expected figures could pressure the U.S. dollar, benefiting gold.

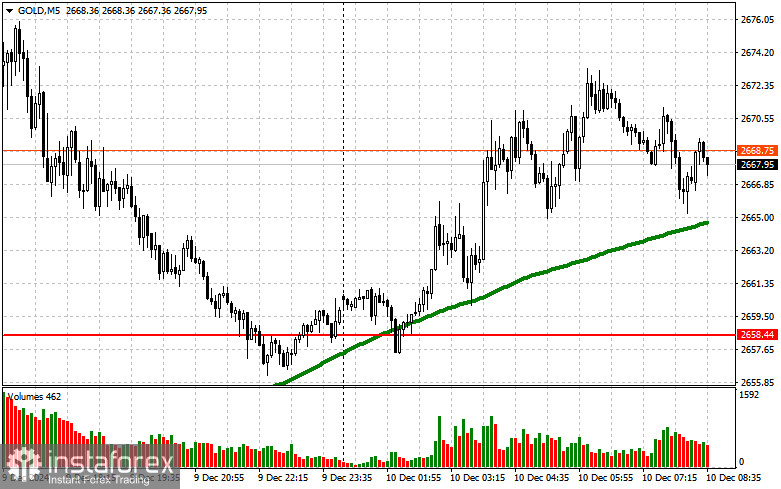

During Asian trading, gold traded around $2,670 per ounce after rising 1% on Monday. This increase followed news that China's central bank added gold to its reserves for the first time in seven months. Geopolitical concerns have also boosted demand for safe-haven assets amid fears of a power vacuum in Syria after Bashar al-Assad was ousted over the weekend.

As noted earlier, the data expected on Wednesday and Thursday will give Federal Reserve officials a more complete picture of inflation ahead of their meeting next week. Any signs that progress in curbing price growth has stalled could reduce the likelihood of further rate cuts. However, swap markets indicate a 90% probability of a 25-basis-point cut; higher borrowing costs typically weigh on gold as it does not yield interest.

Gold reached an all-time high of $2,790 per ounce in October this year, driven by the Fed's pivot to a dovish monetary policy and increased demand for safe-haven assets amid heightened tensions in the Middle East and Ukraine. Since then, prices have declined as the U.S. dollar strengthened following Donald Trump's election victory. However, geopolitical tensions could reignite interest in safe-haven assets like gold.

Market participants expect instability in the Middle East and the ongoing crisis in Ukraine to remain central issues, potentially triggering new surges in gold demand. Ultimately, gold's trajectory will depend on the balance between global economic factors and investor psychology.

As for the current technical picture of gold, buyers need to break through the nearest resistance at $2,685. Achieving this would target $2,708, though surpassing this level may prove challenging. The next key resistance is at $2,734, after which a sharper rally toward $2,758 could be discussed. In the event of a decline, bears will aim to regain control at $2,621. A successful breach of this range would deliver a severe blow to bullish positions, pushing the price toward a low of $2,590, potentially reaching $2,540.