To Open Long Positions on EUR/USD:

The data scheduled for the second half of the day is very important. This includes the U.S. Consumer Price Index (CPI) for November and the CPI excluding food and energy prices, which is even more significant. If U.S. inflation rises sharply, the Federal Reserve will likely adopt a more conservative approach to rate cuts in the near future. If the data aligns with economists' forecasts, the Fed will likely ease its policy next week, potentially weakening the dollar against the euro in the short term.

If pressure on the pair persists after the data release, I prefer to act around the new support level of 1.0464. A false breakout at this level would be an appropriate condition to increase long positions, targeting a return to 1.0503, which previously acted as support this morning. A breakout and retest of this range would confirm the entry point for buying with a target of 1.0539. The ultimate target will be the 1.0565 high, where I will take profits. Testing this level would revive the euro's bullish potential.

If EUR/USD declines and shows no activity around 1.0464 in the second half of the day (which seems likely), pressure on the pair will only increase, leading to a larger drop in the euro. In this case, I will only act after a false breakout around the 1.0430 support level. I plan to buy immediately on a rebound from 1.0394 with a target of a 30-35 point correction within the day.

To Open Short Positions on EUR/USD:

If the euro rises amid sharply reduced U.S. inflationary pressure, protecting the resistance level of 1.0539 will be the sellers' priority for the second half of the day. A false breakout there, as described above, will provide a good entry point for short positions, aiming for support at 1.0503. A breakout and consolidation below this range, followed by a retest from below, would be another viable option for selling, with a target at the 1.0464 low, which would return control to the bears. The ultimate target will be the 1.0430 area, where I will take profits.

If EUR/USD rises in the second half of the day and bears fail to act actively at 1.0539 (where moving averages are also located and favor the sellers), I will delay selling until the next resistance at 1.0565. I will also sell there but only after a failed consolidation. I plan to open short positions immediately on a rebound from 1.0593 with a target of a 30-35 point downward correction.

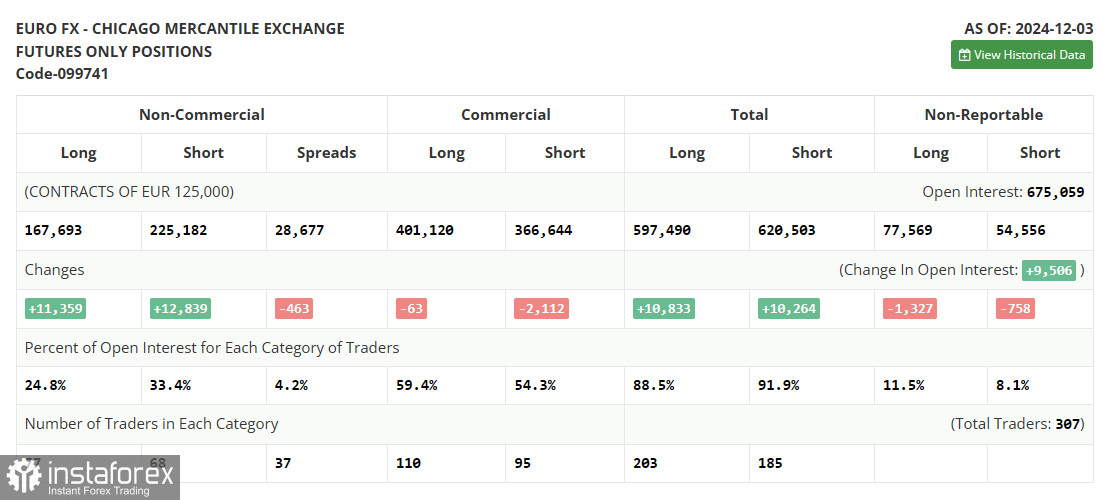

The COT Report (Commitment of Traders) for December 3 showed a significant increase in both short and long positions, leaving the market dynamics largely unchanged. Key inflation data from the U.S. is forthcoming and will determine the future direction of U.S. monetary policy and the dollar. If the numbers are uneventful, the Fed will likely lower interest rates, weakening the dollar further. According to the COT report, long non-commercial positions increased by 11,359 to 167,693, while short non-commercial positions rose by 12,839 to 225,182. As a result, the gap between long and short positions fell by 463.

Indicator Signals:

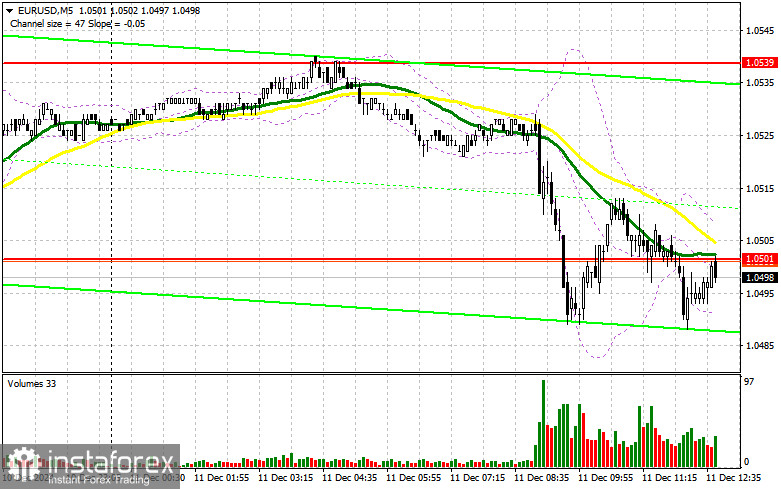

- Moving Averages: Trading is below the 30- and 50-day moving averages, indicating attempts to push the euro lower.

- Note: The moving averages referenced by the author are on the hourly H1 chart and differ from classic daily moving averages on the D1 chart.

- Bollinger Bands: The lower boundary of the indicator around 1.0503 will act as support in case of a decline.

Indicator Descriptions:

- Moving Average (MA): Indicates the current trend by smoothing volatility and noise. Period – 50 (yellow on the chart); Period – 30 (green on the chart).

- MACD Indicator: (Moving Average Convergence/Divergence – the convergence/divergence of moving averages). Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-Commercial Traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long Non-Commercial Positions: The total long open positions of non-commercial traders.

- Short Non-Commercial Positions: The total short open positions of non-commercial traders.

- Net Non-Commercial Position: The difference between short and long positions of non-commercial traders.