Do old patterns still work? An analysis of seasonal currency dynamics on Forex shows that December is typically a good month for the euro and a poor one for the U.S. dollar. According to MUFG, EUR/USD tends to strengthen in the last month of the year, only to lose its gains between January and March. This pattern held in December 2016, when Donald Trump first assumed office in the U.S. But does this mean history will repeat itself?

When an investor buys a stock, what do they prioritize: a strong balance sheet or higher profits? The answer depends on what drives the market—fear or greed. From a stock trader's perspective, Europe represents a region with a stronger balance sheet. While the issues in France and Italy are evident, the Eurozone boasts a government debt-to-GDP ratio of 88.2%, consistently falling from its peak of 98.8%. By contrast, the U.S. ratio stands at 97.8% and continues to rise.

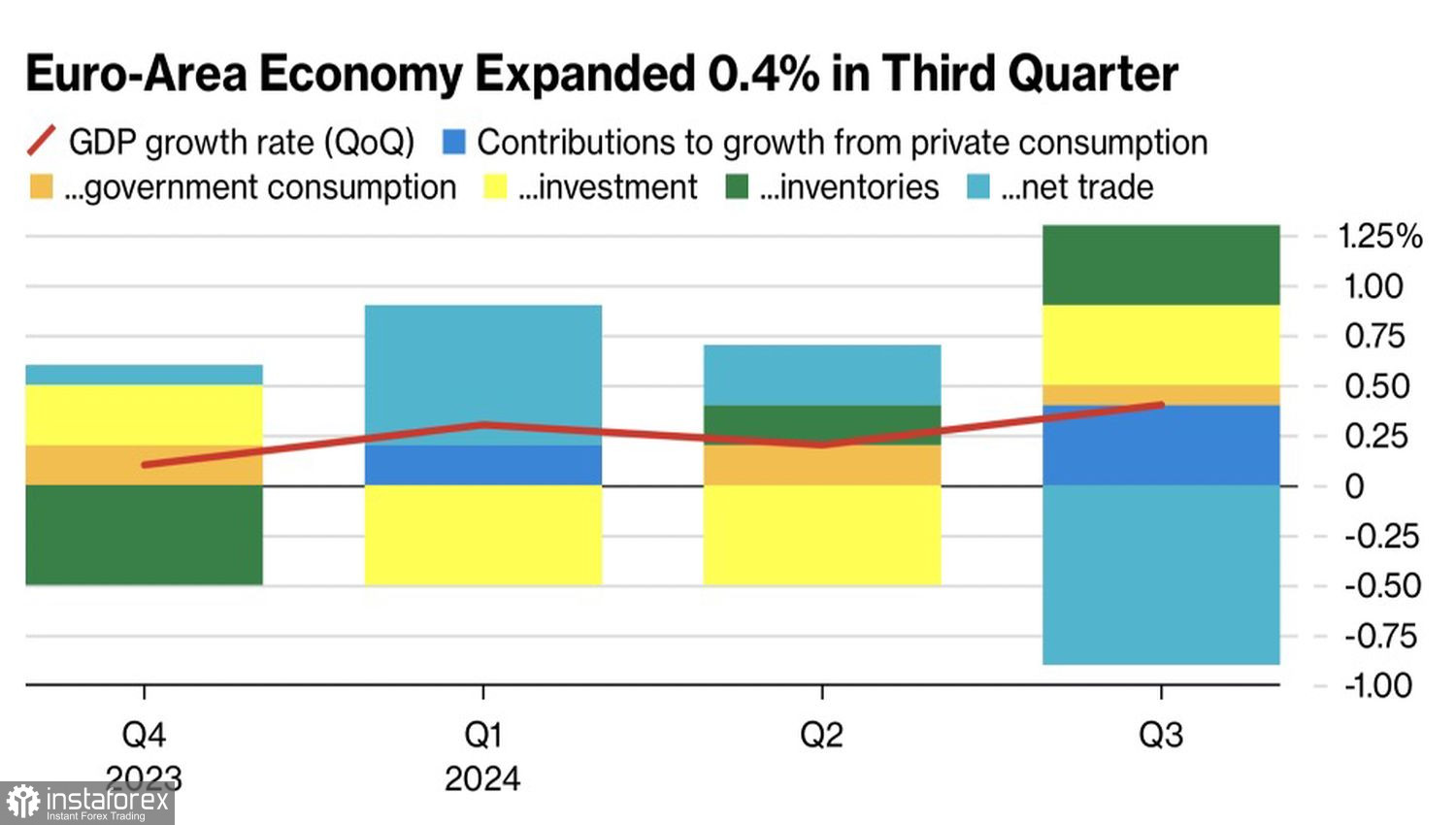

The Eurozone's balance sheet is undoubtedly stronger, but the U.S. delivers impressive profits. Its economy grows at nearly 3%, while a 0.4% GDP expansion in the Eurozone is considered a strong performance.

European Economic Dynamics

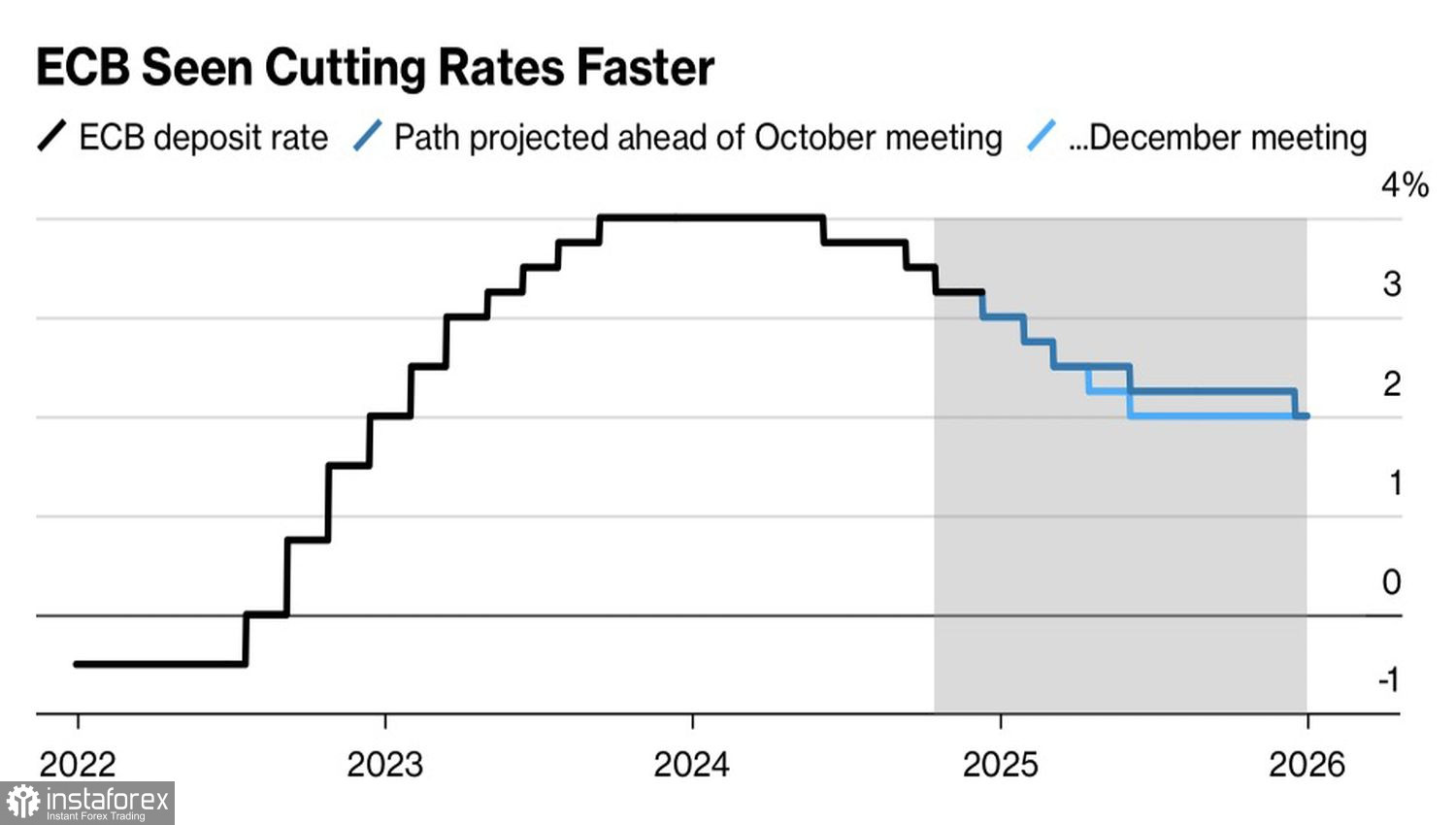

To stimulate growth, it would be prudent to continue cutting interest rates. This could encourage households and businesses to shift from saving to spending, providing relief to recession-hit Germany and politically embattled France. All European Central Bank's Governing Council members agree on the necessity of further monetary easing. However, opinions diverge on whether this will effectively revive the economy, as it depends on whether the slowdown is cyclical or structural.

According to Bloomberg, borrowing costs are expected to drop from 3.25% to 3.00%, with the deposit rate eventually reaching 2.00%. Futures markets predict a lower rate of 1.75% by the end of the easing cycle. Meanwhile, Citi and PIMCO project an even more significant drop, with the terminal rate at 1.50%.

Dynamics and Forecasts for the ECB Deposit Rate

The current borrowing cost differential between the U.S. and the Eurozone is 150 basis points (bps). By the end of 2025, this gap is expected to widen to 175–200 bps, further expanding yield spreads in debt markets across the two regions. This will likely sustain the downward trend in EUR/USD. Donald Trump's "America First" policy could also exacerbate this divergence. Fiscal stimuli are expected to boost U.S. GDP, while trade tariffs could hinder growth in the Eurozone.

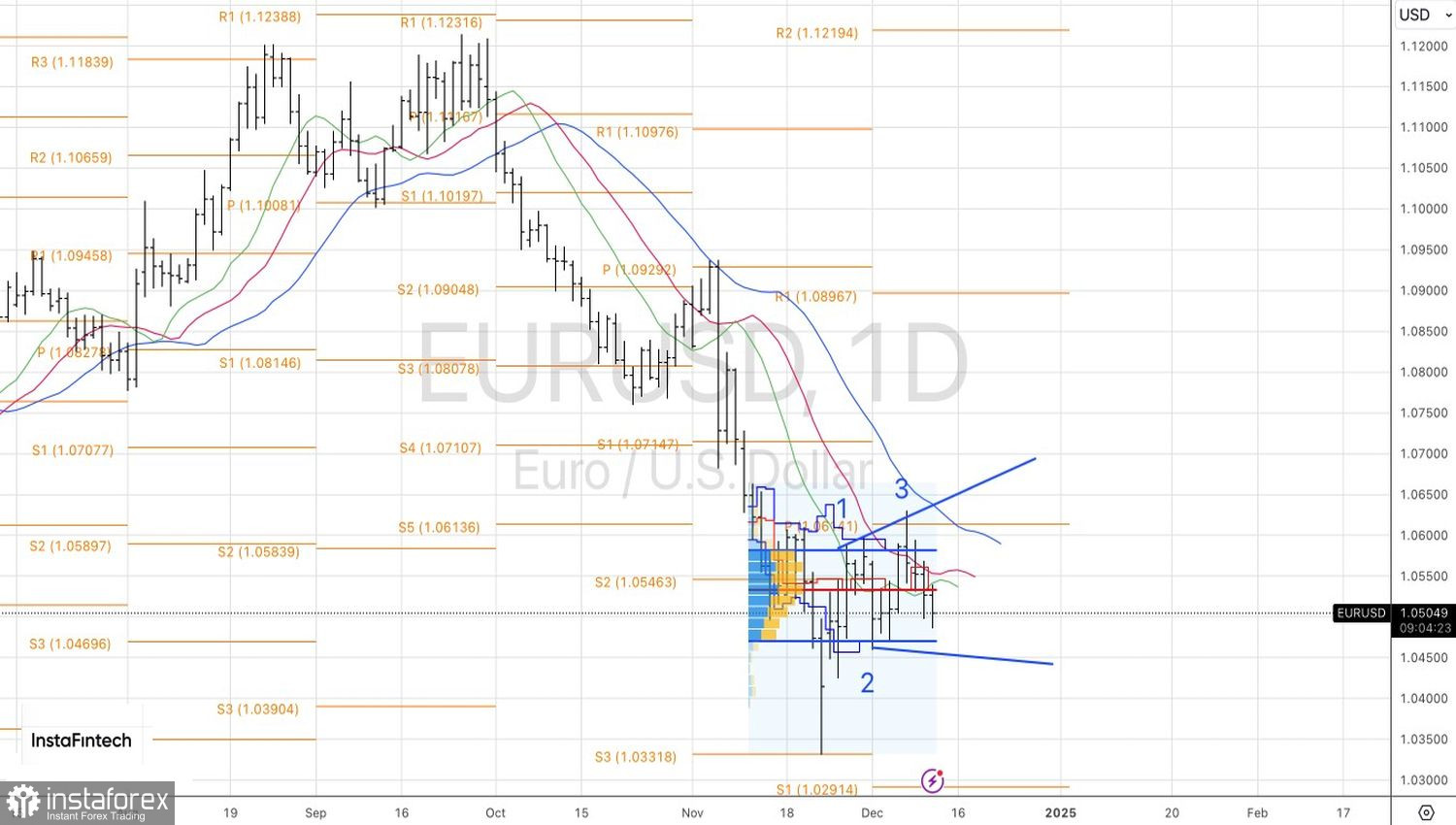

On the daily chart, EUR/USD bears have breached the pair's fair value and appear poised to resume the downtrend. A decisive break below the 1.0455–1.0460 support area is necessary to confirm this. Such a move would provide opportunities to increase short positions. Otherwise, it makes sense to think about switching from selling to buying.