The euro continues to face challenges, and there are objective reasons for this, which we will discuss below. On the other hand, the pound is showing more resilience under current conditions, remaining within its horizontal channel and retaining potential for further bullish market development.

Yesterday's data showed that price growth remains within economists' expectations but still poses challenges for U.S. policymakers. Some view this as a signal for easing monetary policy, while others warn against hasty decisions. It is crucial to understand that every Federal Reserve decision will depend on further analysis of the economic situation and its potential consequences. Amid rising consumer goods and services prices, central banks face a dilemma: lowering rates could accelerate inflation and boost economic activity. This situation calls for a cautious and flexible approach to decision-making. Regardless, next week, the Fed's next steps will be a key indicator for currency markets.

Today is important, as traders anticipate clear signals from the European Central Bank amid uncertainty over eurozone economic indicators. The decision on interest rates will be crucial in shaping market sentiment, and any hints of rate cuts could trigger a euro decline. Market participants will closely analyze the statement delivered by ECB President Christine Lagarde following the meeting for subtle hints and forecasts. A revival of interest in risk assets largely depends on investors' confidence in economic policy stability.

Unfortunately, there is no significant data from the UK today for the pound. However, this does not deter buyers from returning to last week's highs. Despite the lack of new data, traders continue to buy the pound on every dip, preserving the potential for further bullish development in the pair.

If the data aligns with economists' expectations, it is best to use a Mean Reversion strategy. The Momentum strategy is recommended if the data significantly exceeds or falls short of expectations.

Momentum Strategy (Breakout):

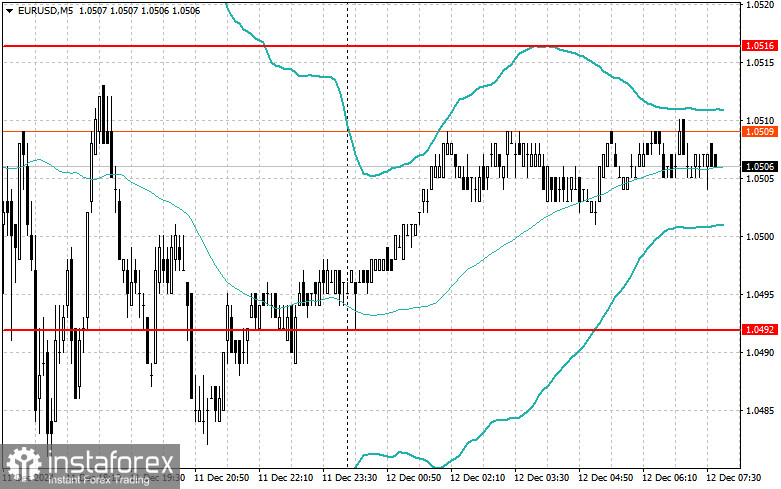

For EUR/USD:

- Buy on a breakout above 1.0535 to target 1.0565 and 1.0593.

- Sell on a breakout below 1.0500 to target 1.0464 and 1.0430.

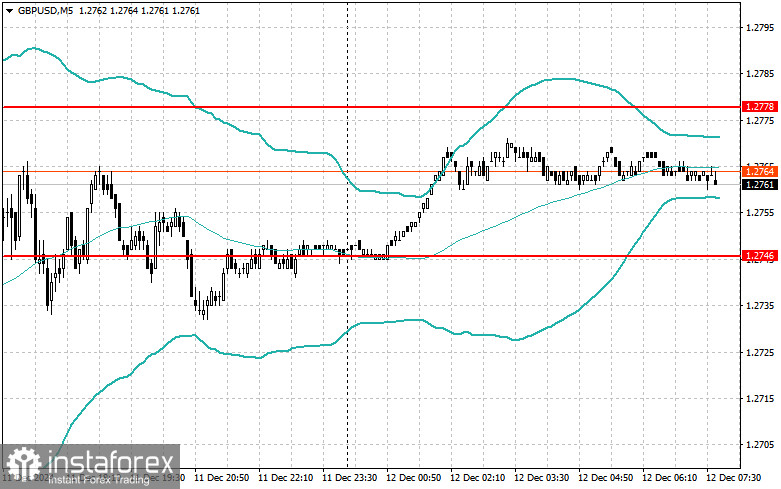

For GBP/USD:

- Buy on a breakout above 1.2778 to target 1.2808 and 1.2848.

- Sell on a breakout below 1.2747 to target 1.2717 and 1.2688.

For USD/JPY:

- Buy on a breakout above 152.74 to target 153.19 and 153.57.

- Sell on a breakout below 152.42 to target 152.10 and 151.70.

Mean Reversion Strategy:

For EUR/USD:

- Look for selling opportunities after a failed breakout above 1.0516 and a return below this level.

- Look for buying opportunities after a failed breakout below 1.0492 and a return above this level.

For GBP/USD:

- Look for selling opportunities after a failed breakout above 1.2778 and a return below this level.

- Look for buying opportunities after a failed breakout below 1.2746 and a return above this level.

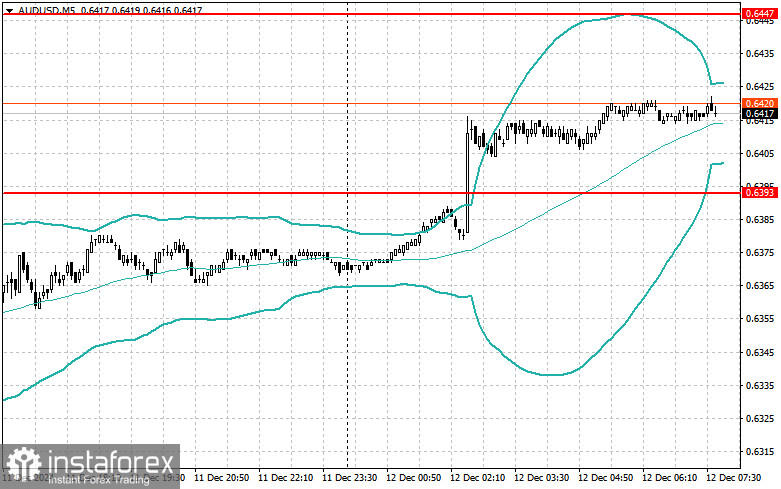

For AUD/USD:

- Look for selling opportunities after a failed breakout above 0.6447 and a return below this level.

- Look for buying opportunities after a failed breakout below 0.6393 and a return above this level.

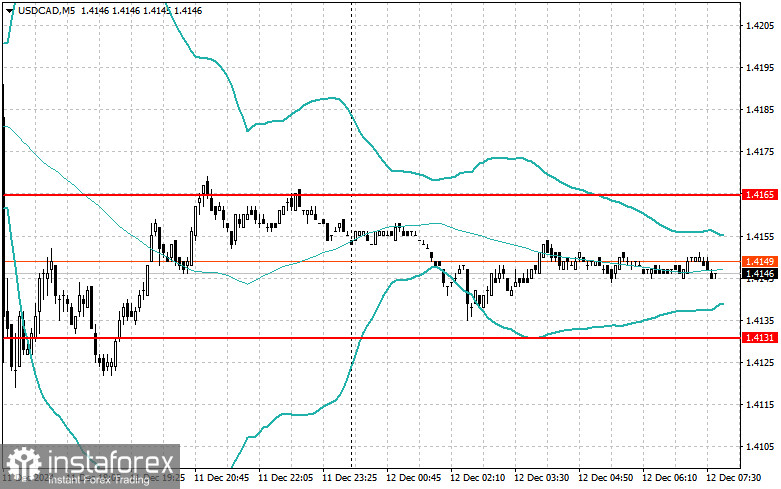

For USD/CAD:

- Look for selling opportunities after a failed breakout above 1.4165 and a return below this level.

- Look for buying opportunities after a failed breakout below 1.4131 and a return above this level.