Analysis of Trades and Trading Tips for the British Pound

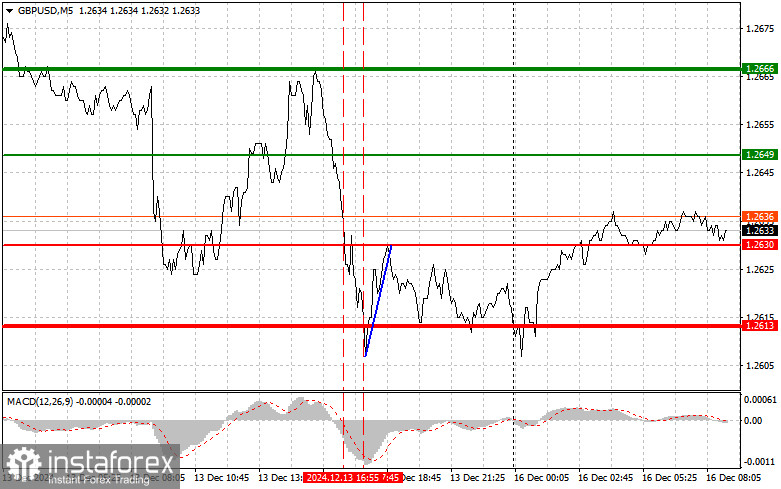

The test of the 1.2630 price level occurred when the MACD indicator had moved significantly below the zero line, limiting the pair's downward potential. For this reason, I chose not to sell the pound and missed a rather good downward move. Buying on the rebound at 1.2613 yielded about 20 pips of profit.

Today's PMI reports will undoubtedly serve as an important indicator for assessing the state of the UK economy. Special attention should be paid to the services sector, which has recently shown signs of recovery due to improving consumer demand and rising employment. An increase in business activity in this sector could positively impact the broader economic climate, boosting investments and improving living standards. Conversely, the manufacturing sector has been pulling the economy down and remains a key concern. A worsening situation for manufacturers could lead to renewed selling pressure on the pound. Improvements in manufacturing figures, however, could provide a positive impulse for the broader economy, supporting short-term pound purchases.

Buy Signal

Scenario #1:

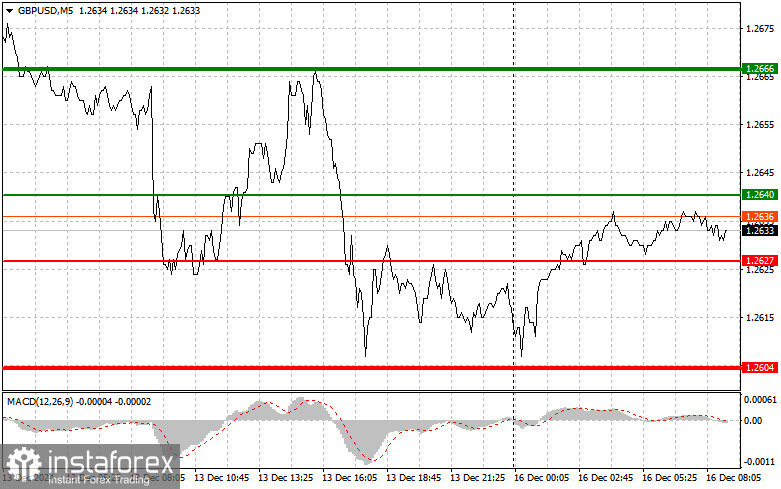

Today, I plan to buy the pound upon reaching the 1.2640 entry point (green line on the chart), targeting a rise to 1.2666 (thicker green line). At 1.2666, I plan to exit purchases and open a sell position in the opposite direction, aiming for a 30-35-pip movement in the opposite direction. A rise in the pound today can only be expected after strong economic data.

Important! Before buying, ensure the MACD indicator is above the zero line and starting to rise.

Scenario #2:

I also plan to buy the pound in the event of two consecutive tests of the 1.2627 level, provided the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal upwards. Growth can be expected towards the opposite levels of 1.2640 and 1.2666.

Sell Signal

Scenario #1:

I plan to sell the pound after the price updates the 1.2627 level (red line on the chart), leading to a quick decline in the pair. The primary target for sellers will be 1.2604, where I plan to exit sales and immediately open a buy position in the opposite direction, aiming for a 20-25 pip movement in the opposite direction. Selling the pound is possible, but doing so from a higher level is better.

Important! Before selling, ensure the MACD indicator is below the zero line and starting to decline.

Scenario #2:

I also plan to sell the pound if there are two consecutive tests of the 1.2640 level, provided the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reversal downwards. A decline can be expected to the opposite levels of 1.2627 and 1.2604.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.