Review of Trades and Trading Tips for the British Pound

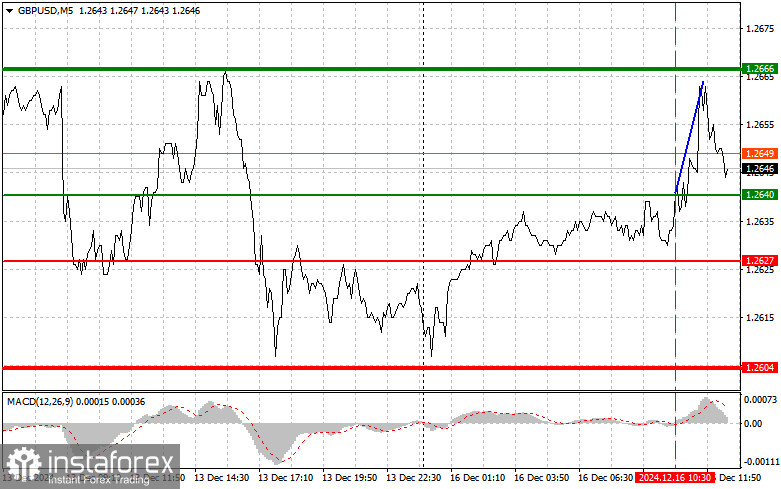

The test of the 1.2640 price level coincided with a moment when the MACD indicator had just started moving upward from the zero line, confirming a correct entry point for buying the pound. As a result, the pair rose to the 1.2666 level, slightly falling short of breaking above this level.

The rise in activity in the UK services sector, supported by investor optimism, temporarily strengthened the pound. However, the manufacturing sector's weak performance, with actual data falling short of forecasts, highlights persistent structural challenges in the economy. This underscores the need to reassess economic policies and consider measures to stimulate growth. While low interest rates could foster favorable conditions for investment and consumption, high inflation makes it unlikely that the Bank of England will pursue this path.

In the second half of the day, similar data on the US Manufacturing PMI, Services PMI, and Composite PMI are expected. Poor performance could support the pound.

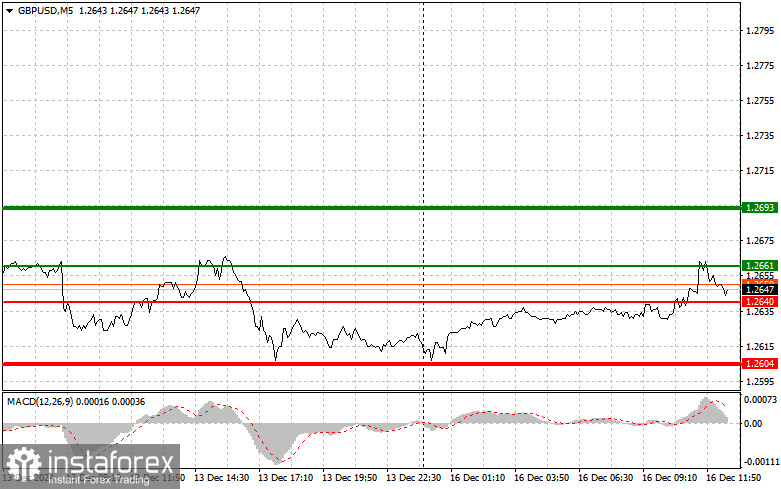

For intraday strategies, I will primarily rely on the implementation of Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Today, I plan to buy the pound when the entry point near 1.2661 (green line on the chart) is reached, targeting growth to the 1.2693 level (thicker green line on the chart). At 1.2693, I plan to exit purchases and open sales in the opposite direction, expecting a movement of 30–35 points downward from the level. A rise in the pound can only be anticipated following weak US data.Important! Before buying, ensure that the MACD indicator is above the zero line and just beginning its upward movement.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.2640 price level, when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. Growth can be expected toward the opposite levels of 1.2661 and 1.2693.

Sell Signal

Scenario #1: I plan to sell the pound after the 1.2640 level (red line on the chart) is broken, which will lead to a rapid decline in the pair. The key target for sellers will be 1.2604, where I plan to exit sales and immediately open purchases in the opposite direction, expecting a 20–25 point rebound. Sellers will likely show up only after strong US statistics.Important! Before selling, ensure that the MACD indicator is below the zero line and just beginning its downward movement.

Scenario #2: I also plan to sell the pound if there are two consecutive tests of the 1.2661 price level, when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected toward the opposite levels of 1.2640 and 1.2604.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: Estimated price for setting Take Profit or manually fixing profit, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: Estimated price for setting Take Profit or manually fixing profit, as further decline below this level is unlikely.

- MACD Indicator: When entering the market, it's important to consider overbought and oversold areas.

Important Notes for Beginner Forex Traders

- Carefully decide when to enter the market. Before the release of major fundamental reports, it's best to stay out of the market to avoid sharp price swings.

- If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially when trading large volumes without proper money management.

- Remember, successful trading requires a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.