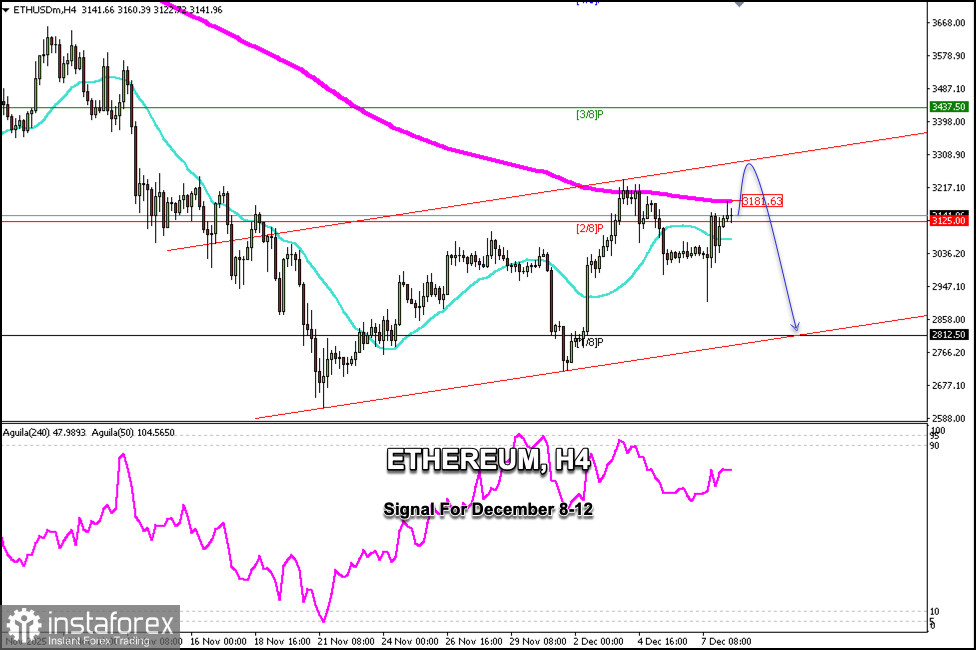

Ethereum (ETH/USD) is trading around $3,141, below the 200 EMA, and within the uptrend channel formed since November 21, with a slight recovery but showing signs of exhaustion.

Over the weekend, ETH reached the key support level of $2,900, which served as a good support, giving momentum to the cryptocurrency. The price is now above the 2/8 Murray, which is likely to continue rising in the coming days until it reaches the top of the uptrend channel around $3,310.

Conversely, if Ether falls below the 2/8 Murray and consolidates below the 21 SMA, we could expect a resumption of the bearish cycle, which could push the price down to 1/8 Murray around $2,812.

In the coming days, it is more likely that Ethereum will trade within the range below $3,300 and above $2,800. Both levels suggest an opportunity to open long and short positions when it approaches resistance and support levels.

With a sharp drop and break below $2,800, we could see ETH reach the psychological level of $2,500, which coincides with the 0/8 Murray. Don't miss an opportunity to enter short positions if the price consolidates below the uptrend channel.