Analysis of Trades and Tips for Trading the British Pound

No tests of the specified levels occurred during the first half of the day due to significantly reduced volatility in the pound following yesterday's sell-off. The release of data on the Core Personal Consumption Expenditures Index is likely to garner attention from analysts and investors. An increase in this indicator could signal rising inflation, which would support U.S. economic growth but compel the Federal Reserve to maintain high interest rates. Additionally, data on changes in U.S. consumer spending and income levels will be published. Strong readings would prompt traders to sell the pound. The University of Michigan's Consumer Sentiment Index and inflation expectations will close out the day.

For intraday strategy, I will focus on Scenario #1 and Scenario #2.

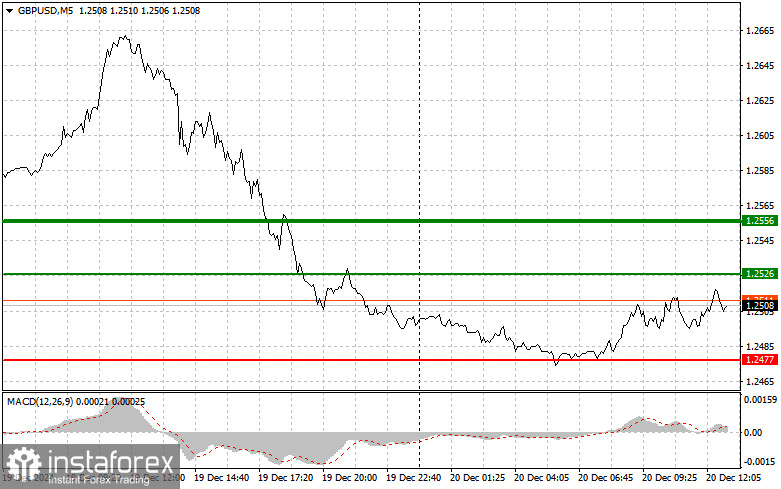

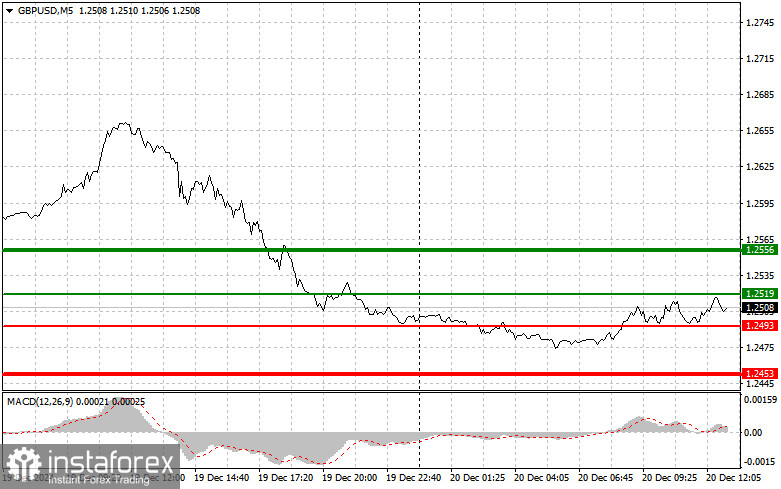

Buy Signal

Scenario #1: Today, I plan to buy the pound at 1.2519 (green line on the chart) with a target of 1.2556 (thicker green line on the chart). At 1.2556, I will exit the buy trade and open sell positions in the opposite direction, anticipating a 30–35 point downward move from the entry point. A pound rally today will depend on weak U.S. data.Important: Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.2493 level, with the MACD indicator in the oversold zone. This will limit the pair's downward potential and trigger a market reversal upward. Growth toward 1.2519 and 1.2556 can then be expected.

Sell Signal

Scenario #1: I plan to sell the pound after breaking below the 1.2493 level (red line on the chart), targeting 1.2453. At this level, I will exit the sell trade and immediately buy in the opposite direction, anticipating a 20–25 point upward move. Sellers will only take control after strong U.S. data.Important: Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I also plan to sell the pound if there are two consecutive tests of the 1.2519 level, with the MACD indicator in the overbought zone. This will limit the pair's upward potential and trigger a market reversal downward. A decline toward 1.2493 and 1.2453 can then be expected.

Chart Overview

- Thin green line: Entry price for buying the instrument.

- Thick green line: Target price for taking profit or manually closing the trade, as further growth beyond this level is unlikely.

- Thin red line: Entry price for selling the instrument.

- Thick red line: Target price for taking profit or manually closing the trade, as further decline beyond this level is unlikely.

- MACD Indicator: When entering the market, pay attention to overbought and oversold zones.

Important Notes for Beginner Forex Traders

- Exercise extreme caution when entering the market, especially before key fundamental reports are released. It is better to stay out of the market during these times to avoid sharp price fluctuations.

- If you choose to trade during news releases, always set stop-loss orders to minimize potential losses. Without stop-losses, you could quickly lose your entire deposit, especially if you trade large volumes without proper money management.

- Always have a clear trading plan, like the one provided above. Making spontaneous trading decisions based on current market conditions is a losing strategy for intraday traders.