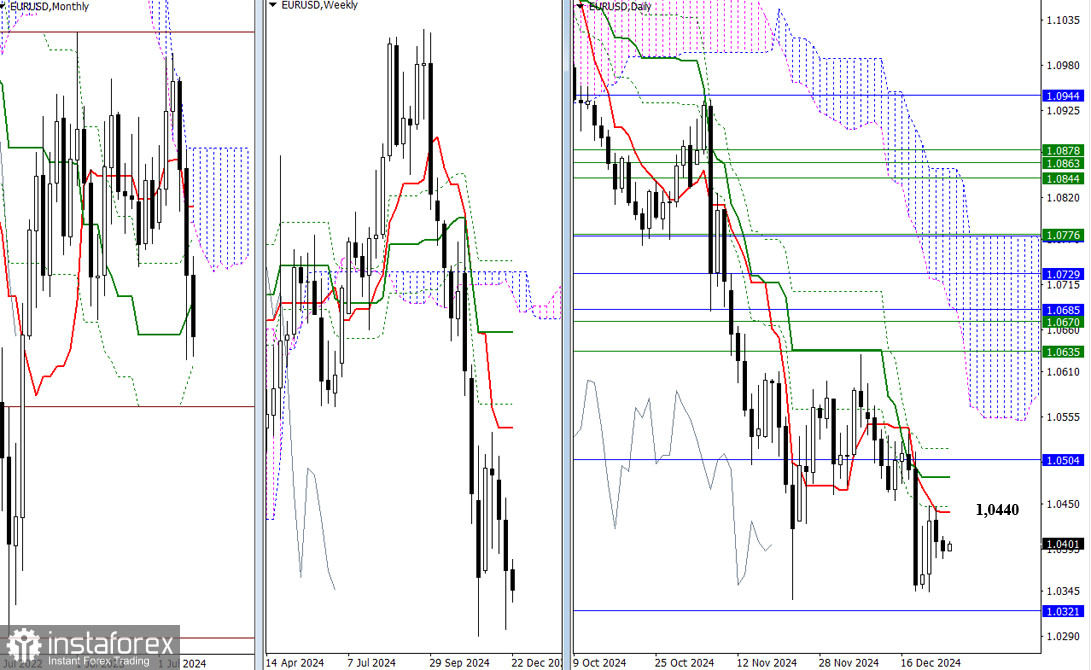

EUR/USD

Higher Timeframes

As December, the final month of 2024, nears its end, the euro has taken another pause, remaining in a state of indecision. The previously mentioned benchmarks and their positions remain significant. Changes and new prospects are only possible for bullish players after the daily Ichimoku cross (1.0440 – 1.0482 – 1.0517) is overcome and a return to the bullish side of the monthly mid-term trend (1.0504). For bearish players, it is essential to update the lowest extremum (1.0334) and overcome the support of the final level of the monthly Ichimoku cross (1.0321) in the current conditions.

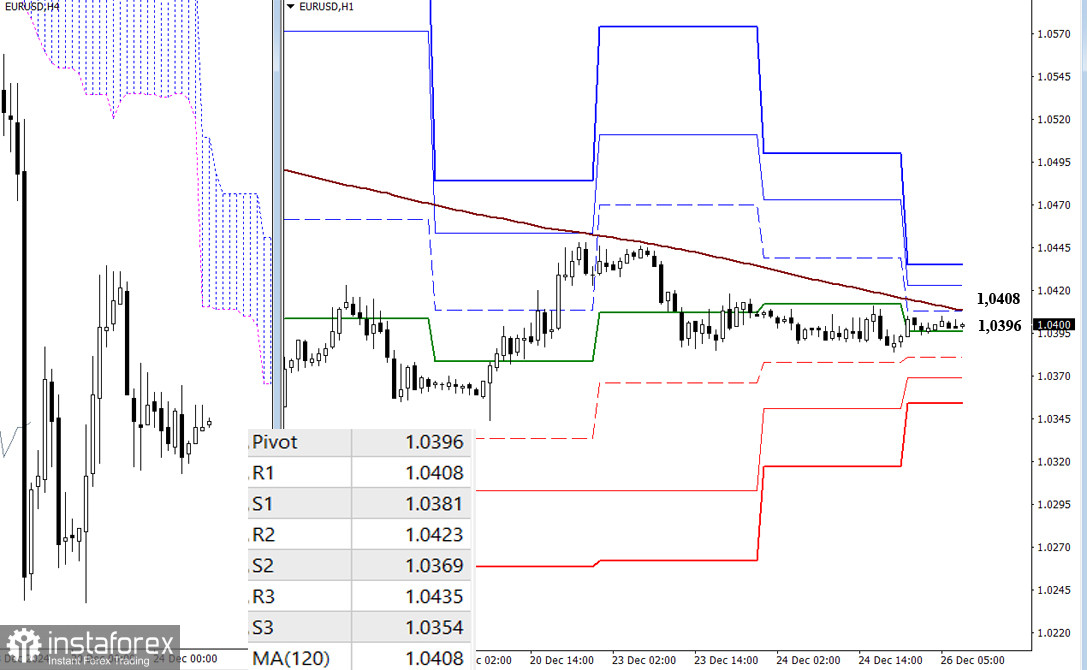

H4 – H1

On the lower timeframes, the pair continues to move sideways, remaining within the zone of influence of key levels that today align their efforts around 1.0396 (the central Pivot level of the day) and 1.0408 (the weekly long-term trend). A shift in market activity could lead to testing and breaking additional benchmarks on lower timeframes. For bullish players, the focus will be on overcoming the resistances of the classic Pivot levels (1.0423 – 1.0435). Meanwhile, bearish players will aim at the support of the classic Pivot levels (1.0381 – 1.0369 – 1.0354).

***

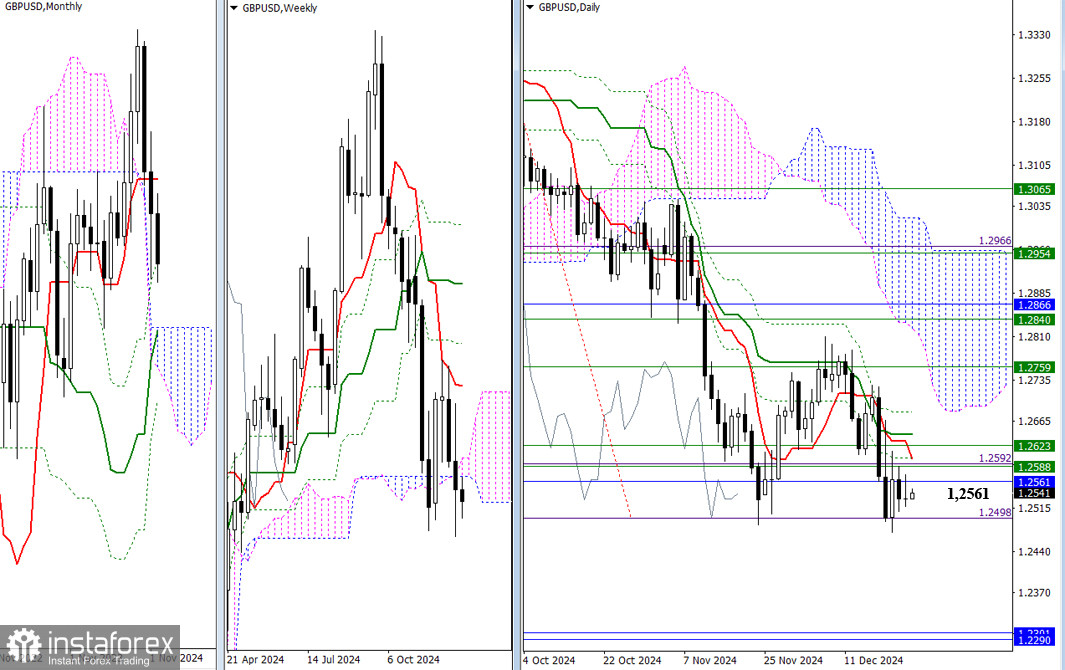

GBP/USD

Higher Timeframes

Like the euro, the pound has been reluctant to show activity in the year's final days, leading to consolidation around the monthly level of 1.2561. For bearish players, the key remains to restore the downward trend (1.2474), opening the path toward monthly supports (1.2290 – 1.2301). For bullish players, the possibilities remain hindered by resistance zone clustering levels from various timeframes at the thresholds of 1.2561 – 1.2588 – 1.2623 – 1.2682.

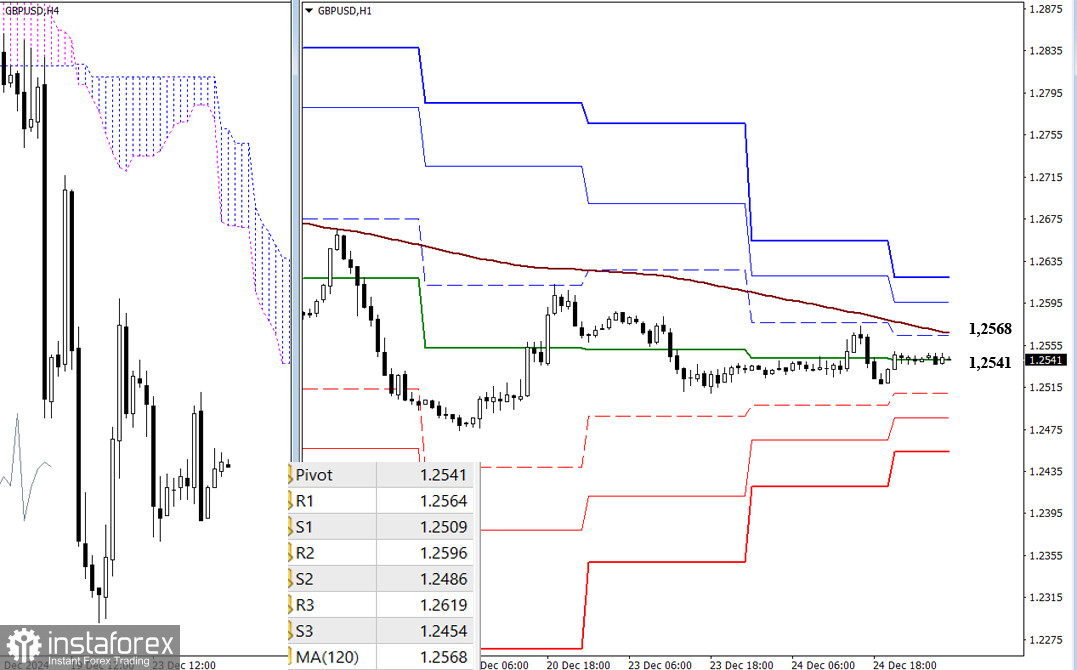

H4 – H1

On the lower timeframes, uncertainty prevails. The market has been gravitating around the central Pivot level (1.2541) for several days, sitting beneath the resistance of the weekly long-term trend (1.2568), which dictates the current balance of power. If the price consolidates above the trend and reverses it, bullish players may use this as support to recover their positions. Additional intraday reference points today include supports (1.2509 – 1.2486 – 1.2454) and resistances (1.2596 – 1.2619) from the classic Pivot levels.

***

Technical Analysis Tools Used

- Higher Timeframes: Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels.

- Lower Timeframes (H1): Classic Pivot Points + Moving Average 120 (weekly long-term trend).