Analysis of Monday's Trades

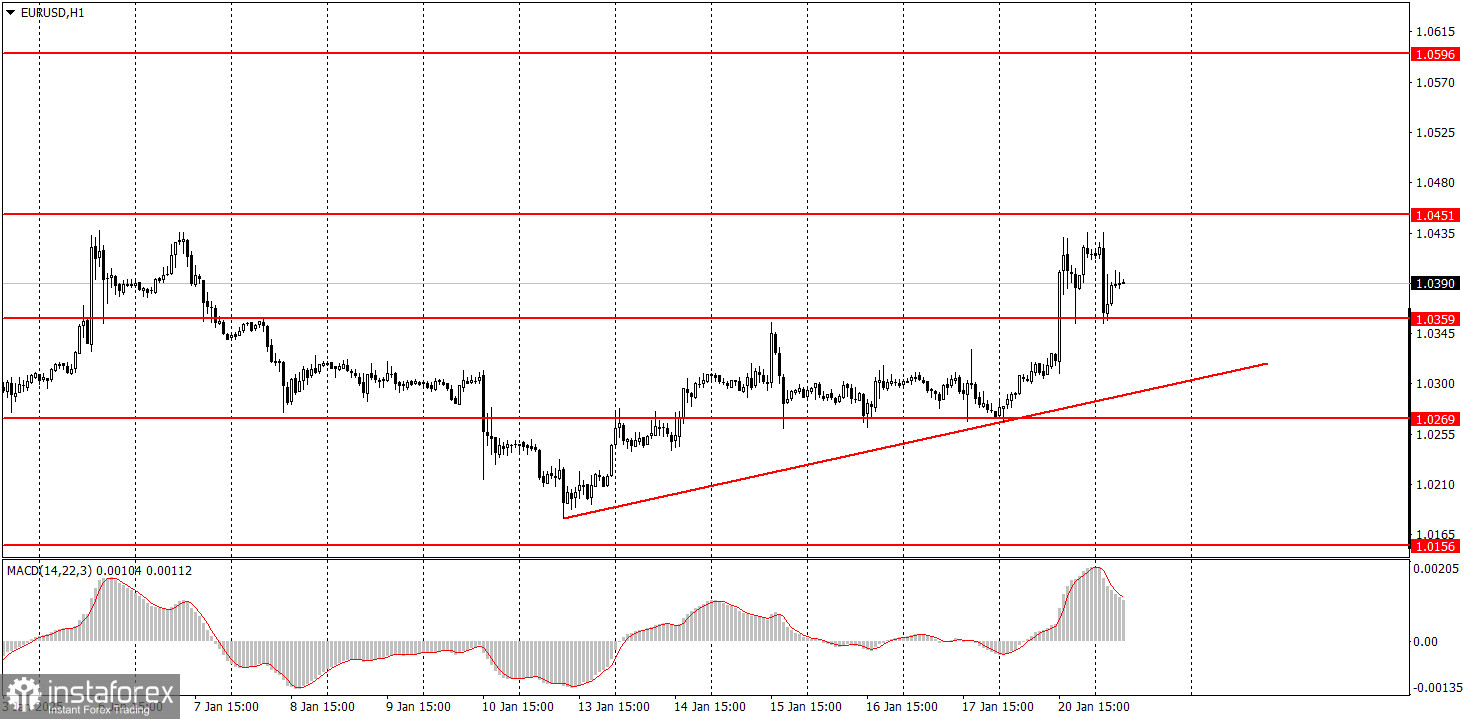

1H Chart of EUR/USD

On Monday, the EUR/USD currency pair exhibited a sharp and strong rise. The euro began to strengthen almost immediately after the market opened, marking the start of both the day and the week. This movement suggests that the dollar's decline was not tied to any specific economic factors. The only notable event scheduled for the day was Donald Trump's inauguration, which took place without any incidents. The dollar's decline can be naturally associated with this event. Although Trump made several important statements, it is important to note that the dollar's drop began well before his speech or the inauguration itself. This behavior reflects unpredictable market emotions. We believe that such erratic movements should be avoided. Even though several solid trading signals emerged yesterday, trading during high-profile events typically involves erratic price movements, sudden reversals, and heightened volatility.

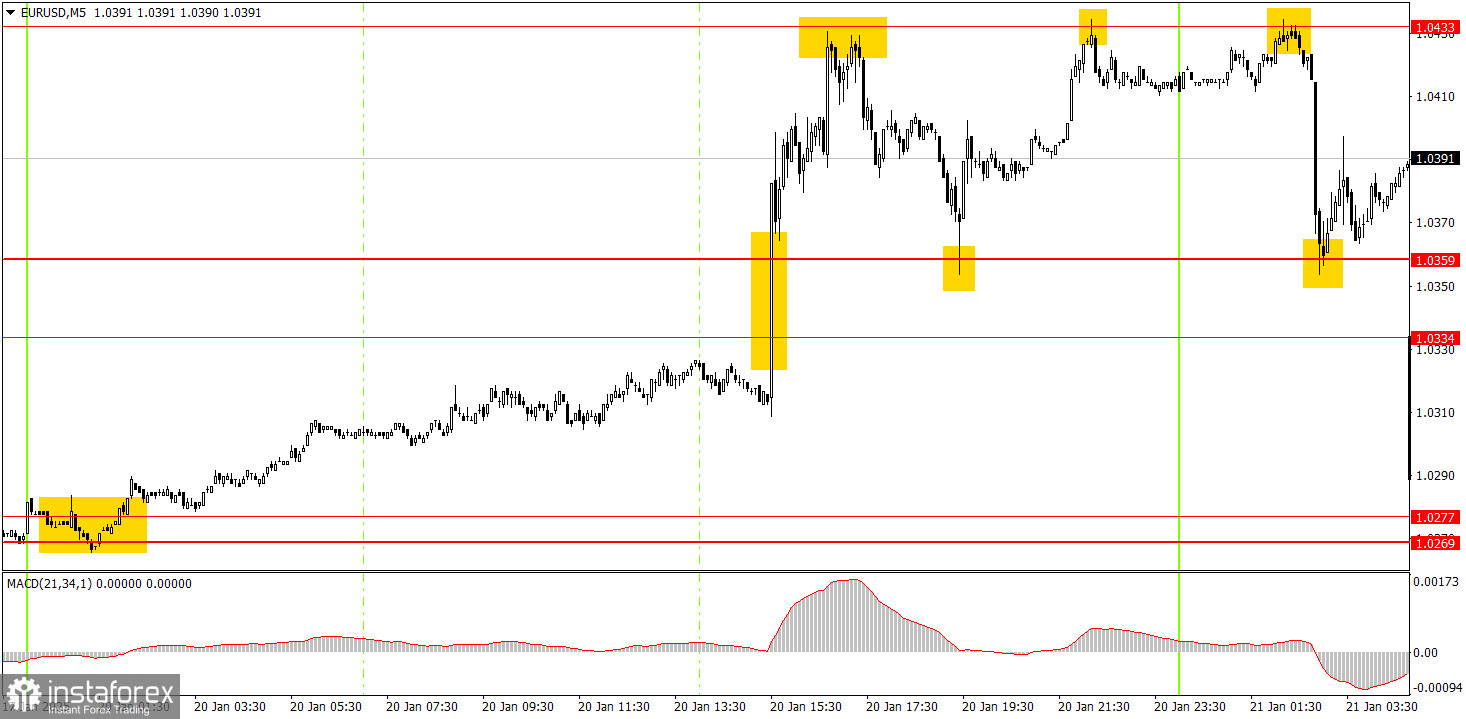

5M Chart of EUR/USD

In the 5-minute timeframe on Monday, a wealth of strong signals was created. Overnight, the price bounced off the 1.0269-1.0277 range and then steadily increased for half the day, reaching the 1.0433 level during the U.S. session. This signal could have been acted upon overnight or by "chasing the train" during the European session. Traders experienced excellent opportunities to open positions and profit from subsequent rebounds at the 1.0433 level, another bounce at 1.0359, two additional rebounds from 1.0433, and yet another from 1.0359.

Trading Strategy for Tuesday:

On the hourly timeframe, the EUR/USD pair is continuing its downward trend. We believe the euro's decline is poised to persist in the medium term, with parity not far off. As previously noted, further declines of the euro are expected, as the fundamental and macroeconomic conditions continue to favor the U.S. dollar. Currently, a correction is in progress, supported by a trendline. A break below this trendline will indicate the end of the correction.

Movements on Tuesday may be much weaker than on Monday, and the dollar could start regaining its losses. However, we now have a trendline to guide us.

On the 5-minute timeframe, consider the following levels: 1.0156, 1.0221, 1.0269-1.0277, 1.0334-1.0359, 1.0433-1.0451, 1.0526, 1.0596, 1.0678, 1.0726-1.0733, 1.0797-1.0804, and 1.0845-1.0851. On Tuesday, ZEW indices are scheduled for release in the Eurozone, while the U.S. economic calendar is empty. As a result, volatility may decrease significantly, with the dollar leaning toward growth.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.