Analysis and Trading Tips for the Japanese Yen

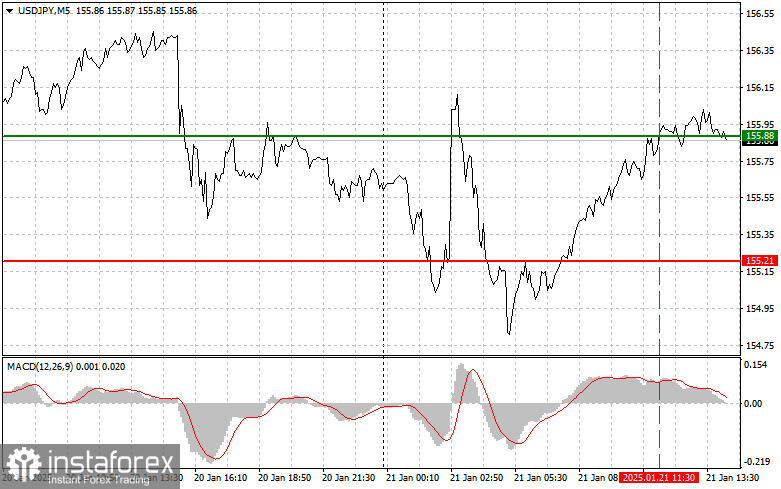

The test of the 155.88 price level occurred when the MACD indicator had already moved significantly above the zero line, limiting the pair's upward potential—especially after rising market expectations regarding interest rate changes in Japan. For this reason, I did not buy the dollar.

Expectations of further interest rate hikes in Japan this week will likely continue to drive yen purchases and dollar sales, so exercise caution. Even measures introduced by the Trump administration regarding trade tariffs will be less relevant compared to potential shifts in Japan's monetary policy. Personally, I will continue to focus on selling, taking advantage of attractive prices.

For intraday strategies, I'll rely more on the execution of Scenario #1 and Scenario #2 in line with the downward trend.

Buy Signal

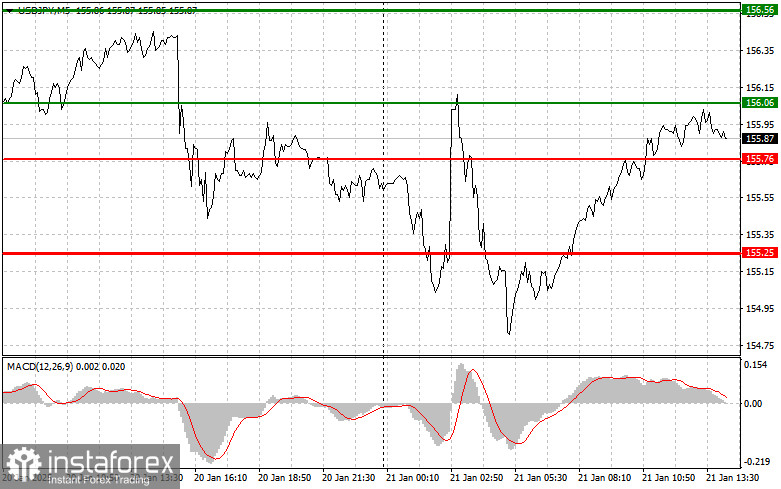

Scenario #1: Today, I plan to buy USD/JPY at 156.06 (green line on the chart) with a target of 156.56 (thicker green line on the chart). At 156.56, I will exit purchases and open sell positions, expecting a 30–35 point pullback from this level. A rally in the pair is only expected following new statements from Trump.Important! Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY in case of two consecutive tests of the 155.76 level while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a market reversal upward. Growth to the opposite levels of 156.06 and 156.56 can be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY after breaking below 155.76 (red line on the chart), targeting 155.25, where I will exit sales and immediately buy back, expecting a 20–25 point rebound. Selling pressure on the pair is expected to persist within the ongoing downtrend.Important! Before selling, ensure that the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell USD/JPY in case of two consecutive tests of the 156.06 level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. Declines to the opposite levels of 155.76 and 155.25 can be expected.

Chart Explanation

- Thin Green Line: Entry price for buying the instrument.

- Thick Green Line: Presumed price level for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin Red Line: Entry price for selling the instrument.

- Thick Red Line: Presumed price level for Take Profit or manually locking in profits, as further declines below this level are unlikely.

- MACD Indicator: Use overbought and oversold zones as guidance for market entry.

Important Notes for Beginner Forex Traders

Beginner traders should make trading decisions cautiously. Before the release of significant fundamental reports, it's best to stay out of the market to avoid sharp price movements. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you trade large volumes without proper money management.

Remember: Successful trading requires a clear trading plan, similar to the one outlined above. Spontaneous trading decisions based on current market conditions are inherently a losing strategy for intraday traders.