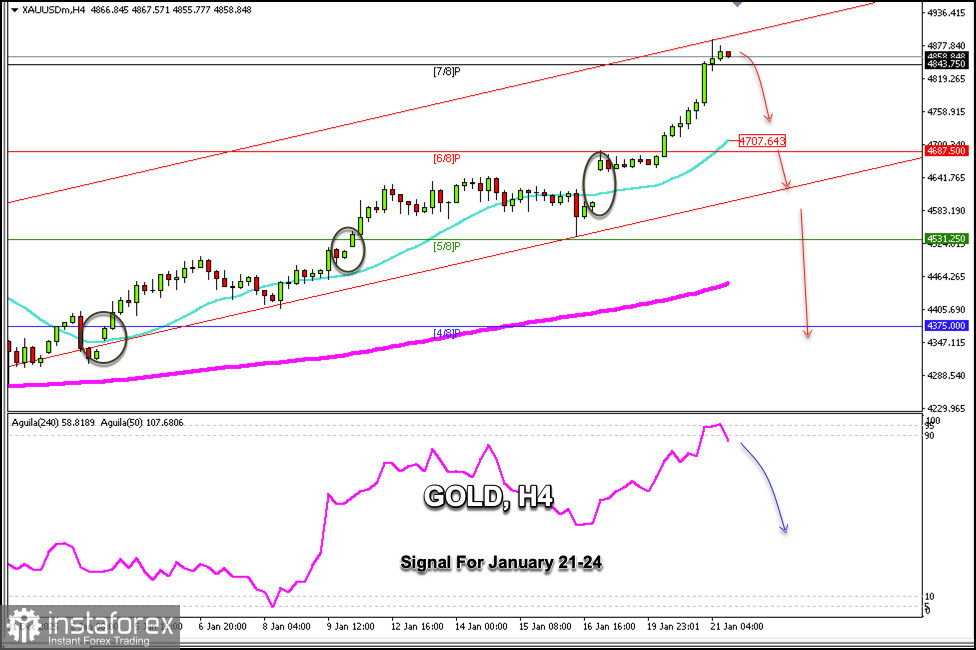

After reaching a new all-time high of around $4,888, gold is showing signs of exhaustion and is likely to fall sharply in the coming hours to the 6/8 Murray, located at $4,687.

Gold reached the top of the uptrend channel formed in December 2025. XAU/USD encountered rejection. Thus, a technical correction is in the cards, during which the price could reach the bottom of the uptrend channel around $4,635.

On the H4 chart, we can see that the Eagle indicator has reached extremely overbought levels, showing a negative signal. This setup could allow us to open short positions at current price levels, or if the instrument falls below the 7/8 Murray located at $4,843.

On the H4 chart, we can see that gold has left a sequence of GAPS. There will likely be a drop towards $4,327 in the coming days, which represents the last gap formed at the beginning of January.

Our trading plan for the next few hours is to sell below $4,870, with targets at $4,820, $4,760, and $4,687.

Gold is running out of bullish momentum. Therefore, a strong technical correction is imminent in the coming hours.