Analysis of Trades and Trading Recommendations for the Japanese Yen

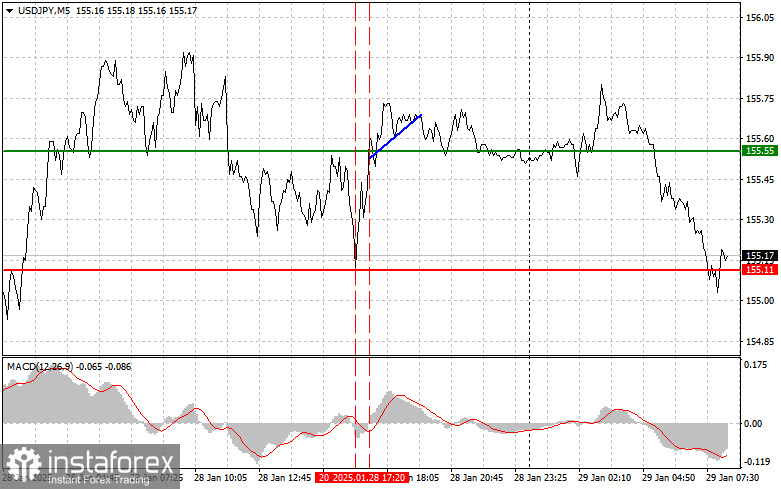

The 155.55 level test coincided with the moment when the MACD indicator had just started to move upward from the zero mark, confirming a correct entry point for buying the US dollar. As a result, the pair saw an increase of only about 15 points, and that was the end of the move. I did not sell at 155.11 because, at that moment, the MACD had already moved significantly downward from the zero mark.

Today, the Japanese yen slightly strengthened against the dollar following the release of the Bank of Japan's meeting minutes, which indicated that further interest rate hikes are quite likely in the near future. The minutes also expressed concerns about Trump's policies, which add a high degree of uncertainty to Japan's economic growth prospects.

The tightening of Japan's monetary policy could become a significant factor in strengthening the yen, especially amid global economic instability. Therefore, investors are closely monitoring signals from the Bank of Japan, looking for new guidance on interest rate direction. Domestic developments in Japan also play an important role—increased investments in infrastructure and innovative technologies could positively impact the Japanese economy, which, in turn, would support the yen. However, external factors such as trade disputes and market fluctuations remain a constant area of concern.

For intraday strategy, I will focus on executing Scenario #1 and Scenario #2.

Buy Scenarios

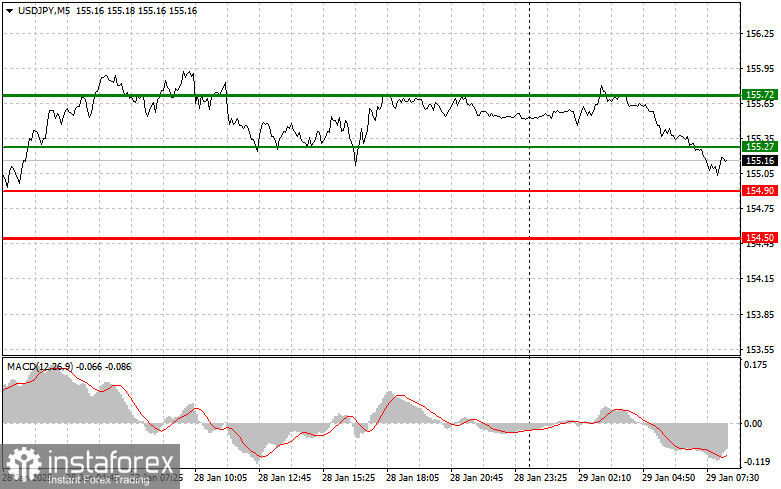

Scenario #1: I plan to buy USD/JPY today at the 155.27 level (green line on the chart). Target: 155.72 (thicker green line on the chart). At 155.72, I will exit long positions and consider selling for a 30-35 point downward correction. It is best to buy the pair on pullbacks and deep corrections in USD/JPY.

Important! Before buying, make sure the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario #2: I also plan to buy USD/JPY if there are two consecutive tests of the 154.90 level, with the MACD indicator in the oversold zone. This will limit the pair's downward potential and trigger a reversal upward. Target levels: 155.27 and 155.72.

Sell Scenarios

Scenario #1: I plan to sell USD/JPY only after a breakout below 154.90 (red line on the chart). This will likely trigger a rapid decline in the pair. Key target for sellers: 154.50, where I will exit short positions and immediately look to buy for a 20-25 point rebound. Selling pressure may return at any moment.

Important! Before selling, make sure the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario #2:I also plan to sell USD/JPY if there are two consecutive tests of the 155.27 level, with the MACD indicator in the overbought zone. This will limit the pair's upward potential and trigger a reversal downward. Target levels: 154.90 and 154.50.

Chart Explanation:

- Thin green line – Entry price for buying the trading instrument.

- Thick green line – Suggested Take Profit level or an area where profit can be fixed, as further growth above this level is unlikely.

- Thin red line – Entry price for selling the trading instrument.

- Thick red line – Suggested Take Profit level or an area where profit can be fixed, as further declines below this level are unlikely.

- MACD Indicator – It is crucial to consider overbought and oversold zones when entering the market.

Important Notes for Beginner Forex Traders:

- Exercise caution when making trading decisions.

- Avoid trading before the release of major fundamental reports to prevent exposure to sharp price swings.

- If you decide to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you risk losing your entire deposit quickly, especially when trading large volumes without proper money management.

- A well-defined trading plan is essential for successful trading.

- Avoid spontaneous trading decisions, as reacting impulsively to market movements is a losing strategy for intraday traders.